Adrien Henni, chief editor, East-West Digital News

Specialized research agency Data Insight has just released the international version of its Russian ecommerce report for 2020. Many market segments recorded explosive growth as the pandemic drove millions of consumers to online shopping, accelerating pre-existing expansion.

Domestic sales of physical goods amounted to 27 trillion rubles (some $37 billion at the average exchange rate of the year), up 58% from 2019— placing Russia among the world’s fastest-growing ecommerce markets.

The most spectacular growth rate was in e-grocery, with sales volumes reaching 13 billion rubles ($180 million), up 250% from 2019. Illustrating this trend, market leader X5 Retail Group posted a 347% GMV jump, becoming Russia’s largest digital company in food retail.

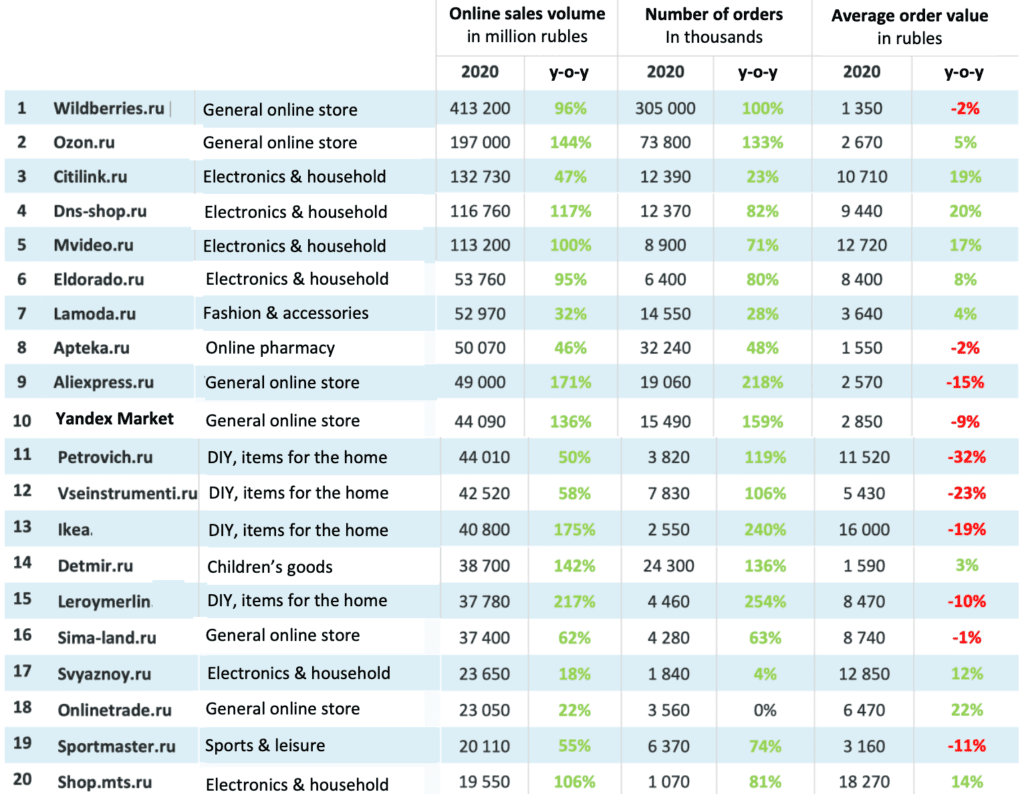

Data Insight also ranks Russian ecommerce sites by sales volume, number of orders and average order value. The 2020 ranking identifies the following leaders:

- Wildberries.ru maintained its leadership in 2020 as its sales revenues reached 413 billion rubles ($5.7 billion), nearly doubling year over year. However, the company posted a net profit of only 2,11 billion rubles ($29.1 million), twice less than in 2019. Meanwhile, the company launched sales in Poland, Slovakia, Ukraine and Israel—before Western Europe and the U.S. in early 2021.

- With a whopping 144% year-on-year revenue growth, Ozon.ru ranked second in 2020. It was #7 in 2017, #4 in 2018 and #3 in 2019. The year was extremely favorable to Ozon on the financial front, too. After a $150 million pre-IPO round in March, the company made a triumphant debut on the NASDAQ in November, raising more than $1.2 billion instead of the expected $500 million.

- Selling electronic appliances and a variety of other products, Citilink.ru fell from second place in 2019 to the third one in 2020, with a relatively modest 47% year-on-year growth. The Merlion group, which owns the site, has engaged in talks with Sber for a potential acquisition.

Online fashion leader Lamoda—a property of Global Fashion Group—held seventh place among Russian ecommerce sites. It underperformed the market with a mere 32% sales growth year over year.

On their side, Western omnichannel retailers Ikea and Leroy Merlin made an impressive online performance. According to Data Insight’s analysts, the Swedish DIY giant generated almost $566 million in online sales revenues last year (up 175% from 2019), while its French competitor made around $524 million (up 217%).

Amazon is absent from this ranking. The U.S. giant’s sales to Russian consumers are modest, based only on a cross-border offer.

Top 20 Russian ecommerce sites in 2020

Source: Data Insight Domestic sales only. The sales numbers include VAT as well as delivery fees. Sales of ready-to-eat food, digital goods, services, as well as cross-border orders, are not covered. This table is an excerpt from Data Insight’s Top 100.

This article first appeared in East-West Digital News, the international online resource on Russian digital industries. It is reposted with permission.

Favorite