Sponsor content is created on behalf of and in collaboration with Chargebee and approved by DigitalCommerce360.

What do you get when you pack a pandemic, an economic downturn, and war into three years? The year 2022. In other words – a challenging time for businesses. Inflation is eating into a large chunk of the discretionary household income, making customers extremely wary of their expenditure; the sudden lull in venture capital funding means throwing more money to acquire more customers is not an option. What’s worse, some of your existing customers are looking for an exit, and the latest guidelines on cancel experiences require you to escort them there!

Growing customer acquisition costs (CAC) and competition are putting a tremendous strain on acquisition engines. And businesses that primarily rely on acquisitions to drive revenue growth are on a slippery slope.

On the other hand, retaining your existing customers is at least 5-25x cheaper than acquiring new ones. And while most businesses still think of retention reactively, keeping customers and converting them into advocates through personalized experiences can help you build higher lifetime value (LTV) by introducing upsell and referral opportunities.

However, fixing a retention strategy around discounts at the exit makes customer experiences more about price and less about value. Having optimized revenue strategies and billing experiences for over 4500+ companies, we discovered six salient steps that challenge the status quo on retention, turning it from a loss aversion technique to a growth lever.

1. Diversify Your Offer Strategy to Address Customer Needs

Rebates or monetary discounts are often closely associated with the term offer. It, however, does not justifiably capture the distinction between cost-efficiency and customers’ sought value of your product.

For customer retention to work, businesses must put customers front and center of their retention strategy. It means, instead of driving offers based on the assumption, that your customer needs should shape your offers at the time of cancellation.

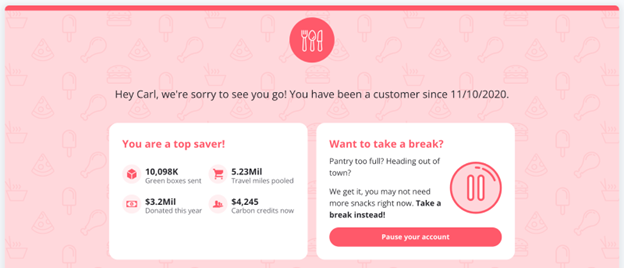

At the height of the pandemic, one of America’s largest prepared meal delivery services wanted to address the pandemic-induced subscription cancellations. While their usual offer flow seemed to falter, the company decided to first experiment with randomized offers for a set of customers to find patterns and discover what served them best.

They quickly realized that the option to skip multiple weeks of delivery attracted high acceptance rates. Soon the axis of their retention strategy changed from ‘pricing’ to ‘plan flexibility.’ Customers grappling with the economic pressures of the pandemic were given the option to pause delivery, in addition to being presented with discount offers. Within a month of implementing this change, the company reported significant growth and success metrics.

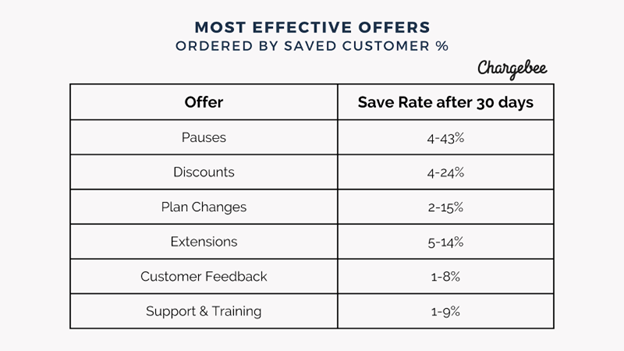

Experimenting with multiple cancel offers is a great way to discover new avenues to build long-term customer engagement. A recent retention efficiency in the eCommerce industry by Chargebee also found that compared to discounts, offering the opportunity for customers to pause generated better save rate ranges after 30 days of accepting the offer.

Source: 2022 State of Retention for eCommerce: The Ultimate Cheat Sheet

2. Satisfy Unmet Needs With Plan Changes

We’ve realized that most subscribers don’t leave because they’re unhappy with the product. They cancel because they are simply on the wrong package or plan for their needs.

And this is when a targeted plan change offer can become an effective tool in your arsenal.

Pauses, extensions, and plan changes are far more effective at retaining customers, with pauses and plan changes having an average 70%+ effectiveness.

Types of plan changes include:

- Upgrades (lower-tier to higher-tier, usually given at a discount or no price change)

- Downgrades (higher-tier to lower-tier)

- Term changes (monthly to annual or annual to monthly)

- Bundles (switch from bundle A to bundle B)

Customers might want to switch to a lower-tier product and forego an extra feature. Or perhaps they would prefer a monthly subscription to an annual plan to keep their cash outgo to a minimum.Th

ese use cases show that addressing needs immediately before cancelation can help keep subscribers and some of their revenue. The challenging part is figuring out which users are ready for a plan change, and you can do this by testing different offers.

3. Contextualize Discounts Without Cannibalizing Revenue

Discounts, however, are still the highest grosser of immediate ‘customer saves.’ A study by Chargebee Retention found that 49% of saved customers attributed discounts as the reason. Discounts incentivize your customers’ continued engagement with your brand.

We find the discounting sweet spot to be between 15 and 30%, where users are sufficiently encouraged to accept a lower price, but the brand isn’t sacrificing too much value. These ranges will differ depending on the service or good, so to optimize for the highest LTV, test how offer acceptance rates change based on the strength or type of discount you offer.

At the same time, discounts also bear the highest opportunity cost. While discounts will retain most customers, it does nothing to guarantee that you won’t get a consecutive cancellation from the same customer. And, a discount always comes at a cost to profitability.

Let’s assume you have two customers – A and B. Customer A has an average order value (AOV) of $10 and has been transacting with you for the last two months. B is an enterprise customer with an AOV of $100 and has transacted with you over the previous four years.

You can save both at the point of cancellation with a 50% discount. However, the value these customers bring to your business varies significantly. Also, nearly 50% of your long-term customers are likely to consider subscribing to a new product from your company, getting in a high upsell potential.

Hence, identifying and contextualizing who you are offering a discount to is also essential. This brings us to our next point.

4. Segment Customers To Build Targeted Deflection Modules

Not every customer or subscriber of your brand is at the same stage of their lifecycle. Therefore, the perceived value of your business for each customer is also distinct.

To leverage your retention strategy to grow customer LTV, your offers at the point of cancellation must be mindful of the distinct stage of maturity each of your customers is in and should instead act as a qualifier to nudge them to the next level.

- For a pre-revenue customer, who is still in the trial period, discounts should incentivize their trial expiry, making it easier to convert into a paying customer.

- For a new product user who wants to cancel, educating them on the sustained benefits of using your product is a more effective way to convince them to make a subsequent payment than merely proposing a discount.

- For a long-term customer whose annual contract expiry date is running close, activating expiry triggers for your customer success executives to address any residual experience problems will help facilitate a renewal.

The ability to build deep analytics about individual customers is also a critical aspect of offer diversification, making retention more contextual to every customer’s exit intent.

5. Reduce Exit Friction for Better Customer Experiences

The state of California’s recent updates to its Automatic Renewal Law (ARL), effective July 1, 2022, reconfirmed what customers have been signaling toward for eons. Retention strategies shouldn’t be labyrinths. Internal research also found that 80% of customers are likely to purchase a subscription that lets them easily cancel online.

While any business loves minimizing customer churn, achieving that by complicating exit accounts for more disgruntled customers while reducing the window of a potential win back in more favorable circumstances at a later stage.

While more global guidelines are likely to follow suit, the Californian ARL requires merchants selling to Californian residents to allow cancels “without further steps that obstruct or delay the consumer’s ability to terminate the automatic renewal or continuous service immediately.”

It also makes the cancellation process leaner. We found limiting cancellations to 1-2 clicks to be the most efficient for customers.

Offers should exclusively be made on-page instead of showing pop-up models that require an extra click to close. It still does not minimize your brand’s ability to deliver hyper-personalized experiences that may motivate your customers to stay or open up an opportunity to return later.

Source: Six Steps to Design a Compliance-friendly Online Cancel Flow

6.Analyze Transaction Events Post Customer Saves

For the longest time, most businesses have only been building retention to minimize revenue leakage. Even the typical success metrics associated with retention reflect this.

Businesses obsess over save rates and deflection percentages without considering the actual value of a saved customer. In a sense – one typically believes retention to save revenue instead of adding to the bottom line through upsells.

While the number of customers saved exhibits whether your retention strategy can successfully address immediate customer concerns, post-deflection upsells can exhibit your efficiency in building sustained and meaningful relationships.

Measuring post-save events like upsells/downgrades helps discover optimization opportunities and a precise dollar value return on your retention engine. It also helps guide you in future investments to improve your retention strategy.

Favorite