U.S. online grocery sales held steady in March, according to data from the monthly Brick Meets Click and Mercatus Grocery Shopping Survey.

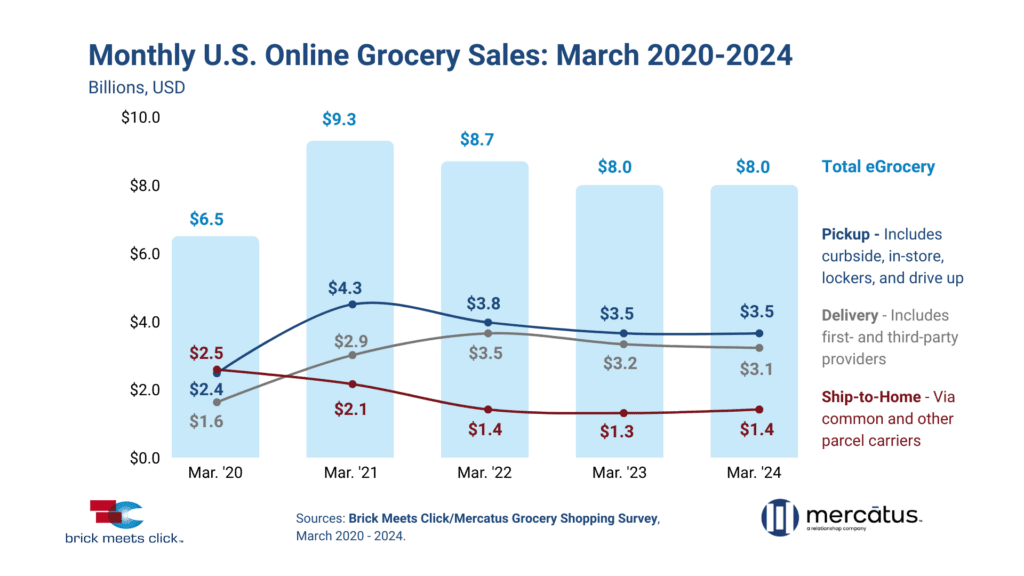

After falling two years in a row, March online grocery sales were nearly identical in 2024 and 2023. March online grocery sales grew fast in 2021, to $9.3 billion from $6.5 billion in 2020. Since then, they decreased to $8.7 billion in 2022 and then $8.0 billion both this year and in 2023. Overall, online grocery sales in March 2024 are up 23% from March 2020.

Brick Meets Click and Mercatus conducted the survey at the end of March 2024 with 1,810 respondents who shop for groceries online. Results compare with those from a March 2023 survey of 1,742 online grocery shoppers, as well as:

- March 2022 (1,681 respondents)

- March 2021 (1,811 respondents)

- March 2020 (1,601 respondents)

“While most people recognized that the pandemic was a catalyst for buying groceries online, few could fully anticipate the implications of that surge,” said David Bishop, partner at Brick Meets Click. “Now, four years after COVID-19 first impacted our everyday lives, eGrocery in the U.S. looks very different from both a contribution and growth perspective, and this will impact how grocers and others expand and drive profitability in their respective businesses moving forward.”

Brick Meets Click and Mercatus define the three receiving methods for online grocery sales as:

- Delivery: Includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup: Includes orders received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-home: Includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

March online grocery sales in the US

Pickup sales accounted for less than a third of online grocery sales in 2019, Brick Meets Click said. Since then, it has taken the largest sales share of the three methods in 2021 and has remained the largest. Pickup sales didn’t change year over year in 2024, holding still at $3.5 billion.

Ship-to-home online grocery sales grew 5.9% year over year to $1.4 billion in March 2024 — the only method to grow. Delivery was the only sales method to decrease year over year in March — 2.6% to $3.1 billion in 2024.

More than three-quarters of all U.S. households (78.6%) use online grocery, according to Brick Meets Click. That customer pool consists of active, lapsed and infrequent online grocery customers, it said. In contrast, that online grocery household penetration was at 70.8% in March 2020.

Brick Meets Click and Mercatus said a challenge brick-and-mortar grocers face is building a mobile app that assists customers as they shop, whether that’s online or in a physical store.

“Mass retailers, like Walmart and Target, have already invested heavily in enhancing the perceived value from using their mobile apps and it shows,” Brick Meets Click said.

Brick Meets Click and Mercatus data shows that 76% of households that primarily buy groceries from Walmart and that also buy groceries online made at least one online grocery order from Walmart in March 2024. Meanwhile, that rate was lower among households that primarily shop at a supermarket and buy groceries online. Only 60% of them bought groceries online from a supermarket in March.

“Helping customers build their basket of goods by using tactics like personalized offers or targeted deals is not just key to growing sales but also to improving the chances that they’ll come back again,” said Mark Fairhurst, global chief growth officer at Mercatus. “For today’s grocers, keeping your online customers engaged is more important than ever as growth is now more likely derived from increased order frequency and/or spend per order.”

Do you rank in our database?

Submit your data with this quick survey and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter, Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite