When ecommerce beauty brand Furtuna Skin launched in 2019, it had just one product: its face and eye serum.

The rest of the collection was supposed to launch in March 2020, said Chrissie Jemison, vice president of digital. As with much of the world, the pandemic changed that.

With a full product assortment available, Furtuna Skin had to cover its ecommerce bases and make sure it had a strong enough conversion rate and average order value. It launched a skin care quiz to help with that.

Guiding the shopper

Jemison said Furtuna Skin has a 9% conversion rate among users who complete the skin care quiz and make a purchase. It helps grow AOV, too, she said.

“After taking a number of these myself, it got to the point I would see results and think, ‘well, you’re just trying to sell me on everything,’” Jemison said. “Our goal is to really get the right products in our customers’ hands.”

So the brand uses its quiz to offer a “hyper-curated” assortment that’s typically two or three products, Jemison said.

“We want to guide users to the items that will help them with their skin concerns,” Jemison said.

Moreover, rather than trying to sell a full-size product, Jemison said Furtuna Skin offers shoppers a “custom sample set.” Shoppers can pick any four items, which the product recommendations from the quiz help them select, and buy sample-sized versions of them to test.

“We’re giving them two to three recommendations and saying test them out; see for yourself. Buy a discovery set,” Jemison said. “It is a lower-priced item because it’s a sample set, but that’s where we’re seeing greater success rather than just in lifting AOV.”

Learning the basics about loyalty and ecommerce subscriptions

By February 2021, it was time to focus on retention, Jemison said. That’s when Furtuna Skin simultaneously launched its loyalty program and auto-replenishment. Furtuna Skin’s full collection had launched in June 2020, but items had only been available for one-time purchases.

“Skin care is one of those categories that lends itself so beautifully to a subscription program,” Jemison said. “So we knew there was opportunity there.”

Furtuna Skin uses retention marketing platform Yotpo for its loyalty program. But the platform Furtuna Skin used to power its subscriptions wasn’t the best fit, Jemison said.

The subscription provider at the time, Recharge, required Furtuna Skin to duplicate its product catalog to identify which products were selling for one-time purchase and which sold for subscriptions. This was especially a problem for Furtuna Skin, Jemison said, because all its products are produced from ingredients in the retailer’s private estate in Sicily, Italy. The 800-acre estate — with a farm and wild terrain where its employees forage for ingredients it uses in its products — is also where sister brand Bona Fortuna’s products come from.

“That means we do small batches of products,” Jemison said.

She added that from an operations perspective, that means producing a new SKU for every new batch. Swapping out SKUs constantly, and having to create duplicates for each one in the online product catalog, was too much for Jemison’s “very lean” team, she said.

Moreover, shoppers would check out with a subscription product on Furtuna Skin’s website and get “kicked over” into a different checkout experience. Jemison referred to this as “hijacking” the cart in the checkout page.

This was a problem because, for example, when consumers were going through the checkout process while Furtuna Skin offered a promotion of a special gift with purchase, Jemison would have to set up the promotion on two separate platforms for the shopper to redeem it: Shopify (which hosts the brand’s ecommerce website) and Recharge.

Subscription switch

Furtuna Skin replatformed from Recharge to Ordergroove in summer 2022. Since then, its subscription orders more than doubled, to more than 7% of sales now from 3% before making the switch. Jemison said she projects subscriptions to account for 10% of total sales by the end of the year. She said the long-term goal is to get that up to 15% to 20% of total sales.

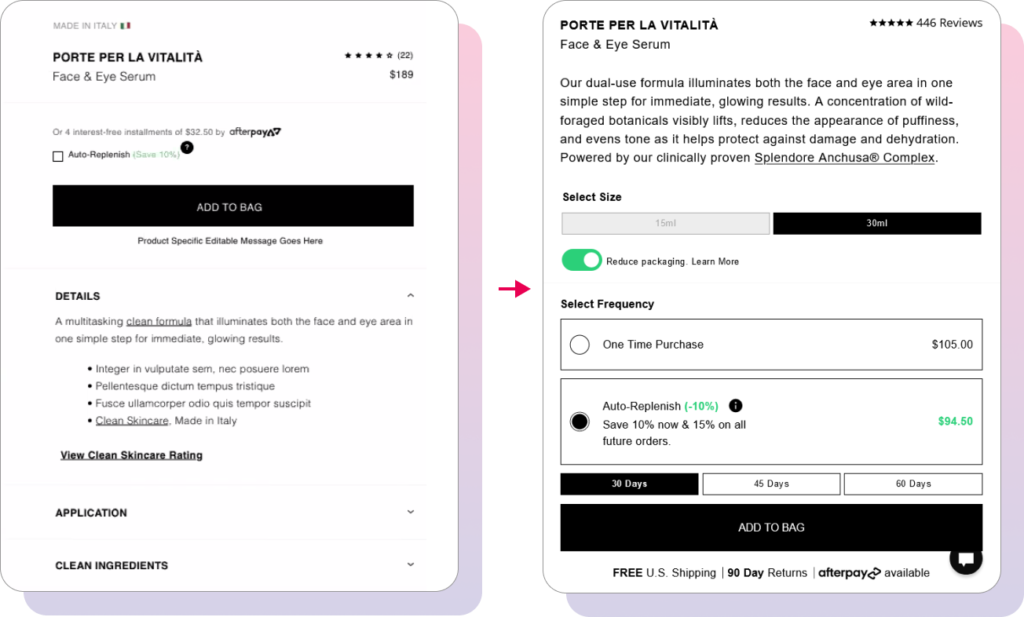

Furtuna Skin shares examples of how its checkout page looks before and after replatforming to a different subscription vendor.

Moreover, since making the switch, Furtuna Skin boosted its subscriber count 103%, and 50% fewer subscribers abandon their subscriptions. Furtuna Skin retains more than 30% of its customers too, and she said that number is still growing.

“A significant reason for our success with Ordergroove is that they were more flexible with their UX and UI options for us to present on our product detail page to make it very, very clear that you can make a one-time purchase or do auto-replen, and here’s your offer for doing auto-replenishment,” Jemison said.

She said Ordergroove’s platform integrates with Yotpo without issue. It doesn’t “hijack” checkout, and Jemison doesn’t have to duplicate her product catalog.

Ordergroove also allows Furtuna Skin to offer different incentives for one-time and subscription purchases, she said. Furtuna Skin currently offers 10% off the first order of a subscription product. It offers 15% off for every recurring order thereafter. Those recurring orders also build up loyalty points, which consumers can later use toward subscriptions as well.

Do you rank in our database?

Submit your data with this quick survey and we’ll see where you fit in our next ranking update!

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.

Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite