Retail media networks have become one of the hottest topics in retail in 2024. Interest at the highest levels can be seen in growing investment. In addition, retailers are increasingly leveraging retail media networks to monetize their customer bases and create advertising opportunities for brands that they sell.

The growth story this year shows no signs of slowing down. For evidence, look no further than major retailers — including Walmart, Home Depot, Saks and others — that have expanded, rebranded, created or otherwise shared new plans for their retail media networks.

More could be coming. In December 2023, Deloitte published a poll finding that 64% of retailers said they plan to implement a retail media network by the end of 2024.

What are retail media networks?

Retail media networks are a type of advertising platform where retailers can sell ad space on their own digital channels to third parties. Advertisers can target their ads using the retailer’s first-party data on customers, including information from loyalty programs. Ads can be placed on retailers’ websites, within mobile apps or in stores via screens and displays.

Retail media networks also open up a new revenue stream for retailers.

Here are the most important developments so far in 2024.

1. Albertsons works with Criteo

Albertsons Media Collective, the advertising piece of the grocery chain, is working with commerce media platform Criteo to expand in-store retail media offerings for advertisers. Criteo is helping Albertsons develop new ad formats, like sponsored video and commerce displays, it said.

Albertsons Media Collective can use a combination of first-party data, in-store sales and other shopper information to give advertisers better ad-targeting abilities.

Albertsons is No. 24 in the Top 1000, Digital Commerce 360’s ranking of North America’s leading retailers by online sales.

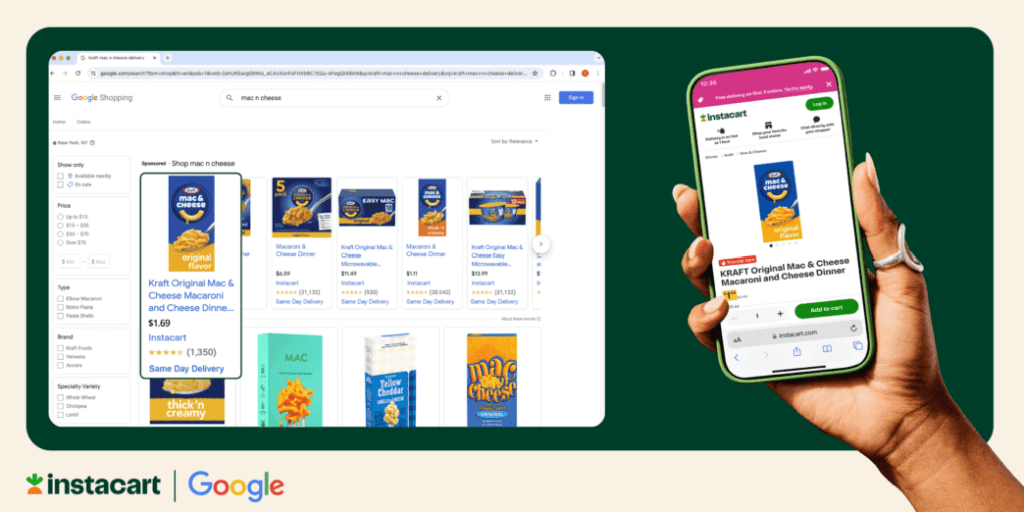

2. Instacart uses Google shopping data for CPG partners

Instacart announced in January that it would make Google Shopping accessible to Instacart advertisers.

“Instacart’s closed-loop platform and first-party retail media data are critical differentiators for CPG brands,” said Laura Jones, chief marketing officer of Instacart. “Today, our team works with more than 5,500 brand partners to help them grow their businesses and drive incremental sales. With our collaboration with Google, we’re now able to layer our valuable retail media data over Google Shopping ads’ capabilities to enhance audience signals for our CPG partners’ campaigns off of Instacart,” she said.

Instacart is one company experimenting with retail media networks.

The grocery delivery company also debuted ads on Caper Carts. Instacart described them as AI-powered smart carts that will make personalized recommendations through advertisements. Recommendations will be based on the time of year, ongoing promotions, and other products already in the customer’s cart, Instacart said.

3. Macy’s Media Network recruits VP from Walmart Connect

Macy’s hired Michael Krans as a vice president in March who is in charge of running the Macy’s Media Network. Krans spent the two years prior at Walmart Connect, Walmart’s retail media network.

The Macy’s ad network collaborates with advertisers across Macy’s and Bloomingdale’s, helping them target the retailer’s customers. The goal is to lead to discovery and brand awareness among Macy’s customers. It launched the network in 2020.

“Macy’s Media Network is one of retail’s premier platforms for advertisers helping them to connect with highly engaged customers across Macy’s and Bloomingdale’s, giving marketers a host of opportunities to more effectively leverage their media campaigns,” Max Magni, chief customer and digital officer, said in a statement.

Macy’s ranks No. 14 in the Top 1000.

4. Lowe’s and Google team up on a retail media solution

In March, Google announced a retail media solution in partnership with Lowe’s.

The beta uses Google’s Search Ads 360 product to facilitate retail media campaigns. The program extends advertisers’ reach to new third-party channels beyond the retail media network’s owner.

