It may appear all orders are received within two days, but that is the perception, not the reality. It is essential to shop retailers to see how they actually perform. That leads me to ask how long delivery should take.

For me, that could be but days but certainly no more. As someone who lives close to stores and can take advantage of in-store or curbside pickup with no added fees, there simply wouldn’t be much that I would be willing to wait for beyond that time frame. Of course, not all products are available at stores that are convenient to me, so that might weigh into my decision-making.

Shopping early is a trend

There seems to be a lot of discussion around delivery. In fact, when Digital Commerce 360 and Bizrate Insights surveyed 1,088 online shoppers in September 2022, almost one in three (30%) said they would shop earlier knowing that delivery would take longer.

Additionally, when asked the most important factors in choosing a retailer for the online holidays, 32% cited delivery speed. That was only behind free shipping at 59% and competitive prices at 52%

Amazon sets the tone

With almost half of online shoppers saying they will make at least half of holiday purchases on Amazon, the mass merchant’s delivery is considered the gold standard among shoppers. My experience with shopping typically finds two-day delivery, and that will serve as the backdrop for this exercise.

Testing retailer delivery will tell the story

I assessed retailer performance and start with a sample of 12. All but one, Amazon, had a physical store presence. For each retailer, I placed an order on Nov. 28, otherwise known as Cyber Monday. This way, retailers will be in the thick of things as it will have been a busy few days.

- Amazon

- Best Buy

- Dick’s Sporting Goods

- J.Crew

- Kohl’s

- Macy’s

- Nordstrom

- Sephora

- Target

- Ulta

- Urban Outfitters

- Walmart

Alerting shoppers to gift initiatives and timing is optimal

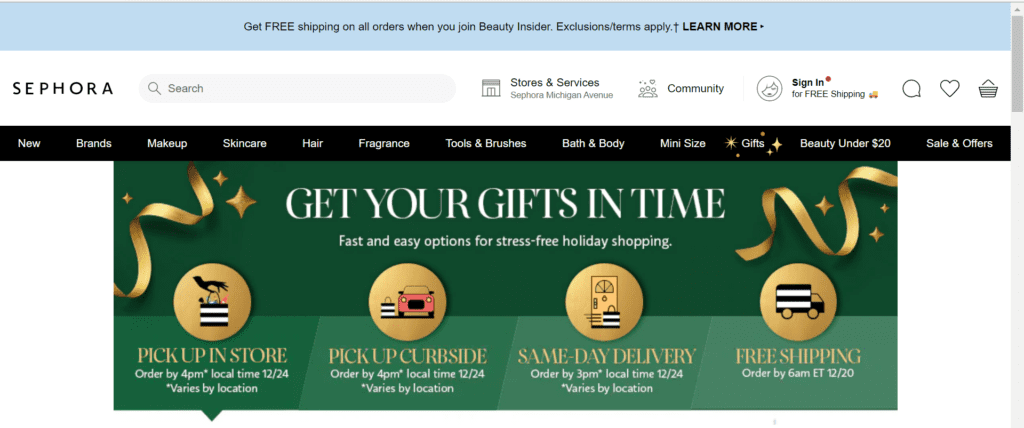

Despite the interest among shoppers around delivery, only two out of the 12 retailers tested dedicated homepage real estate to delivery concerns. Sephora’s message laid out the options for stress-free holiday shopping. The Learn More link detailed important timing information for each of the options.

Sephora links to shipping information from homepage.

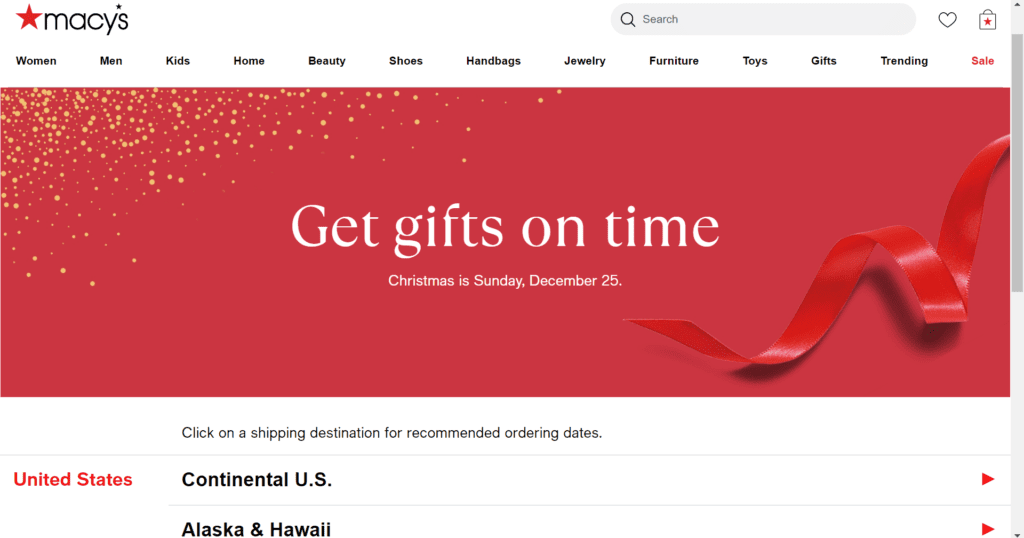

On the crowded Macys.com homepage, the retailer managed to slip in a message about getting gifts on time. Once shoppers clicked on the details, they could choose a shipping destination that included recommended ordering dates.

Macys outlines delivery by location.

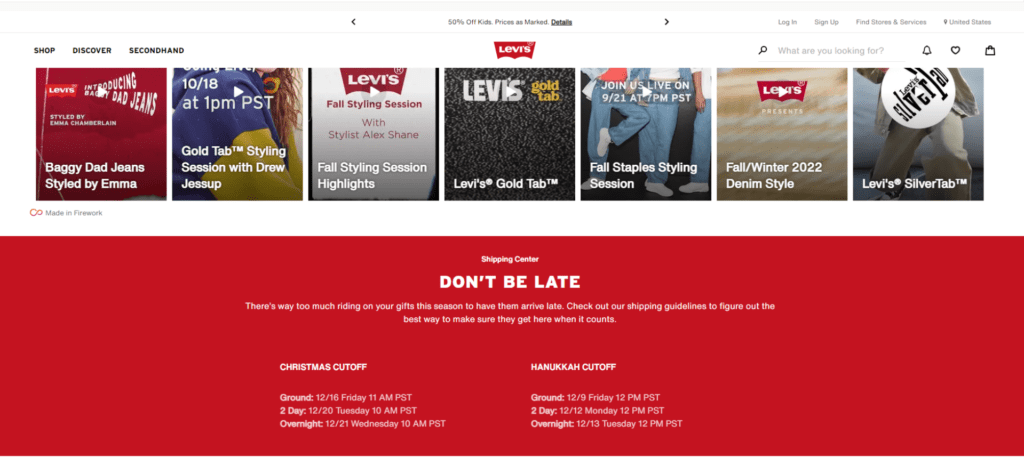

Lastly, our team came across an excellent example from Levi’s. The retailer’s homepage shipping center messaging reminded shoppers not to be late and provided cutoff dates for both Hanukah and Christmas.

Levi’s don’t be late message details cutoff dates.

Most retailers fail to talk returns

When it comes to returns, one rarely finds a message about extended return dates on the homepage. It’s unfortunate, as in many instances these policies serve as a bonus for shoppers and may increase conversion. For the 12 retailers we checked, 67% had an extended return date beyond their standard policy. Urban Outfitters was the clear winner with a generous Feb. 28 extension. January 31 was most popular (Amazon, Macy’s, Walmart, Sephora) while others like Best Buy gave until just Jan. 9, which is in line with technology restrictions I’ve seen in the past.

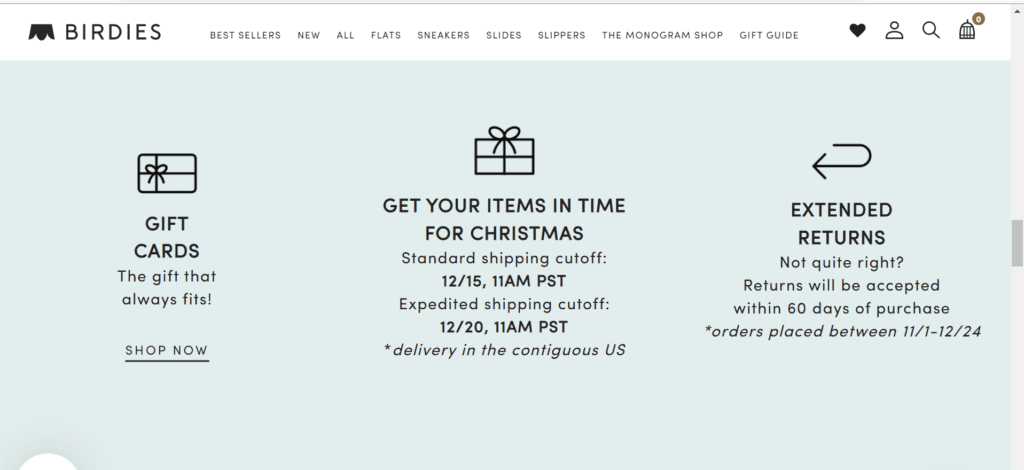

Birdies, a footwear retailer, articulates its gifting policies on the homepage and should be commended for its visibility and clarity.

Birdies shares gift information from gift cards to delivery and return details.

Three informational elements impact purchase behavior

Shoppers want to know about in-stock status, as that is the first step when thinking about making a purchase. From there, it’s nice to get a sense of when the retailer expects to deliver product. Lastly, there is the hard truth about when it actually arrives. It is these three issues that we decided to test over Cyber Monday.

1. Is the product in stock?

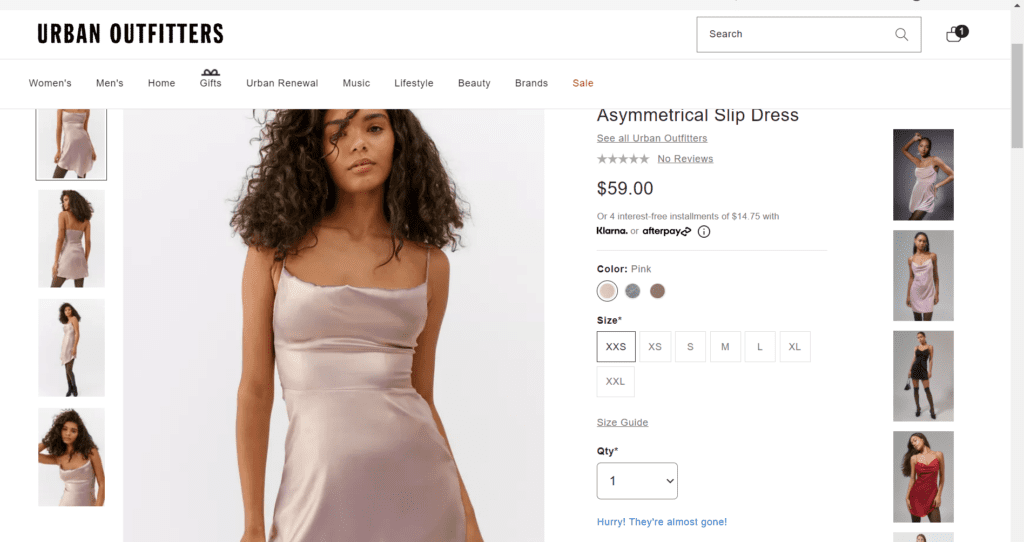

In some instances, inventory seemed to be limited. In the case of Urban Outfitters, the retailer encouraged shoppers to hurry because the size/color combination selected is almost gone. Some retailers shared such information at the product page, while others addressed it in the shopping cart.

Urban Outfitters product page highlights stock levels.

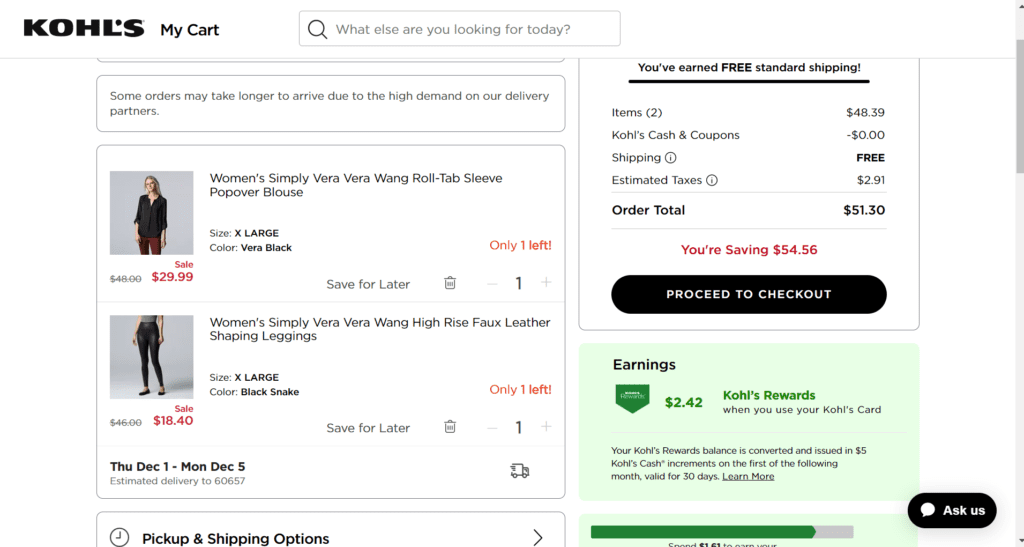

Kohl’s indicates inventory levels in the shopping cart, giving shoppers a sense of urgency.

Kohl’s shopping cart provides inventory levels.

My sentiment is that the earlier you can alert the customer to any inventory concerns, the better of an experience they will have.

2. How long will it take to arrive?

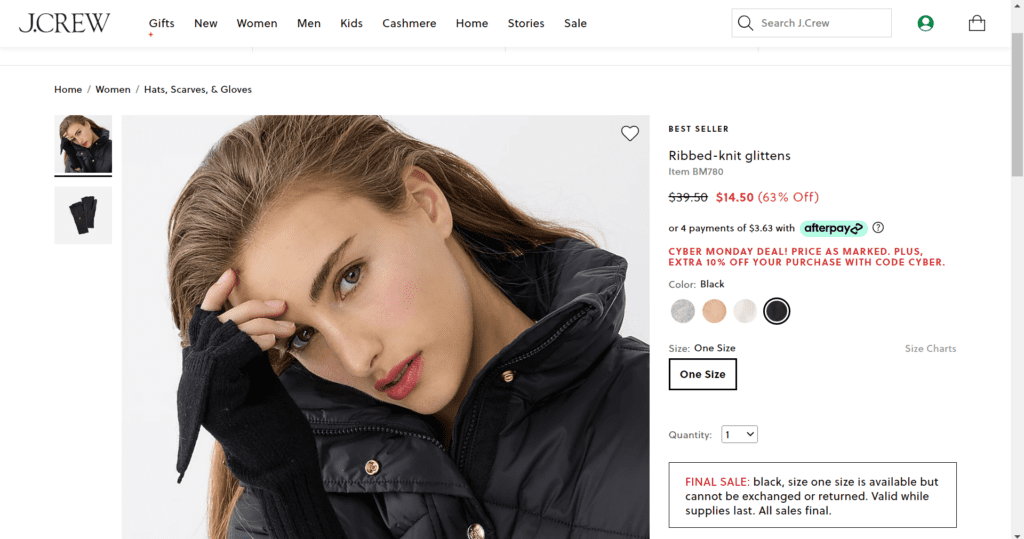

I looked to see if retailers specified an expected delivery date, and here, seven out of 12 (or 58%) included one. The quickest were slated to arrive in two days (Amazon, Best Buy), while I would have to be most patient for a pair of socks from J.Crew at almost two weeks from my order date. My bigger concern with them was finding something that I could actually return. This “Final Sale” message appeared on so many of the products, it was far from ideal for gift giving.

J.Crew final sale messaging is called out at the product page.

In some instances, a company like Nordstrom will provide a range like Dec. 8-13, which I have come to expect, though it is not as desirable for “need to know” shoppers. Several came back with a “usually ships in four days,” but that too would lack confidence in my book.

Buyer beware, because as it turns out, these dates are not guaranteed. Best Buy notified me of a delay, and it looks like it didn’t even ship until Dec. 1, which was beyond its Dec. 3 promised delivery date.

Promised delivery dates see mixed results

Let’s look at their promises and see how well they hit the mark. Seven out of 12 (or 58%) had a promised delivery date. Unfortunately, five retailers did not make a specific promise, and those included:

- Dick’s Sporting Goods

- Kohl’s

- Macy’s

- Ulta

- Urban Outfitters

For the retailers with systems that supplied that information to online shoppers, delivery promises as compared to actual delivery were a mixed bag. Two were early, two were on time, two late and for one, I’m still waiting.

Early

- Four days: Sephora

- Two days: Walmart

On time

- Amazon

- Crew

- Target

Late

- One day: Nordstrom

- Three days: Best Buy

3. How long did it really take to get?

When all was said and done, here’s how these retailers delivered.

Ten days after Cyber Monday, I had received all but one package, though Macy’s and J.Crew managed to come in just under the 10-day mark. Based on the 12 orders received, the average number of days was 5.60 to receive those orders.

The breakout among those surveyed in terms of number of days to deliver was:

- 2 days (Amazon, Dick’s Sporting Goods)

- 3 days (Kohl’s, Sephora)

- 4 days (Ulta)

- 5 days (Best Buy, Nordstrom)

- 7 days (Walmart)

- 8 days (Target, Urban Outfitters)

- 10 days (J.Crew, Macy’s)

I was surprised with the long delivery turnaround dates. Of course, we would be remiss not to mention that when it comes to shipping, not everything goes as planned.

I advise retailers to alert shoppers to products that may be out of stock or have limited inventory. Retailers can avoid shopper disappointment by providing realistic promises and then executing accordingly. At the same time, shoppers need to shift expectations, giving retailers a more realistic time frame in which to deliver orders. Often, this can be five days or more.

No one wants to wait, but shoppers always prefer the straight facts. The truth only stings for a moment. Disappointment is far more long lasting.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.

Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite