Best Buy Co. Inc. wasn’t doing so hot five or six years ago thanks to ecommerce giants like Amazon.com Inc. taking a big slice of sales in Best Buy’s product categories, said Best Buy’s chief supply chain officer Rob Bass at the ProMat 2019 conference this month in Chicago.

Amazon dominated 31.8% of purchases made in the consumer electronics category in 2018, according to a Rakuten Intelligence survey of 3.1 million U.S. online shoppers.

So, Best Buy knew it needed to make some big changes if it was going to survive. It wanted to become more efficient, improve its supply chain and figure out how it could compete in a different way, Bass said.

But there were several issues to combat: 60% of Best Buy’s ecommerce units shipped are repack items—meaning Best Buy moves product into its Best Buy-branded packaging and boxes rather than use what the manufacturer sends the product in—and 80% of its SKUs are eligible for repack. But Best Buy didn’t have the capital to invest in a bigger team to keep up with the ecommerce repack item demand, as well as shoppers’ growing demand for more efficient ecommerce fulfillment and delivery. Plus, most of its distribution centers were five-day-a-week operations and its systems were “old enough to smoke and drink in the U.S.,” Bass said.

But it did have a few warehouses in locations that could serve a wide market: Compton, California; Piscataway, New Jersey; and Chicago. Best Buy wanted to put its “big-hitting ecommerce SKUs” inside these buildings and transform them into new metro ecommerce centers, Bass said.

Best Buy found logistics system integrator Bastian Solutions, coupled with AutoStore—a bin storage system in which bins are stacked vertically in a grid and retrieved by robots that travel on the top layer of the system—to overhaul its distribution centers. The process took about 12 months to implement, but the retailer declined to provide specifics of costs or when it started using the new system.

At each of Best Buy’s three metro ecommerce centers, the retailer now has 30,000 bins and 73 robots. Best Buy delivers about 30-40% of a store’s inventory from its metro ecommerce centers and segregates store delivery by aisle. At Best Buy’s regional distribution centers—located in San Francisco, Atlanta and Findlay, Ohio—Bastian and AutoStore outfitted the centers with 150,000 bins and 195 robots.

An ecommerce fulfillment bin in one of Best Buy’s metro ecommerce centers.

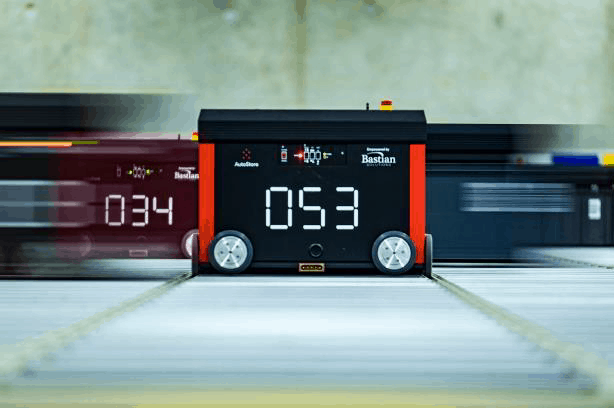

An example of an AutoStore robot that navigate along the top layer of the bin storage system.

Since implementing these new systems, Best Buy packs 20,000 units per hour, but declined to provide specifics of how many units it packed prior to this. However, Bass did note that Best Buy’s warehouse workers would walk seven to eight miles per day retrieving and packing products. Now, they stand in place while the bins and robots move around the facilities.

“The solution we’ve come up with to use regional distribution centers and metro ecommerce centers has given us the edge to go from five to six calendar days to about two days of shipping,” Bass said. “We’re very proud of that so we can match Amazon’s speed of delivery without the Prime member price tag.”

But Best Buy, No. 8 in the Internet Retailer 2018 Top 1000, has also teamed up with Amazon (No. 1) “to work with them rather than fight against them all the time,” Bass said. Best Buy opened a storefront on Amazon.com to sell TVs, which come equipped with Amazon’s Fire smart-TV platform. The two Fire TVs, one made by Toshiba and the other from Best Buy’s house brand Insignia, are also available in Best Buy stores and on its website. During the holidays, two of the five best-selling televisions on Amazon were sold through Best Buy’s storefront.

Favorite