Ecommerce order volume has increased nearly 47% in the last 30 days ended April 20 compared with the February average, according to logistics vendor Narvar Inc., which has more than 650 retail clients in its network.

Last-mile technology vendor Convey has noticed similar spikes. For the week of April 6-12, shipment volume was up 55% compared with the year-ago week, according to the vendor’s data that is based on 130 retail clients. In fact, every week starting Feb. 10, shipment volume is elevated compared with the year-ago week, with the exception of April 13-19.

And with such a surge in orders, shipping delays are also increasing. Retailers are taking an average of 1.5 days longer than normal to fulfill orders, according to Narvar data. This is likely because of staffing challenges, says Narvar’s CEO and founder Amit Sharma, such as employees calling in sick and retailers implementing social distancing regulations in warehouses, which may slow efficiency.

Convey’s retail clients also have had increases in the time to fulfill orders, with a gradual worsening as the pandemic continues, says Kirsten Newbold-Knipp, Convey’s chief growth officer.

Delays are even more pronounced for large-format products, or products that are more than 150 lbs. or more than 48 inches in length, such as a large piece of furniture. For those orders, the average time for a retailer to fulfill it has more than doubled in the past 6 weeks, to an average of 68 hours now, up from 32 hours at the start of March, according to Convey data.

“This is an indicator of supply chain slowdowns because these bigger items are not as often held in inventory, and instead are ‘made to order’ once the shopper makes the purchase versus fulfilling the order out of existing inventory,” Newbold-Knipp says. “If any of the suppliers along the supply chain shut down or slow down, it impacts the overall production time.”

The three major shipping carriers, FedEx Inc., UPS and the United States Postal Service, have all dipped in their percent of deliveries that are on-time since the start of March. As of April 14, USPS delivered the most on-time orders at 89.3%, UPS was next at 86.0%, followed by FedEx at 81.7%. All three carriers were around a 90% or higher for on-time delivery rate at the start of March, according to Convey.

Shipping carriers have increasingly cited the coronavirus as the reason for the delay, according to Convey data.

A spokeswoman for FedEx says it has had an increase in ecommerce shipments, which it expects to continue to increase. It is working on “optimizing our services to best support this increased demand,” she says, without revealing more. Shipping carrier UPS declined to comment.

Often, retailers will let shoppers know of a shipping delay via email. Email analytics vendor SparkPost finds an eight-fold increase in the number of emails retailers have sent with a shipping delay message March 16-April 16 compared with a month earlier. “Amazon, Best Buy and Nordstrom are among those showing higher volumes of related messaging,” says John Landsman, manager of research analytics at SparkPost, which has 15,000 clients.

Even with delays, many retailers maintain their email marketing programs. However, SparkPost reports an 8% drop in the number of campaigns online-only retailers have sent after March 15, when many locations had stay-at-home orders, compared with a month before this, and a 15% drop in emails for retailers that sell in-stores and online.

“Retailers badly want and need the business and appear willing to take orders and then apologize for not being able to deliver these orders within their normal service standards,” Landsman says. “Part of the issue is simply managing fulfillment logistics against the constraints of supply chain disruptions, staff availability and medical safety.”

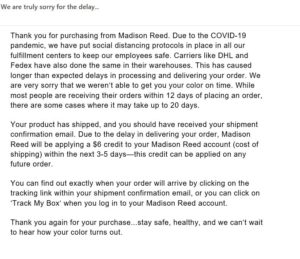

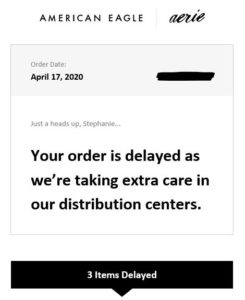

Digital Commerce 360 editors also have noticed an increase in shipping delays in their personal purchases, including from apparel retailers Old Navy (owned by Gap Inc., No. 23 in the 2020 Digital Commerce 360 Top 1000), Boden, Aerie (owned by American Eagle Outfitters Inc., No. 49), Faherty Brand and hair color retailer Madison Reed. Most messages cited reduced staff and taking extra precautions in the warehouse as the reason for the delay.

Delayed shipment message from Boden.com

Delayed shipment message from MadisonReed.com

Delayed shipment message from OldNavy.com

Delayed shipment message from Aerie.

Delayed shipment message from Faherty Brand.