“With self-service, retailers will be able to selectively share first-party audiences with their brand partners in a privacy-centric way, without exposing user-level data,” Google project manager Ewan Fisher said at the time. “This lets brands reach high-intent shoppers with relevant ads, increasing performance while respecting consumer privacy.”

Google is also looking for future retail partners, he added.

Lowe’s is No. 11 in the Top 1000.

5. Home Depot rebrands its ad operation as Orange Apron Media

Home Depot relaunched its retail media network as Orange Apron Media four years after it first formed. The name is a reference to uniforms its employees wear, and an attempt to differentiate the network from the proliferation of other retail media networks across the industry, Orange Apron Media vice president Melanie Babcock told Digital Commerce 360.

Advertisers can purchase ad space on Home Depot’s website, including on banners and product carousels and in promotional emails. In select stores, they can also buy ads to display on in-store TVs and end caps.

Home Depot currently reports a few thousand supplier advertisers. It plans to double that number over the next few years, Babcock said.

Home Depot is No. 4 in the Top 1000.

6. Chase brings banking into the retail media network game

Chase ventured into the retail media network space with Chase Media Solutions in April. The digital media business will give brands a way to connect with Chase’s 80 million customers, it said. It said Chase Media Solutions is the only bank-led media platform of its type, with advantages over the more typical retail media networks.

“Like retailers, we have first-party data and a dedicated audience,” Rich Muhlstock, president of Chase Media Solutions, said in a statement. “But what sets us apart is the unrivaled scale and insights from our customers – having long-served as a trusted guide for their financial decisions. Chase reaches across brands, merchants and shopping verticals, providing a comprehensive view of purchase behavior; this strengthens the degree of personalization, helping brands deliver offers that stoke consumer interests.”

Initial partners include Air Canada, Solo Stove, Blue Bottle and Whataburger.

7. Walmart outlines growth plans for Walmart Connect

In early April, Walmart shared updates and goals for Walmart Connect, its advertising business.

A few of the many changes coming to Walmart Connect include:

- Greater on-site display access

- Advertising for complementary brands that don’t sell through Walmart

- Media partnerships with Roku and TikTok

- Self-service capabilities for in-store advertising

- Better analysis tools

The retailer has made other moves to grow its advertising business, including with its proposed acquisition of Vizio. Walmart could use data from Vizio’s 18 million active users to improve ad targeting for Walmart Connect.

Most recently, it announced an integration with the advertising technology platform Infillion in Mexico. The partnership will allow Walmart to offer its advertisers in Latin America elevated media plans optimized with artificial intelligence (AI), it said.

Walmart Connect generated about $3 billion in sales last year and is growing quickly. In Walmart’s fiscal fourth quarter report, chief financial officer John David Rainey said sales increased 22% year over year.

Walmart is No. 2 in the Top 1000. It is also No. 9 in the Global Online Marketplaces Database, Digital Commerce 360’s ranking of top online marketplaces by third-party gross merchandise value (GMV).

8. Saks creates luxury retail media network

Saks announced the launch of Saks Media Network to connect customers with digital advertisers. The ecommerce retailer said it will be one of the first retail media networks in the luxury retail space.

Saks said it will use the company’s “iconic brand, rich first-party customer data and robust traffic of over 435 million annual site visits,” to increase the revenue of brands that sell on its website through sponsored product ads and display banners.

Several prominent brands that sell through Saks are already using the Saks Media Network, it said, including Stuart Weitzman and Rag & Bone.

Saks’ retail media network also strengthens its relationship with the brands it sells, the retailer said. Its in-house media team creates custom strategies for retailers to drive business to their brands.

SaksFifthAvenue.com and SaksOff5th.com are owned by Hudson’s Bay Co. The parent company is No. 26 in the Top 1000.

9. Best Buy partners with CNET

Best Buy announced a new agreement with tech news website CNET to integrate the publication’s recommendations and content across the Best Buy website, stores, and mobile app.

The consumer electronics retailer called it a “new retail media model between a media publication and retailer.” Advertisers can share ad spaces across the two companies, leveraging the audiences of both across the funnel. They have a combined 50 million unique visitors monthly, Best Buy said.

“This partnership sets a powerful precedent for how content and retail media brands can collaborate to bring more opportunities to both consumers and advertisers,” said Lauren Newman, executive vice president of revenue at CNET. “With a focus on data-driven insights, we’re introducing a new standard to help brands expand audience reach and measure the impact across what was previously a fragmented digital media ecosystem.”

Best Buy first launched its retail media network, Best Buy Ads, in 2022. It ranks No. 8 in the Top 1000.

10. T-Mobile announces a retail media network

T-Mobile Advertising Solutions, the company’s ad business, will add a retail media network to its portfolio, it said. The network will extend across 20,000 screens in more than 11,000 T-Mobile stores across the U.S., reaching 58 million consumers each month. Advertisers can reach an additional 7 million consumers each month through the company’s T Life loyalty app, it said.

Finally, T-Mobile also announced a partnership with streaming company Plex to expand its connected TV (CTV) reach. Advertisers can use Plex’s free, ad-supported video on demand to reach consumers with relevant ads, T-Mobile said.

Do you rank in our database?

Submit your data with this quick survey and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter, Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite