The app-based delivery company DoorDash Inc. is getting into the grocery business, opening delivery-only fulfillment centers in eight cities, with plans to open more in the coming months.

DoorDash is setting up distribution centers to support a virtual convenience store chain.

The new DashMart centers—each of which is a mini fulfillment center used only to fulfill online delivery orders—opened Wednesday in Chicago; Minneapolis; Columbus, Ohio; Cincinnati; Dallas; Salt Lake City; Redwood City, California; and the greater Phoenix area.

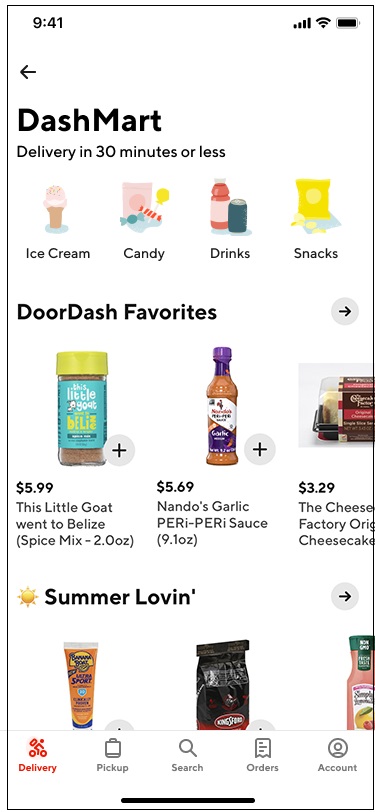

DashMart offers delivery in 30 minutes or less. Over the coming months, DoorDash plans to launch the service in additional U.S. cities, including San Diego; Baltimore; Denver; Sacramento, California; and Concord, California. The delivery company did not reveal how many DashMart fulfillment centers it ultimately wants to open. Consumers can access DashMart via the DoorDash app.

DashMart offers thousands of essentials found in convenience and grocery stores such as chips, ice cream, spices, beverages, sunscreen, cough medicine and dog food. DashMart also sells food from national restaurant chains, including The Cheesecake Factory and Nando’s and local restaurants like Brother’s BBQ in Denver and Corey’s NYC Bagel Deli in Chicago. A spokeswoman says DoorDash has no plans to open DashMart for in-store shopping.

The idea of DashMart is to create a new channel for merchants and brand manufacturers to sell online—and not compete with them, the spokeswoman says. “What we want to be is the tide that helps all boats rise,” she says. To do that, DashMart plans to share its data with the merchants, restaurants and brands involved.

The approach to its data-sharing process will be like the one DoorDash employs for its Drive product. Drive is a fulfillment service that allows businesses to use DoorDash for deliveries of orders that originate outside the DoorDash marketplace. Drive, which launched in 2016, offers participating retailers “anonymized insights” to help them make better-informed merchandising decisions.

Besides getting it into the convenience retail grocery business, DashMart allows DoorDash—best known for delivering meals from restaurants—to sell products from local consumer brand manufacturers. Those offerings include sauces and spices from This Little Goat in Chicago and cookies from Tempe, Arizona’s Noms Bake Shop—each of which sells online but does not offer on-demand delivery for local consumers.

The creation of DashMart follows the April launch a convenience-store category in the DoorDash app. The new category allows customers to order from convenience and drug stores partnered with DoorDash, such as 7-Eleven, Walgreens, CVS and Wawa. DoorDash says the convenience category includes more than 2,500 stores in more than 1,100 U.S. cities. DoorDash promises deliveries from other convenience stores in 30 minutes or less. “The convenience [store] category is massive, and we don’t believe it’s a winner-take-all market,” the spokeswoman says.

The fees for DashMart depend on the size of the order. Grocery delivery is also available on DashPass, DoorDash’s subscription service that provides unlimited deliveries of orders of $15 or more for $9.99 per month. A DoorDash spokeswoman says the new service adds value to existing DoorPass memberships and has the potential to bring in new DoorPass members.

Working to keep restaurants alive

In May, DoorDash launched Main Street Strong, an initiative designed to help restaurants get through the recovery phase of the COVID-19 pandemic. Main Street Strong includes DoorDash Storefront, a service that enables restaurants to create online stores. Also part of the initiative is Weblinks, for restaurants that would prefer to have DoorDash manage their digital ordering experience by redirecting their customers to DoorDash. Through the rest of 2020, DoorDash will waive the set-up, software and merchant delivery fees for restaurants that sign up for the Storefront program. DoorDash launched the Weblinks program offering 0% commission to restaurants with five or fewer locations on all weblink orders, through the end of 2020.

Since it launched in 2013, DoorDash has raised $2.5 billion from 28 investors across more than 11 funding rounds, according to Crunchbase. Most recently, the company raised $400 million in a Series H round led by Durable Capital Partners. At the time, the delivery company confirmed to Crunchbase that the latest funding round brought its valuation to nearly $16 billion.

In February, DoorDash submitted paperwork to go public, but it has not announced a date for an initial public offering.

Favorite