Total U.S. online grocery sales in December 2024 mirrored the prior month, according to new data from the monthly Brick Meets Click and Mercatus Grocery Shopping Survey.

In both months, sales grew year over year to about $9.6 billion, or 18.7%. The details vary slightly, though. How much U.S. consumers spent buying groceries online in December differed from November by fulfillment type.

Brick Meets Click and Mercatus define the three receiving methods for online grocery sales as:

- Delivery: Includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup: Includes orders received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-home: Includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

December marked the fifth straight month in which U.S. consumers spent at least $9.5 billion buying groceries online.

That’s part of a trend in which online grocery sales surged year over year in the second half of 2024. They increased 17.7% year over year in the last six months of 2024, whereas the first half of the year’s online grocery sales were nearly flat (a 0.3% increase), according to Brick Meets Click and Mercatus.

They attributed the main difference to “aggressive promotions of annual subscriptions or memberships that began mid-year and have continued off and on since then.” Mass merchants, marketplace providers and supermarkets offered discounts ranging from 33% off to 80% off.

“While subscriptions and memberships aren’t new, the deep discounts were new, and they resonated with customers by offering the opportunity for significant savings,” said David Bishop, partner at Brick Meets Click, in a statement. “As a result, customers are more vested in their provider-of-choice, motivating many to place more orders which helps those providers to gain a larger share of the grocery wallet and improve engagement and retention rates.”

December online grocery sales

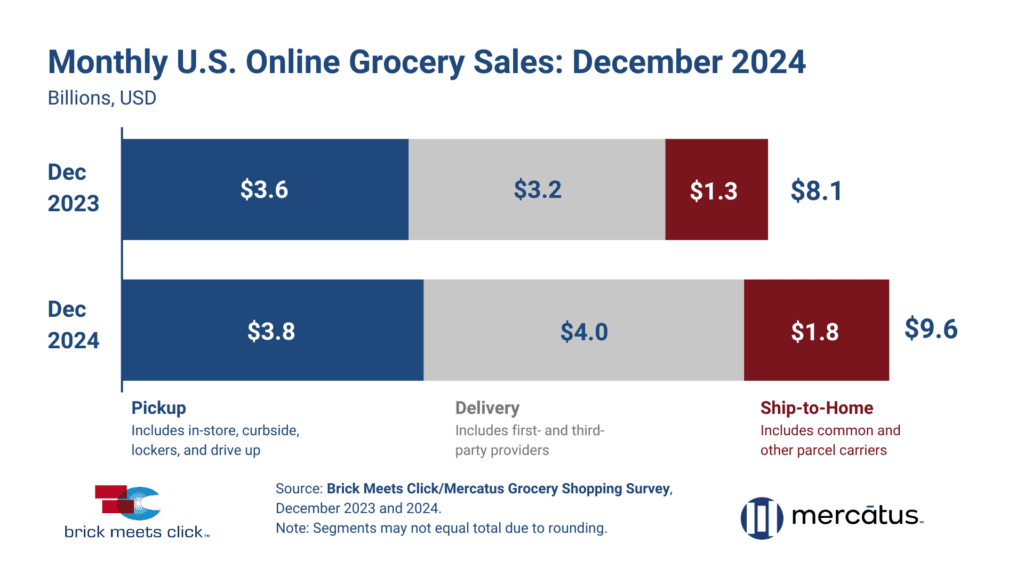

Delivery overtook Pickup as the lead fulfillment type for December online grocery sales.

U.S. consumers spent about $4.0 billion on Delivery in December, according to Brick Meets Click and Mercatus. Meanwhile, they spent around $3.8 billion on Pickup and $1.8 billion on Ship-to-Home. That’s 24.6% year-over-year growth for Delivery, 5.3% for Pickup, and 40% for Ship-to-Home.

Each receiving method gained sales year over year — the opposite of what happened in December 2023.

And by store type, grocery operators “continue to face increasing challenges to online growth,” Brick Meets Click and Mercatus said. They define grocery operators as supermarkets and hard-discount stores. Mass Merchants are responsible for some of that competition, they added.

More than half of all monthly active users (MAUs) completed at least one online grocery order with a Mass Merchant in December. That compares to about one-third of all MAUs completing at least one online grocery purchase with a grocery operator. Additionally, a third of grocery operators’ MAUs also completed an online grocery purchase from a Mass Merchant in December.

“Regional grocers looking to boost eGrocery sales should focus on delivering real savings and targeted loyalty perks,” said Mark Fairhurst, chief growth marketing officer at Mercatus, in a statement. “By leveraging AI-driven personalization and integrated loyalty solutions, grocers can convert occasional shoppers into loyal digital customers, driving repeat orders and larger baskets across both online and in-store channels, to fuel sustained growth.”

Albertsons-Kroger merger update

Also in December, a federal judge issued an injunction stopping the deal that would have seen Kroger acquire Albertsons for about $25 billion.

Albertsons would have come out of the merger as a “surviving corporation and a direct, wholly owned subsidiary of Kroger,” it said in an earnings release for its fiscal Q3 2024, which ended Nov. 30. The deal spent about two years in the regulatory and judicial systems.

The Teamsters union released a statement supporting the decision to reject the acquisition. The labor union called the merger “reckless” and said it posed “a direct threat to workers, consumers, and competition in the grocery industry.”

The Kroger Co. ranks No. 6 and Albertsons is No. 19 in the Top 1000 Database. The database ranks North America’s top online retailers by their annual ecommerce sales.

Kroger also owns and operates its namesake store, Kroger, as well as brands including Mariano’s, Dillons, Pick ‘n Save, Pay Less, Food 4 Less, and more. Albertsons also owns and operates a namesake store, Albertsons, as well as brands including Carrs, Haggen, Jewel Osco, Lucky, Safeway and more.

Click here to read last month’s update on online grocery sales.

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the online retail industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, X (formerly Twitter), Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite