Salesforce’s numbers are in: Global online sales reached $1.17 trillion during the 2023 holiday season.

The ecommerce software provider defined the holiday season as Nov. 1 through Dec. 31. Year over year, Salesforce said, global online sales grew 3%. Moreover, the global average discount rate across the entire holiday season was 21%. That’s the highest it has been since 2020, Salesforce said. Salesforce uses data from more than 1.5 billion global shoppers.

In North America, 76 of the top 2000 online retailers use Salesforce as their ecommerce platform, according to Digital Commerce 360 data. In 2022, those 76 online retailers combined for more than $116.97 billion in web sales.

Meanwhile, U.S. online holiday spending reached $221.1 billion, according to data from Adobe Analytics.

How much did global ecommerce sales grow during the 2023 holiday season?

By week, the largest sales growth during the holiday season was a tie between Cyber Week (the week encompassing Thanksgiving, Black Friday and Cyber Monday) and pre-Christmas, according to Salesforce data. Each of those weeks grew sales 6% year over year, Salesforce reported. The next-highest sales growth (4%) was in the first week of November. Christmas-week sales growth declined 4% year over year.

Based on Salesforce’s data, order growth was correlated with sales growth during the 2023 holiday season. Cyber Week and pre-Christmas week each recorded 6% year-over-year order volume growth in 2023. Meanwhile, order volume during the first week of the holiday season grew 2% year over year, Salesforce said. Christmas-week order volume declined 6%.

For the holiday season as a whole, order volume grew 2% year over year, Salesforce said. That correlated with 2% year-over-year growth in units per transaction growth, and the increase in average selling price was 0.7% year over year, Salesforce said.

How popular was store pickup in the 2023 holiday season?

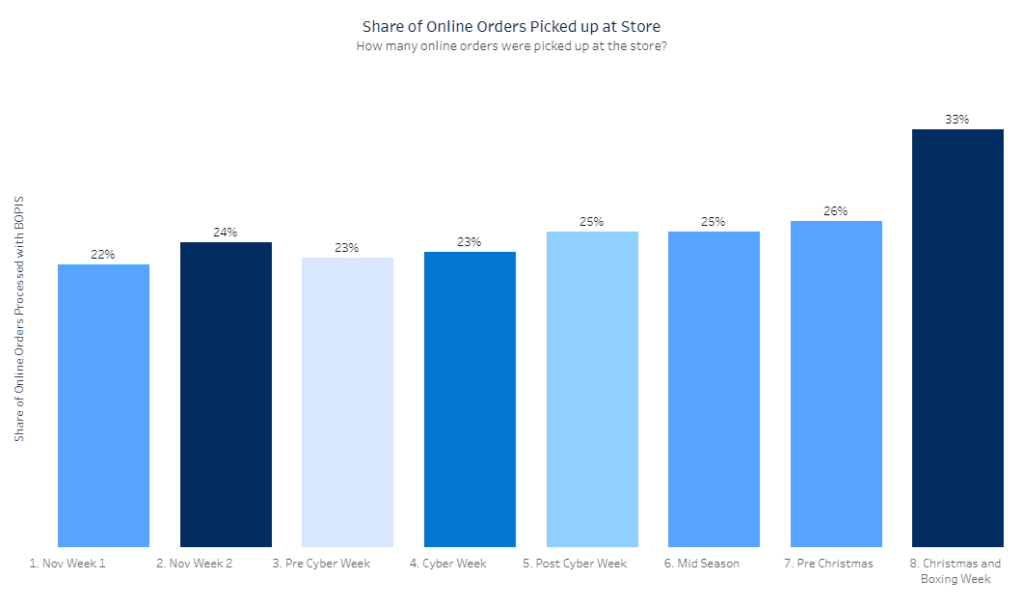

Each week of the 2023 holiday season, at least 22% of orders were picked up at stores, Salesforce found — or more than one out of every five orders. That grew to at least a quarter of all orders from the week after Thanksgiving through Christmas week, according to Salesforce, with about a third of orders (33%) being picked up at stores during Christmas week.

Share of online orders picked up at store during the 2023 holiday season, according to Salesforce.

Mobile shopping trends during the 2023 holidays

Traffic to mobile devices grew year over year during each week of the holiday season, Salesforce said. The largest growth in mobile traffic, 10%, was during Cyber Week. The first week of the holiday season, post-Cyber Week, and the week before Christmas each recorded 9% growth in mobile traffic, according to Salesforce.

In contrast, desktop web traffic decreased each week of the holiday season, Salesforce found.

What channels drove the most online traffic through the holiday season?

Each week of the holiday season, direct traffic accounted for the largest source of online retailers’ global website visits. From Nov. 1 through the end of December, Salesforce data shows, direct traffic accounted for 37% of all visits to online retailers’ websites, with three exceptions. During and directly preceding Cyber Week, that traffic source bumped up slightly to 38%. On Christmas week, it dipped slightly to 36%.

Search traffic accounted for about a third of all website visits throughout the 2023 holiday season, Salesforce found, hovering between 31% and 33% each week. Internal traffic accounted for 14% to 15% of visits each week during that time frame, and traffic from social media platforms combined for 10% to 11% of total visits each week. Advertising and email traffic each accounted for just 1% of global visits to online retailers’ websites.

Global web traffic growth from social media platforms grew 10% year over year in the first week of the 2023 holiday season, tied with the mid-season week halfway between Cyber Week and Christmas. Such traffic from social media platforms was its lowest during the holiday season during Christmas week (4%).

Advertisement traffic growth increased the most in the mid-season week (27%) and the week before Christmas (23%). The week before Thanksgiving, advertising traffic growth decreased 4%, the only week with negative ad traffic growth during the season.

Email and direct traffic were the only other channels to have negative growth during the 2023 holiday season, according to Salesforce data. Email traffic growth decreased 2% the week before Christmas, with a larger drop (-16%) during Christmas week. Direct traffic growth also decreased year over year (2%) during Christmas week.

How did returns factor into the 2023 holiday season?

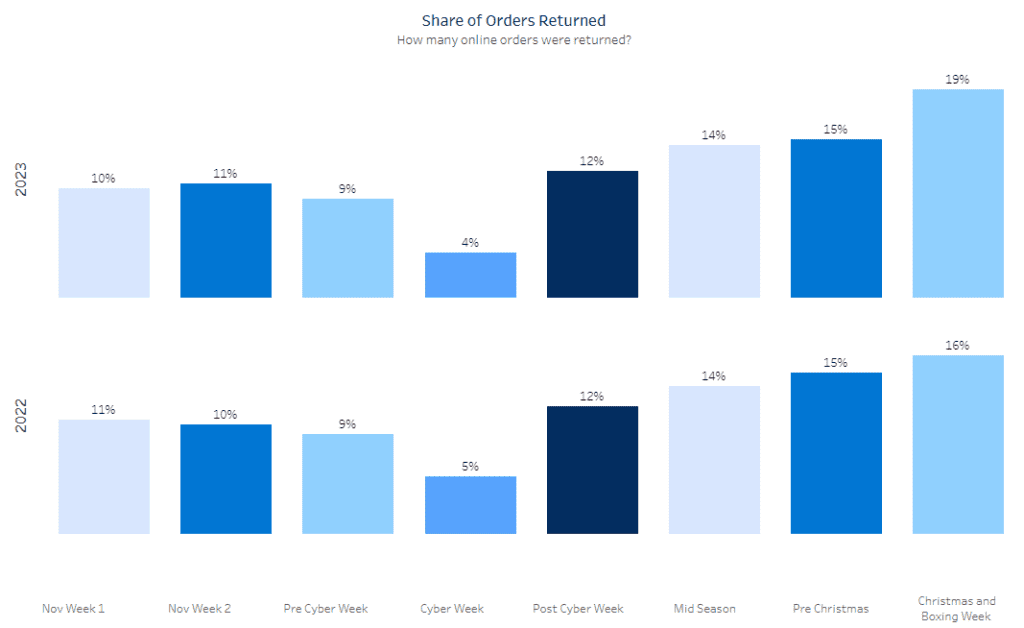

Salesforce data shows that returns during the 2023 holiday season were largely consistent with the 2022 season. The percentage of orders consumers returned each week was essentially flat, with the exception that they grew to 19% during Christmas week in 2023, compared with 16% in 2022. They also grew slightly in the second week of November 2023 (11%) compared with the same week in 2022 (10%).

Share of orders consumers returned during each week of the holiday season in 2023 and 2022, according to Salesforce data.

Returns dipped slightly to 10% during the first week of November 2023 from 11% in 2022, and to 4% during Cyber Week 2023 compared with 5% in 2022.

Do you rank in our database?

Submit your data with this quick survey and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite