FedEx Corp. doesn’t have to deliver more packages to increase its profitability.

The carrier reported that operating income grew 19% to $1.24 billion in its fiscal third quarter of 2024 ended Feb. 29. That’s despite total revenue decreasing to $21.7 billion from $22.2 billion in the year-ago period. Net income grew to $879 million from $771 million in the year-ago period.

“FedEx delivered another quarter of improved profitability in what remains a difficult demand environment, reflecting outstanding service and continued benefits from DRIVE,” said Raj Subramaniam, FedEx president and CEO. “We are making meaningful progress on our transformation, while strengthening our value proposition and improving the customer experience. I’ve never been more confident in our path ahead as we build a more flexible, efficient, and intelligent network.”

478 retailers in the Top 1000 use FedEx for at least some of their fulfillment. The Top 1000 is Digital Commerce 360’s ranking of North America’s leading online retailers by web sales.

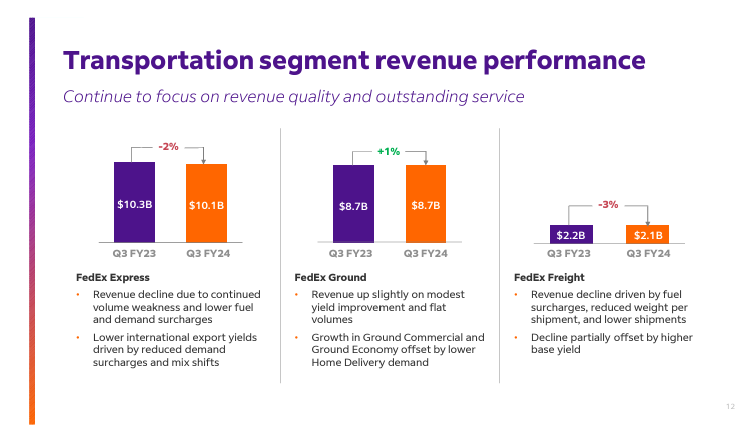

FedEx revenue in Q3 by delivery segment

FedEx Express revenue declined 2% year over year to $10.1 billion. The decline was due to lower volumes and fewer fees for fuel and other surcharges. However, operating income for FedEx Express grew 110% over the same period to $256 million. That was driven by lower operating costs and structural cost cutting across the organization, FedEx said.

FedEx Ground was the only segment to grow revenue in Q3. Revenue increased 1% to $8.7 billion thanks to improved yield, while volume remained mostly flat. Ground commercial and ground economy both grew in Q3, partially offset by declining demand for home delivery.

Freight revenue declined 3% to $2.1 billion due to lower fuel surcharges and a decrease in weight per shipment. That was partially offset by higher base yield, the delivery company said.

Source: FedEx Corp. Investor Relations

FedEx Q3 package volume

“Broadly speaking, volumes are stabilizing as we lap weaker demand from a year ago,” said Brie Carere, chief customer officer.

FedEx Express Domestic average daily volume (ADV) declined year over year in each month of Q3. That was a continuation of declines in volume throughout Q2. FedEx Express International showed the highest growth in ADV in the quarter. ADV grew 8% in December and 8% in January, before declining 2% in February.

FedEx Ground ADV declined 2% in December before increasing 2% in January and 1% in February. Finally, FedEx Freight volume declined each month of Q3, too.

In addition, the fulfillment vendor is facing challenges from its contract with the United States Postal Service, it said. USPS volume has also declined in the quarter, leading to fewer packages delivered through FedEx.

“Despite this volume and revenue draw down, our service obligations to the USPS remain fixed,” Subramaniam said.

FedEx’s current contract with USPS expires on Sept. 29. With that date approaching, FedEx has made “significant progress” on negotiating a new multi-year contract, Carere said.

DRIVE savings plan

FedEx introduced its DRIVE savings plan in fiscal 2023 to improve long-term profitability through cost reductions.

“DRIVE is having a real impact, supporting both operating income growth and margin expansion,” said John Dietrich, executive vice president and chief financial officer. “As we look ahead, we’re focused on continuing to deliver on DRIVE and our commitments to support long-term shareholder returns.”

The initiative led to $550 million in cost savings in Q3, FedEx said. The company expects DRIVE savings to total $1.8 billion in fiscal 2024, and $2.2 billion in fiscal 2025.

FedEx also cut 22,000 jobs over the last 12 months as part of the cost saving goal, it said.

FedEx earnings

For the fiscal third quarter ended Feb. 29, FedEx reported:

- Net income increased 14% to $879 million.

- FedEx revenue declined 2% to $21.7 billion.

- The DRIVE program saved $550 million in costs.

Percentage changes may not align exactly with dollar figures due to rounding. Check back for more earnings reports. Here’s last quarter’s FedEx update.

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter, Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.