Adrien Henni, chief editor, East-West Digital News

Last week Alibaba, Mail.Ru Group, Russian telco MegaFon and sovereign fund Russian Direct Investment Fund (RDIF) announced they received approval from Russia’s antimonopoly authorities for their “social commerce joint venture.”

The JV will leverage on the existing businesses of AliExpress Russia, the B2C marketplace owned by Alibaba which controls a large part of the ecommerce flows between China and Russia. The partners will pour their “capital, strategic assets, leadership, resources and expertise” in the JV.

Keeping the name of ‘AliExpress Russia,’ the JV will “operate across all ecommerce segments, including cross-border and local marketplaces and first-party retail,” as announced in September 2018. This will “create an unmatched value proposition for merchants, consumers and Internet users” across Russia and some other post-Soviet republics.

The JV will aim to leverage Mail.Ru Group’s leading positions in Russia’s social media (via the group’s properties VK and OK, whose audience far exceed that of Facebook in Russia), as well as online gaming (100 million registered users worldwide), email services (100 million user accounts) and online communications.

VK will be a key component of this ecosystem. In February 2019, just a couple of months after their partnership was announced, VK and AliExpress announced the start of a social ecommerce project in Russia. A source from VK told East-West Digital News that Integration will begin over the next few months as the first version of AliExpress app will be launched on the VK Apps platform. Such apps launch instantly on VK with no install required.

Leadership ambitions

“[Through] this partnership, we will offer customers richer social experience and provide entrepreneurs with a platform for growth. This is a major milestone for the Russian ecommerce market, and we believe it will promote the development of the digital economy,” stated Boris Dobrodeev, CEO of Mail.Ru Group.

“AliExpress Russia JV will become an undisputed leader in Russian ecommerce and create an unparalleled social commerce offering for our users,” he added.

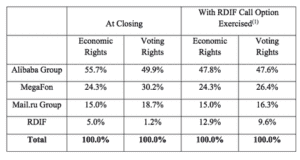

The shareholders’ contributions to the AliExpress Russia JV have been announced as follows:

- Alibaba Group will invest $100 million and contribute AliExpress Russia into the joint venture;

- MegaFon will sell its 9.97% economic stake in Mail.Ru Group to Alibaba Group in exchange for a 24.3% stake in the AliExpress Russia JV with 30.2% voting rights;

- Mail.ru Group will contribute its Pandao ecommerce business as well as cash investments of $182 million in exchange for a 15% stake in the AliExpress Russia JV with 18.7% voting rights;

- The RDIF will invest $100 million in the JV and may further acquire additional shares of the JV from Alibaba Group for $194 million. Should it exercise this option, the sovereign fund will own economic and voting stakes in the joint venture of 12.9% and 9.6%, respectively.

Economic and voting interests of AliExpress Russia JV shareholders. Source: Mail.Ru Group

Accelerated ecommerce development

Russian ecommerce is entering a promising development cycle: although the size of this market reached just around $23 billion last year (taking into account only orders of physical goods), including some $5 billion for cross-border sales, growth in this sector is accelerating.

In October last year Morgan Stanley predicted that market size could exceed $50 billion by 2023. But Data Insight analyst Boris Ovchinnikov believes online retailers could do even better.

“Over the past year or two, the performance of many players, including both large and medium-sized sites, has been so impressive that forecasts may have to be revised upwards,” he told East-West Digital News.

The AliExpress Russia JV partners are not the only major players to invest in the sector. Sberbank, the state-controlled financial giant, has put half a billion US dollars in an ecommerce joint venture with Yandex, while Ozon, one of the most established industry players, has just raised $150 million from its existing shareholders.

Meanwhile, Global Fashion Group, the international entity which controls Russian fashion platform Lamoda, has just announced plans to raise €300 million in a Frankfurt IPO.

This article first appeared in East-West Digital News, the international online resource on Russian digital industries, and is reprinted with permission.

East-West Digital News is conducting an international research on Russian ecommerce with its partners ECommerce Foundation and ThePaypers.com. Foreign brands and online retailers selling to Russia or considering doing so are invited to participate in an online survey; they will receive the research report free of charge.

Favorite