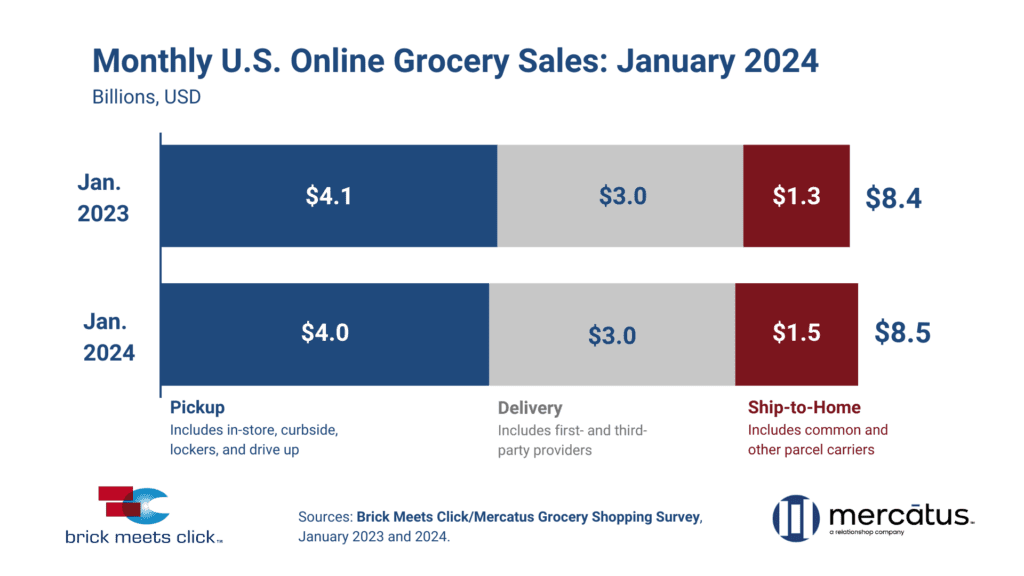

Online grocery sales grew 2% year over year in January, but 2024 still began with mixed results, according to data from the monthly Brick Meets Click and Mercatus Grocery Shopping Survey.

Survey data showed that the number of households that bought groceries online grew. However, there was a downward year-over-year trend in order frequency and average order value (AOV), Brick Meets Clicks and Mercatus reported.

They conducted the survey at the end of January 2024 with 1,745 respondents who shop for groceries online. Results compare with those from a January 2023 survey of 1,735 online grocery shoppers.

January online grocery sales in the US

Brick Meets Click and Mercatus define the three receiving methods for online grocery sales as:

- Delivery: Includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup: Includes orders received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-home: Includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Ship-to-home online grocery sales grew 7.8% year over year to reach $1.5 billion in January. That makes it the only segment of the three to grow year over year, as delivery remained flat at $3 billion and pickup declined 1.9% to $4.0 billion. Ship-to-home also saw a larger order volume in January 2024 as well as a 7% AOV increase.

Still, pickup had the most sales of the three categories, finishing the month with nearly half (47.4%) of online grocery sales. Meanwhile, the 3% growth in AOV for online grocery sales opting for delivery did not offset the larger decline in order volume, Brick Meets Click said.

“When more than 10% of U.S. households have less money to spend on groceries this year than they did last year, changes in buying behavior are certainly expected,” said David Bishop, partner at Brick Meets Click. “The reduction in SNAP payments that took effect at the end of February 2023 is one of the factors driving the flight-to-value trend which we’ve observed and tracked since mid-2023.”

Amazon, Walmart and the online grocery sales arena

Walmart and other mass merchants continued to outperform the broader online grocery sales market, Brick Meets Click said. Mass merchants expanded their bass of monthly active users by almost 10%, according to Brick Meets Click data. They also grew AOV in January, helping to compensate for flat year-over-year order frequency.

At the same time, the number of monthly active users at supermarkets declined more than 5%, and the average number of orders fell at a larger rate, Brick Meets Click said without specifying that rate.

Amazon accounts for the largest share of ship-to-home online grocery sales, Brick Meets Click said. The retailer’s sales improved compared to 2023, “but those improvements need to be put into context,” Brick Meets Click added.

Amazon had lost a “large” number of monthly active users in January 2023, making the growth in January 2024 “driven partially by easier comparable results,” Brick Meets Click said.

“Overall, Amazon’s year-over-year MAU gains more than offset the drop in order frequency, and moderate AOV gains also helped drive its positive sales results,” Brick Meets Click said.

Amazon is No. 1 in the Top 1000, Digital Commerce 360’s ranking of the largest North American online retailers. Walmart ranks No. 2.

“Competing online is only getting more challenging for regional grocers as customer expectations continue to increase,” said Mark Fairhurst, global chief growth officer at Mercatus. “So, beyond improving key elements of the experience, like fill rates, wait times, and product quality, regional grocers also need to work even harder to identify additional ways to help their customers save money.”

Do you rank in our database?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite