To put the season in context, I suggest concepts that have been percolating in my mind about the upcoming holidays. Rather than focus strictly on the numbers, I will lean in more on intuition and sentiment. I’ve gathered input from my editorial peers to gain outside perspective and am including retailer marketing and messaging that supports these themes.

Now that I have discussed everything from promotions to inflation in my initial post, let’s look deeper into the delivery and post-order elements that may also matter.

A few questions come to mind:

- Will orders be delivered promptly, or will delays affect shopper satisfaction?

- Will online shoppers still be interested in curbside pickup?

- What role will returns play in retailer selection?

Deliveries will be delayed this holiday season

It feels like deliveries will be timely, but you only know once you place the orders. I will be doing that along with many online shoppers over Cyber 5.

From a survey we conducted in September with Bizrate Insights of 1,088 online shoppers, we know that the No. 3 answer on how shoppers choose retailers is delivery speed (32%). This is only behind free shipping at 59% and competitive prices at 52%. And one of our editors speaks to this like a true shopper.

“I’m expecting all of my packages to be on time. After all of the supply chain issues this year, I’m not giving retailers much slack.”

And our September survey of 70 retailers shows that retailers believe 36% of consumers will demand even faster shipping.

Delivery expectations

One of my peers surmised, “Expectations for timely deliveries of online orders are probably lower this year as shoppers expect delays. Everything everywhere is seeing the labor and supply chain crunch, so it’s not going to be a surprise that online orders are delayed, too, when even my drive-thru order is slower than ever.”

One New Yorker on our team concurs. “No doubt about it. I’m already experiencing slower-than-expected delivery.”

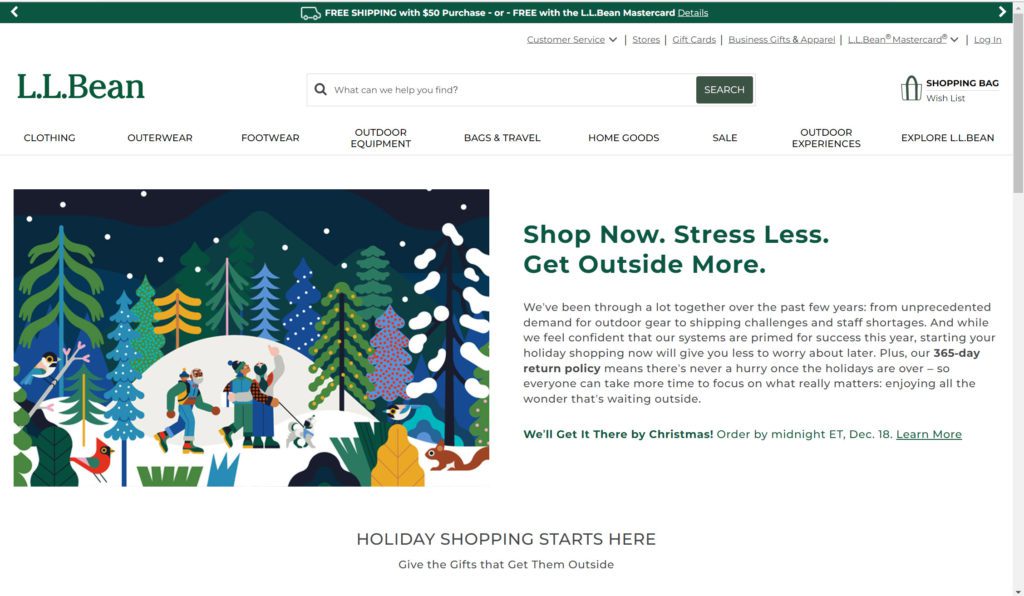

L.L. Bean encourages shoppers to seek a stress-free season

A contrarian view comes from a seasoned veteran who weighs in. “This shouldn’t be a big issue. UPS and FedEx have now had years of experience with peak season. And they’ve reduced their own peaks by raising prices for home delivery and for late pickups. My guess is many retailers will have adapted and will add a day or two to their delivery estimates and cut off holiday order a bit earlier.”

L.L. Bean encourages shoppers to get holiday shopping started ASAP. It reinforces all the messages we are addressing, along with demand for outdoor gear to shipping challenges and staff shortages. It also highlights the retailer’s 365-day return policy and links to its ground shipping cutoff and corresponding dates to cover its bases.

Shoppers will not be as reliant on curbside pickup

I think omnichannel is a favored convenience but not a critical choice among many shoppers post-COVID.

Our research indicates that 27% of shoppers expect to place an order online for pickup at the store. And 30% will check product availability at the store before making the trip.

Editors at Digital Commerce 360 had some interesting perspectives on this topic that I wanted to share. There appears to be a group of people reliant on curbside pickup, but less heavily than in 2020.

Circumstances are always a consideration. “The time-savings and convenience may still be a factor, and with more shoppers back in stores, the savvy ones might take advantage of this to save time in lines. And let’s face it, some will have gotten accustomed to the convenience of curbside and will use it for quick purchases (especially if they’ve got young kids).”

One shared that he believed the exception could be groceries. “Because a grocery shopping trip usually involves numerous items, ordering online and picking up in the parking lot is a significant convenience. But curbside pickup of headphones at Best Buy or apparel from Macy’s seems hardly worth it.”

Year-over-year, projected numbers ranged from 24% to 29%, so such omnichannel activities appear to be a constant despite these flat numbers.

As in past seasons, omnichannel messaging will be prominent on-site and in-store for last-minute shoppers. As the clock winds down after ground shipping cutoffs, the store is typically a strategic advantage.

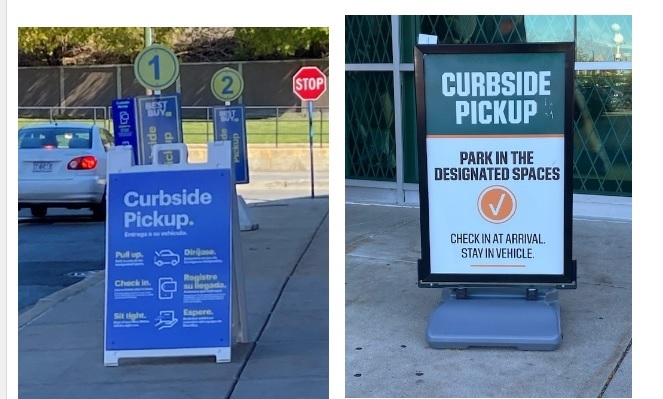

Best Buy and Dick’s Sporting Goods have maintained curbside pickup signage and presence post-COVID.

During recent visits to stores in the Chicago area, I noticed store pickup is still prominent. I came upon this in-store pickup signage on the front door as I entered a Chicago-based Ulta store. Alternatively, Best Buy and Dick’s Sporting Goods have maintained their curbside pickup signage and presence post-COVID, signaling its importance for their businesses and customers.

Online retailers grant shoppers significant leeway when it comes to returns

Free return shipping made its way into the top five at No. 4, with 27% of online shoppers suggesting it’s important when choosing a retailer. As seen in the same chart, only 9% cited an extended return window that allows you to return later. Once again, this suggests money talks. Shoppers don’t want to spend additional money to make those returns.

It was clever how one editor suggested, “Holiday returns are an American tradition, and e-retailers will have to accept it. And bad return policies can lead to negative reviews and bad word-of-mouth. So, either retailers or consumers need to change. And consumers aren’t going to change.” Another concurred, “denying returns is too big a PR risk to bother with.”

Extended timeframes

Turning to extended return timeframes, “many retailers will let shoppers return until the end of January to curry favor with shoppers. This has become an expectation, particularly around the holidays. With Amazon making returns so convenient, this is not the time for competitors to anger customers with picky return policies. Higher shipping rates will make it harder for web-only retailers to offer free returns. Retailers with stores should incent shoppers to return there.”

Despite not agreeing, I still will share one person’s perspective. “I think return times will be standard. Extending time for them will make it harder for them to recover from the inventory glut. That doesn’t appear to standard fare among sellers.”

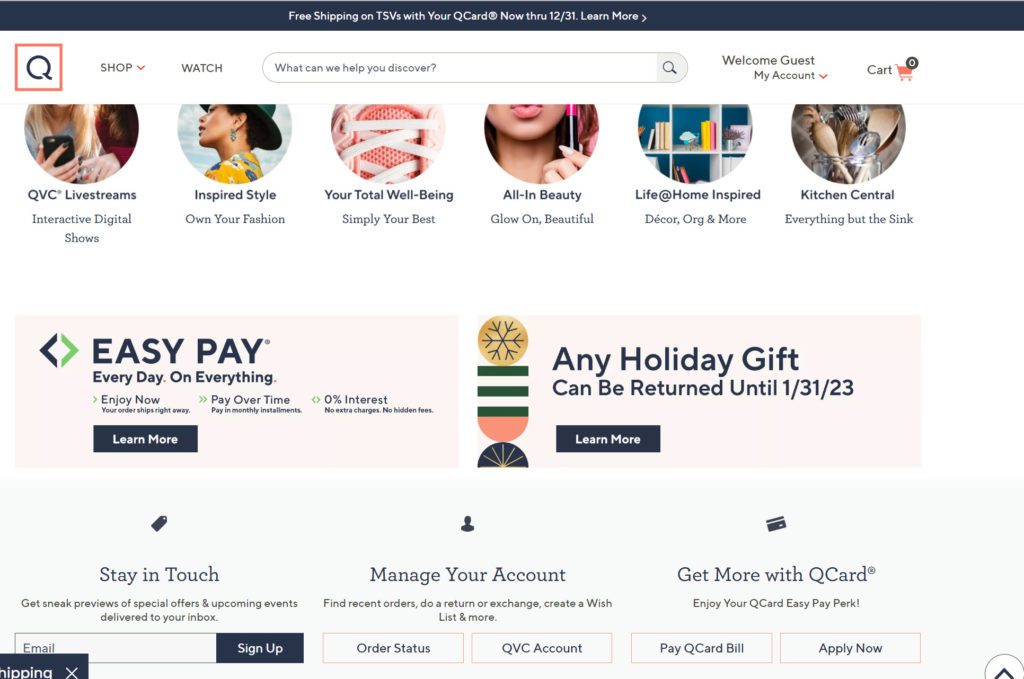

QVC gives its returns deadline strong placement in its online gift center.

QVC pioneered extending the date to return products into late January and gives that strong prominence in its gift center. Convenience matters, and this should be compelling for shoppers.

Much of the season’s success will hinge on the retailer’s ability to deliver in a timely fashion. We can only expect that online shoppers will make convenient choices, always factoring in getting a fair deal. It’s important to remember that return policies matter and can be a critical component in retailer selection and retention.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.

Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.