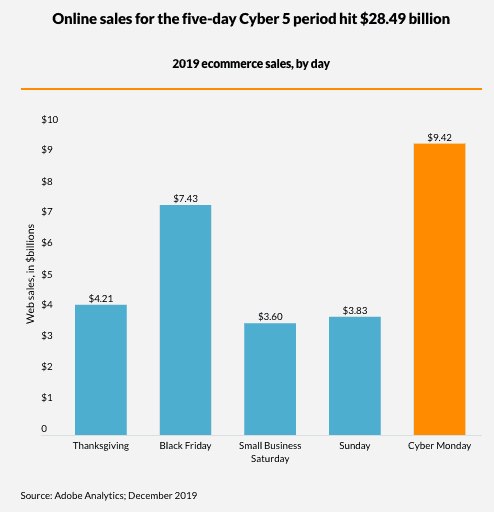

To cap off a pandemic-fueled holiday shopping weekend, consumers spent a record $10.8 billion online on Cyber Monday, which is now the largest shopping day in the history of U.S. ecommerce, according to data from Adobe Analytics. But despite the headline-worthy sales numbers, digital sales increased just 15.1% year over year from $9.4 billion in 2019—far slower than optimistic projections based on massive year-to-date surges in online buying as shoppers have stayed away from stores or opted for omnichannel services like curbside pickup to avoid crowds.

Cyber Monday’s ecommerce growth registered less than half of Adobe’s 35.3% forecast for the day and roughly half of Digital Commerce 360’s 29.8% projection—a big miss. It also marked a slowdown from Cyber Monday 2019, when online sales received a 19.7% year-over-year boost over $7.9 billion in 2018, according to the data insights arm of software company Adobe Inc. The firm’s data is based on transactions from more than 1 trillion anonymous online visits to retail sites, including 80 of the top 100 retailers in the Digital Commerce 360 Top 1000.

While the overall ecommerce market often grows around 15% annually, the range is less robust when put into context with COVID-19’s impact on retail in 2020: Online sales grew an incredible 44.4% in Q2 and 37.1% in Q3.

Figures from technology vendor Salesforce.com Inc. suggest online retailers fell even shorter of holiday weekend predictions: Digital sales in the U.S. jumped just 10% year over year on Cyber Monday, significantly below the company’s 18% projection. The software provider aggregates data from the activity of more than 1 billion global shoppers flowing through its Commerce Cloud platform and extrapolates its clients’ findings to the broader retail industry. However, Salesforce clients fared much better. Ecommerce sales placed through the Commerce Cloud platform grew 31% over Cyber Monday 2019, Salesforce reports.

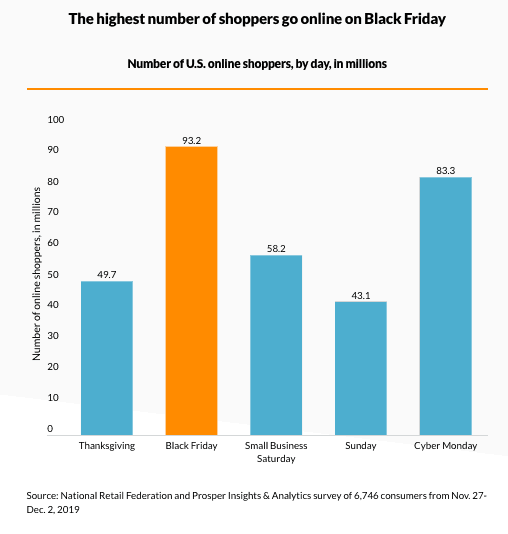

“While there was still a buzz around Black Friday and Cyber Monday this year, these days became a bit marginalized as demand was pulled earlier in the holiday season and the week,” says Rob Garf, vice president of strategy and insights at Salesforce. “The steady drumbeat of sales throughout the holiday will help retailers fulfill orders on time, which will be strained with the surge in online orders coupled with capacity issues of traditional shipping carriers.”

Expiring promotions prompt late-night Cyber Monday purchases

Cyber Monday again won out with the deepest promotions of any day during Cyber Week (the Tuesday before Thanksgiving through the Monday after the holiday), but just barely. The average discount rate in the U.S. for the day was 29%, according to Salesforce data, marking a modest ramp up from a 25% average on Tuesday, Nov. 24; a 27% average on Wednesday, Nov. 25; and 28% on Thanksgiving, Nov. 26.

