Online sales accounted for 11.7% of total weekly grocery spending in the last week of November, new survey data shows.

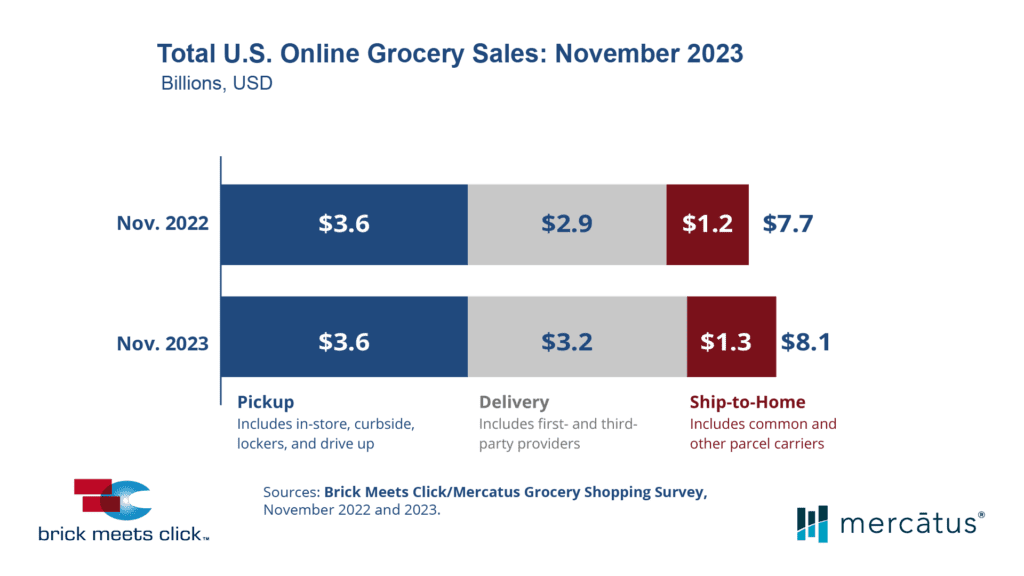

United States online grocery sales reached $8.1 billion in November, according to data from the monthly Brick Meets Click and Mercatus Grocery Shopping Survey. That’s 5.2% growth over November 2022’s online grocery sales, which reached $7.7 billion. Online grocery sales were divided into three key categories: delivery, pickup, and ship-to-home.

Is the online grocery market growing?

Survey data found that mass merchants surpassed supermarkets to become the primary retail destination — online and offline — for most households. In November, 42% of U.S. households used a mass merchant (for example: Walmart or Target) for most of their in-store or online grocery purchases, data showed. That’s a reversal from May when 42% of U.S. households reported using supermarkets as their primary stores.

“The current economic realities and omnichannel strategies are aiding mass retailers in attracting more customers today,” said David Bishop, partner at Brick Meets Click. “The price advantage that a mass rival, such as Walmart, enjoys is motivating cash-strapped households to shift where they shop, and mass customer engagement strategies are making it easier for those customers to shop the way they want.”

Year-over-year changes in fulfillment choice

Brick Meets Click and Mercatus define pickup as including in-store, curbside, lockers and drive-up. Delivery includes those from first- and third-party providers. Ship-to-home includes common and other parcel carriers.

In both 2023 and 2022, the pickup option brought in $3.6 billion in November online grocery sales. Delivery grew to $3.2 billion in online sales in 2023. That’s up from $2.9 billion in November 2022. Ship-to-home sales grew slightly to $1.3 billion in 2023. That’s an increase from $1.2 billion last year.

Online grocery sales among Top 1000 retailers

The Food/Beverage category of Top 1000 retailers — which includes grocers such as The Kroger Co. and Albertsons Inc. — brought in an estimated $31 billion in online sales in 2022. Notably, the category does not include mass merchants such as Walmart or Target. The Top 1000 is Digital Commerce 360’s ranking of the largest online retailers in North America by annual web sales.

The growth in online grocery sales among Food/Beverage retailers has been consistent for the last five years but, because of the COVID-19 pandemic, surged in 2020. That year, online grocery sales from Food/Beverage retailers more than doubled to $27.1 billion from $13.4 billion in 2019. The Food/Beverage category of the Top 1000 then had the largest compound annual growth rate (CAGR) from 2019 through 2022 — 32.4%. The Top 1000 category with the next-highest CAGR in that time frame was Health/Beauty, at 26.5%. On the low end, the Office Supplies category had the slowest growth at 7.4%.

Moreover, the grocery/fresh food subcategory grew faster than any other subcategory within the Food/Beverage from 2019 through 2022. It also outpaced growth for the category as a whole (34.8% for the subcategory versus 32.4% for the entire category). Then, Food/Beverage online sales grew by only 3.4% in 2022 as many consumers returned to shopping for food in supermarkets.

It’s also worth noting that growth in online sales of food and drink did not begin with the pandemic. In the three-year period from 2016 to 2019, Top 1000 sales in the Food/Beverage category posted a 32.7% CAGR.

Do you rank in our database?

Submit your data with this quick survey and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite