The biggest online shopping day in the world, China’s Singles’ Day, is about to kick off.

Sales on Nov. 11 last year hit $17.8 billion for Alibaba Group Holding Ltd.’s online marketplace Tmall, an amount that’s more than two and a half times the sales for U.S. retailers on Black Friday and Cyber Monday combined. A new record will likely be set when Singles’ Day ends this year, and North American brands that sell online in China are making sure they have a share of that large number.

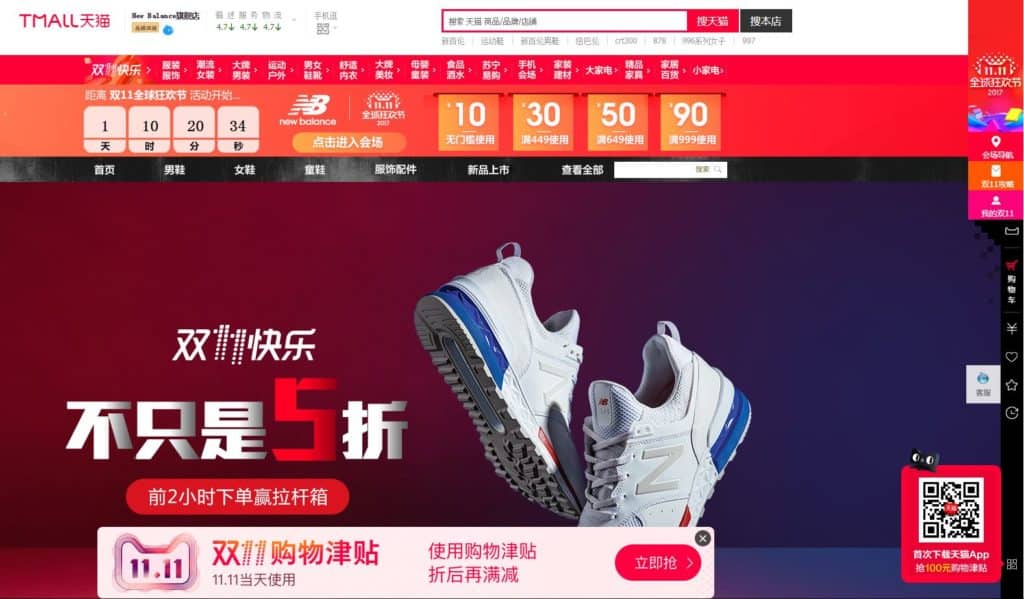

For athletic footwear manufacturer New Balance, “it’s the biggest [online sales] day by far, both when we think about within the China business and our business overall,” says Nathan Isaacson, global senior manager of e-commerce for New Balance. He declined to give sales figures for Singles’ Day.

“We expect this to be the biggest Singles’ Day in our history,” says Bill Partyka, CEO of baby food manufacturer Gerber. “We work with our internal supply chain to make sure we have adequate inventories well in advance. We start shipping those products in June/July so they’re staged, so that they’re ready for the Chinese consumer when they’re ready to be purchased.”

Singles’ Day started as an online sales holiday in 2009 by Alibaba Group Holding Ltd. and has since turned into a national event in China, with Alibaba driving the bulk of sales. At least 140,000 brands will take part in Singles’ Day 2017, including 60,000 international brands. Participating international brands include Adidas, L’Oréal, Mondelez, Procter & Gamble, Siemens and Wyeth. To spur sales, Alibaba says it will send consumers coupons for all products worth 250 million yuan ($37.7 million) via various interactive games.

Isaacson of New Balance says Singles’ Day can be broken down into three phases:

“In the pre-sell period (which takes place in late October), it’s an add-to-cart exercise wherein consumers are seeing promotions and putting down a small deposit,” he explains. “In the pre-heat period (generally Nov. 1-7), it’s another set of promotions that are incentivizing consumers to add to cart but not put down a payment. On 11/11, consumers are swiping the proverbial credit card and then there is also a final rush of promotional activities that are occurring on the day.”

New Balance has been participating in Singles’ Day since 2011.

Isaacson says last year, three-quarters of New Balance’s Singles’ Day sales came from new shoppers. “11/11 for us historically has been a pretty big customer acquisition tactic,” he says.

Unlike Black Friday and Cyber Monday promotions, which tend to be set in stone well in advance of the sales holidays, Isaacson says promotional activity tied to Singles’ Day can evolve rapidly and on the fly.

Being flexible is key if a certain brand or style performs differently than expected, he says. “Brands are expecting certain styles to be big winners, and as they’re seeing inventory levels performing better or worse than expected, then we’re adjusting our tactics to see better sell-through and getting on the phone with Tmall to make sure we’re showing up high in search results for items that are important to us,” Isaacson says. For example, New Balance may offer higher discounts on products it wants to move because Tmall wants to offer the best deals possible to shoppers, he says.

With big sales at stake, Partyka says he and his team invest significant time into planning for Singles’ Day.

“Singles’ Day ends, and we start planning for Singles’ Day 2018 the day after,” Partyka says. “We’ll take a rest period during Chinese New Year and we’ll get right after it.”

Gerber began actively selling online in China in November 2015 after noticing a large number of Chinese parents buying Gerber products that were manufactured in the U.S., imported by third parties and then sold on Alibaba’s Taobao marketplace.

Gerber has participated in Singles’ Day since 2015 and Partyka credits the event with elevating Gerber’s profile among Chinese consumers.

“When you think about the opportunity to bring in so many consumers into a single event, you stimulate trial [of products] and you tell your brand story and that will build out loyalty with consumers down the line,” he says. “It’s basically built us into the No. 1 baby food in China. Before we started to participate at this level with a strategic approach, we were lagging in the middle of the pack, and now we’re a clear No. 1.”

Gerber’s approach involves coming up with the right mix of programming, product discounts and deciding how and where to advertise.

“We’ve looked at how much do we spend outside of the platform versus within the [Tmall] platform and we believe that investing in the platform gives us the best return on investment,” he says. Other marketing channels include paid search, digital advertising, providing products to influencers who then blog on behalf of the brand, participating in live shows and holding flash sales.

While Singles’ Day is known for deep discounts, often out-of-season or overstock inventory, Alibaba has tried to reposition the event as a vehicle for promoting new and premium products. For the second year in a row, the Chinese e-commerce operator has sponsored a glitzy fashion show in Shanghai to promote Singles’ Day. This year’s four-hour extravaganza, which featured pop stars and celebrities, promoted 150 in-season products from such brands as Adidas, Gap, Tag Hauer, Pandora, LVMH’s Rimowa and Estée Lauder’s MAC.

While the event took place Oct. 20, it was released via online and mobile video on Oct. 31. The so-called See Now, Buy Now event allowed consumers to buy or pre-order items they saw during the show, which is uncommon for traditional fashion shows. Alibaba says consumers engaged with that video more than 50 million times and sales from the show doubled those of last year, although it did not disclose sales figures for either year.

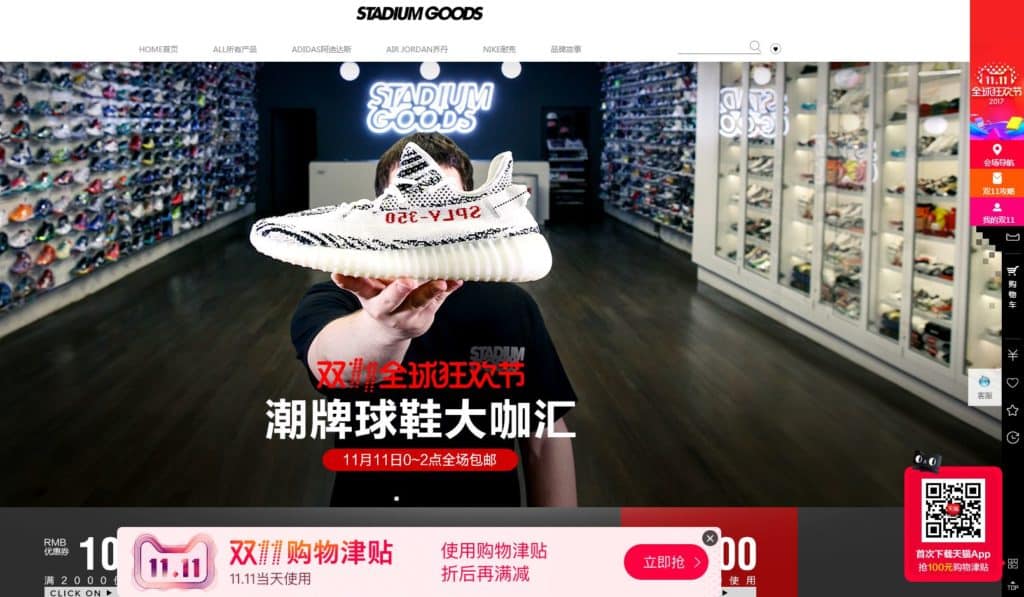

John McPheters, CEO and founder of Stadium Goods, an online marketplace for high-end athletic footwear, hopes to capture some of those affluent, fashion-forward Chinese shoppers on Singles’ Day.

Stadium Goods has been selling online since 2015, and on the Tmall marketplace since August 2016. All of its products come from third-party sellers and generally range in price from hundreds of dollars to up to $50,000 for a single pair of shoes.

“To sell on Tmall for 11/11, you have to lock some of your inventory (that it will sell) for the day,” he says. “That’s a challenge for us as a marketplace business.”

McPheters says to prepare for Singles’ Day, he and his team analyze which brands and styles have been popular with Chinese consumers throughout the year and then communicate that to sellers on the Stadium Goods marketplace.

“We definitely stocked up for this with specific styles that we think people would be interested in,” he says. “We don’t have to buy the inventory. It’s about us communicating opportunity and making sure our sellers are bringing in products to suit our need.”

McPheters says a lot of his Singles’ Day marketing centers on social media and video. He and his team work with a vendor in China to determine which topics Stadium Goods can focus its Singles’ Day marketing around. The marketplace has a graphics professional who handles the editing and overall look of the company’s videos as well as Mandarin speakers who will perform on camera.

“We do a good amount on (social network) Weibo. We do a lot of video on the Taobao platform,” McPheters says. “The majority is live broadcasts that we do here in New York. We find that kids in China are consuming so much video on their mobile devices that it’s a good thing to produce video. We are gearing up with more celebrities and influencers to help us grow our brand out there.”

Stadium Goods is on track to do $120 million in sales this year, McPheters says, and China is an important part of the company’s business.

“There’s a lot of growth happening and there’s no doubt in my mind that 11/11 is going to be our biggest day to date, but it’s hard to compare with what our other shopping days are going to look like because we’ve always outpaced it,” he says. “[Singles’ Day 2016] was our biggest day at the time, and then we outdid that with our Black Friday two weeks later.”

Because Stadium Goods doesn’t store any products in China, the marketplace works with a third-party fulfillment center and a consolidator that specializes in exporting goods from the United States to China.

“We’re pure cross-border,” he says. “Nothing is housed in China.”

Stadium Goods and Gerber are hardly alone when it comes to North American brands looking to cash in on the Singles’ Day excitement.

Macy’s, No. 6 in the Internet Retailer 2017 Top 500, began running Singles’ Day promotions on its Tmall online storefront on Oct. 20, trying to entice shoppers with flash sales and perks like free shipping, a Macy’s spokesman says.

“Singles’ Day, along with Super Brand Day on Tmall, allows us the opportunity to further introduce Macy’s to Chinese consumers,” he says. Tmall launched Super Brand Day in 2016 to give brands that have a direct relationship with Tmall additional exposure on the platform.

Meanwhile, Amazon.com Inc. (No. 1) today launched its own “Overseas Shopping Festival” in China, a collaboration between Amazon China and Amazon USA that runs through Nov. 12. Amazon Prime members in China will receive exclusive discounts during the Overseas Shopping Festival. Prime customers living in Beijing and Shanghai can receive orders of U.S. products in as little as three to five business days, down from five to nine business days when Amazon Prime launched in China last year.

As with its annual Amazon Prime Day sales event in July, the goal of the Overseas Shopping Festival appears to be to promote membership the Amazon Prime free shipping service. Amazon launched Prime in China in October 2016, offering memberships for an annual fee of 388 yuan ($58.42). Members receive free shipping on orders of eligible overseas goods over $29.50. From Nov. 27-Jan. 27, Amazon says it will discount annual Prime memberships in China to 288 yuan ($43.37) to mark the anniversary of the service.

Internet Retailer editor Frank Tong contributed to this report.