The 2020s are not even half over, and retailers have already had to rethink what their omnichannel strategies are in the face of multiple historic shifts in consumer behavior. The decade has challenged retailers year after year to adapt in massive ways. Each step of the way, they have had to adjust to new consumer preferences and economic conditions.

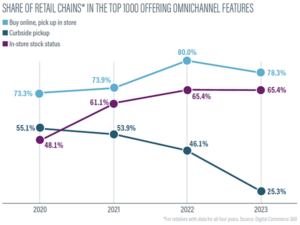

In the 2024 Omnichannel Report from Digital Commerce 360, we began by tracking how the past few years have changed retail. However, we also saw signs of normalization starting to materialize. This could be seen as rates of retailers offering some omnichannel options plateaued. Elsewhere, spikes in some offerings began to recede.

What is important in retail omnichannel strategy?

This year’s report underscores how vital buy online, pick up in store (BOPIS) options (78.3% adoption rate) and in-store stock statuses (65.4%) have become for many retailers in the Top 1000. At the same time, curbside pickup is now offered by a dramatically reduced share (25.3%) of Top 1000 merchants than it was in each of the past three years.

The report digs into the numbers from Digital Commerce 360’s own data and research. Our reporting and analysis track what the most successful online retailers in North America are doing. In addition, it layers on reporting and insights from leaders such as Kroger, Lowe’s, Walmart and others. These insights show what is working and how those companies are innovating.

After that, we turn to more than 1,000 omnichannel shoppers. You’ll find their perspectives in fresh survey results from Digital Commerce 360 and Bizrate Insights. There, consumers explain which omnichannel options make a difference for them. They also tell us what has convinced them to complete orders.

Retail omnichannel trends

Here are three major success stories we found in 2024:

- Buy online, pickup in store (BOPIS) and in-stock store statuses are both still being offered at levels higher than we saw in 2020.

- Curbside pickup, even as it declines among other categories, is still a big priority for major retail chains in the grocery space, as well as office supplies merchants.

- Shoppable video is becoming more common on social and streaming platforms with implications for the largest online retailers and their retail media networks.

Altogether, this report’s data-driven assessment presents a landscape that has moved seismically over nearly half a decade. Though retailers were forced to adapt, the lessons they learned during the COVID-19 pandemic are still informing choices. As a result, a new era is emerging.

What else is in this year’s report?

The 2024 Omnichannel Report includes all of the following:

- The latest data on omnichannel trends in the Top 1000

- Conversion rates for Top 1000 retailers offering BOPIS and curbside pickup

- How shoppable video on TikTok and streaming platforms is being used

- How brands are leveraging their latest augmented and virtual reality experiences

- What matters most in omnichannel for the grocery sector

- Consumer survey data about their omnichannel habits, preferences and recent activity

Key data from the report:

- 78.3% of retail chains in the Top 1000 offered BOPIS in 2023, down from 80.0% in 2022.

- 65.4% of store-based retailers in the Top 1000 offered in-store stock statuses, roughly the same as the year before.

- Only 25.3% of Top 1000 retail chains still offered curbside pickup in 2023, down for the third year in a row from a 2021 high of 55.1%.

- Office Supplies merchants saw the highest rate of offering curbside pickup by category at 50.0%.

- 62% of consumers surveyed said they checked product availability at a nearby store online before making a purchase, making it the most popular omnichannel activity.

- 66% of consumers surveyed indicated that they had completed an in-store or curbside pickup order at Walmart within the past six months.

Do you rank in our database?

Submit your data with this quick survey and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter, Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite