Amazon.com Inc. already was the preferred web shopping destination for many affluent consumers. Now, with its acquisition of Whole Foods Market, Amazon has more than 460 stores in their neighborhoods.

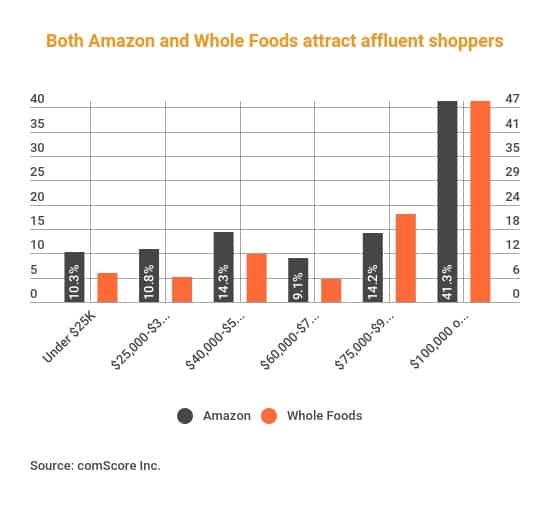

The two retailers both cater heavily to high-income households. While the median household income in the United States in 2015, the last official figure available, was $55,775, 64.6% of Amazon’s shoppers and 75.4% of those who shop at Whole Foods live in households with annual income above $60,000, according to market research firm comScore Inc. In fact, 41.3% of Amazon’s customers have household incomes above $100,000, compared to 48.6% for Whole Foods.

Market research firm GfK MRI says the median household income for an Amazon shopper is $90,100 and for a Whole Foods shopper $95,200.

The skew toward affluent shoppers is particularly evident in the breakdown of members of Amazon’s Prime’s loyalty program. 65% of shoppers who make more than $100,000 belong to Prime, compared with 60% who make $50-100,000, 47% earning $25-50,000 and 33% of those whose annual incomes fall below $25,000, according to a survey by research firm Market Track. A recent Bizrate Insights survey for Internet Retailer showed 70% of online shoppers plan to check out Amazon’s deals on the next Prime Day sales expected in July, but that increases to 75% for shoppers with incomes above $100,000.

Amazon’s acquisition of Whole Foods “is a master stroke,” says Mihir Kittur, co-founder and chief commercial officer of e-commerce analytics firm Ugam. “The two retailers share a great deal of overlap between their target customer segments, which consist of wealthier urban and suburban shoppers,” Kittur says. “That makes this a better fit than BJ’s, Amazon’s previously rumored acquisition target.”

In addition to helping Amazon, No. 1 in the Internet Retailer 2017 Top 500, gain the loyalty of the more affluent shoppers who patronize Whole Foods, it will also help Amazon appeal to “the growing segment of shoppers—mostly younger shoppers—that place a premium on natural, health and/or organic ingredients,” says Ryne Misso, director of marketing for Market Track.

The deal, if it goes through, also would give Amazon a physical presence in higher-income neighborhoods, says Keith Anderson, senior vice president of strategy and insights at Profitero, a provider of e-commerce analytics technology. “Whole Foods has stores in the right places, in all of the affluent urban areas, and they have a brand that resonates,” Anderson says. “In addition to the locations and the brand and the staff, they’ve got credibility in perishables which Amazon simply doesn’t have.”

Those Whole Foods stores could become Amazon pickup points, pushing more visits to those Whole Foods locations, notes Scott Macon, president of Bizrate Insights, a Time Inc. subsidiary that surveys online shoppers. “It’s not hard to imagine Amazon materially expanding same-day delivery with pickup in Whole Foods stores,” he says. “Simply by having people pick up in whole foods their packages, will mean a boost at some level to foot traffic at the Whole Foods location.”

But Misso says Amazon is not just targeting the rich, noting it introduce recently a discounted Prime membership for consumers receiving government assistance. “Amazon is diagnosing everywhere they have opportunities to improve their value and choices for consumers,” he says. “The industry would be wise to assume that Amazon will pursue additional acquisitions if they feel it fills a gap in their offering.”