Once again, retailers offered sizable discounts on popular holiday categories on Cyber Monday. Consumers shopping for computers were the big winners as the category was marked down by 28% with electronics a close second at 27%, according to Adobe. Appliances and sporting goods were both discounted by 20%, and toys were 19% off. Discounts will likely weaken by around 5%-10% across most categories in the weeks before Christmas, Adobe says.

In a frenzy to take advantage of time-sensitive deals, shoppers flocked to the web later in the night on Cyber Monday to nab discounted items in the final hours before promotions expired. From 7 p.m. to 11 p.m. Pacific time, consumers spent $2.7 billion online, according to Adobe. That four-hour timeframe accounted for a quarter of the day’s digital revenue, and shoppers spent a massive $12 million a minute during the peak hour of 8 p.m. to 9 p.m. Pacific time.

Walmart wins big while department stores struggle

Large retailers with more than $1 billion in annual revenue increased online Cyber Monday sales by 486% versus the October daily average while smaller retailers with between $10 million and $50 million in annual revenue received a 501% boost, according to Adobe. But the big names had noteworthy performances—at least early in the day.

Through the first eight hours of Cyber Monday, Walmart Inc. (No. 3 in the Top 1000) was the biggest winner among big-box retailers and web giants analyzed by digital commerce intelligence company Edison Trends. The retail chain’s online revenue surged 150% year over year from midnight Eastern time through 8 a.m. Eastern time—more than five times the 29% growth for Amazon.com Inc. (No. 1) for the same timeframe. Walmart had a 637% explosion in ecommerce sales in just the first hour of Cyber Monday, the firm reports.

The collective year-over-year increase in web sales for Walmart, Amazon, Best Buy Co. Inc. (No. 10), Target Corp. (No. 12), eBay Inc. (No. 5 in the list of Digital Commerce 360 Top 100 Marketplaces) and Etsy (No. 18 in the marketplaces rankings) was 45% for the eight-hour period on Cyber Monday, according to Edison.

Department stores didn’t fare as well early on Cyber Monday. Edison analyzed data on Nordstrom Inc. (No. 18), Kohl’s Corp. (No. 21), Macy’s Inc. (No. 14) and J.C. Penney Co. Inc. (No. 31) and found this group’s combined online sales dropped 10% year over year for the first eight hours of Cyber Monday. Nordstrom was the only retailer with an increase in digital revenue, growing sales 20% over the same period in 2019. Edison’s data is based on e-receipts from more than 28,000 online transactions accessed through the email of U.S. consumers.

Other Cyber Monday takeaways

- Amazon’s marketplace: Amazon reported a record-breaking holiday season to date and announced third-party marketplace sellers had their best-ever Black Friday and Cyber Monday. Independent businesses selling on Amazon—which the web giant says are nearly all small and medium-sized businesses—surpassed $4.8 billion in worldwide sales from Black Friday through Cyber Monday, a more than 60% year-over-year increase from the same holiday weekend in 2019.

- Curbside pickup: With shoppers increasingly turning to omnichannel services to avoid crowds and shipping delays, curbside pickup continues to flourish amid the pandemic. On Cyber Monday, curbside pickup sales grew 30% year over year, Adobe reports.

- Mobile: 37% of sales on Cyber Monday were placed on mobile devices, according to Adobe.

- Traffic: Traffic to ecommerce sites spiked nearly 80% on Cyber Monday, making it the busiest day for online shopping so far during the 2020 holiday season and surpassing online store visits on Black Friday, according to Cloudflare Radar, the insights arm of Cloudfare, a website security company that also provides content-delivery network services.

- Season-to-date spending: Cyber Monday’s digital sales pushed the total season-to-date spending from Nov. 1-Nov. 30 over the $100-billion mark, according to Adobe. That holiday retail milestone was reached nine days faster than last year. So far, shoppers have spent $106.5 billion online, up 27.7% year over year.

Percentage changes may not align exactly with dollar figures due to rounding.

Favorite