Franklin Chu, managing director, Azoya USA

Arguably more important than Singles Day for US and foreign retailers who sell to China through cross-border e-commerce, this year’s Black Friday showed the industry continues to adapt as the market becomes more competitive.

New niche verticals grew in popularity, and the top cross-border e-commerce platforms are investing more in logistics, partnering with more overseas brands, and introducing more interactive, gamified content to enhance the shopping experience.

We dig deeper to explain what happened this year.

Keyword search terms reflect China’s consumption upgrade as niche verticals grow

This year’s Black Friday reflected the continuing consumption upgrade trend in China, as consumers are spending more on discretionary products that enhance their health and lifestyle. Top search keywords on JD’s cross-border platform included “protein powder,” “face masks,” “dieting,” “watches,” “milk,” and “Apple.”

Tmall Global saw growth in dental care-related searches, with keywords such as “tooth cleaners,” “dental plasters,” “dental instruments,” and “electric toothbrushes” seeing an unexpected increase in demand. These results indicate that more niche verticals are starting to grow in popularity.

JD noted that sales of health supplements and vitamins grew 2.6x more than last year’s sales, while sales of electronics and personal care products grew 4.5x and 3.3x, respectively.

Azoya’s retail network saw strong performance from cosmetics and personal care this year. The top five brands were Charlotte Tilbury, Huda Beauty, The Ordinary, Aptamil, and Swisse.

Huda Beauty and The Ordinary were new top sellers this year, as Huda Beauty’s New Nude color cosmetics set has skyrocketed in popularity, partly driven by its widespread use overseas and the celebrity personality of its influencer founder Huda Kattan, a former makeup artist.

The Ordinary’s skincare products have sold well after its founder announced he would temporarily shut down operations, unable to settle a dispute with parent company Estée Lauder.

Cross-border e-commerce platforms invest in cross-border logistics and global brand partnerships

Tmall Global opened its US warehouse for business for Black Friday, enabling new brands such as Hatley (kids apparel), Glamcor (makeup mirrors), Evereden (skincare), Baubax (outerwear), and 30 other new brands to partake in Black Friday promotions.

On a similar note, JD Worldwide set up procurement centers in Japan and South Korea this year, and plans to build more in North America, Europe, Australia, and New Zealand. Little Red Book also operates 29 overseas warehouses in the US, Japan, South Korea, Australia, and Europe.

Azoya’s retail network also prepared extensively for this year’s holiday season by stocking more inventory in Hong Kong. UK beauty & cosmetics retailer Feelunique partnered with Seko Logistics to open up a distribution hub in Hong Kong in October to facilitate faster fulfillment of its China e-commerce orders.

JD Worldwide is doubling down on cross-border e-commerce this year. In the days following Black Friday, it announced that international brands using JD Logistics should be able to deliver 100% of their orders to Tier 1 and 2 cities by the next day, with some deliveries as fast as 1.5 hours. JD Logistics’ 300,000 delivery stations across China enable them to carry out last-mile delivery at a pace that its competitors can’t match.

How are platforms enhancing the cross-border shopping experience?

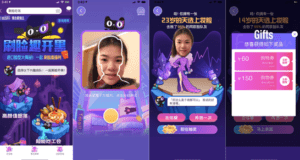

Tmall incorporated games into its Black Friday marketing campaigns this year, encouraging customers to engage in a facial recognition game. Participants picked from one out of 16 product categories, scanning their faces with the Tmall app to receive gifts and coupons based on the results. Over 300,000 users participated.

Tmall also stationed offline facial recognition booths in Beijing, Hangzhou, Shanghai, and Guangzhou, inviting passing pedestrians to try out the game. This campaign reflects the growing gamification of e-commerce in China—as the market becomes more competitive, brands are investing in creative ways to keep customers’ attention.

Content marketing is another method brands are using to vie for customers’ attention. Content-driven social commerce platform Little Red Book partnered with leading overseas brands to launch limited edition product lines ahead of the holiday season. For example, both SK-II and Jo Malone sold limited-edition Christmas products on Little Red Book this year.

Tmall Global’s Black Friday facial recognition game. Source: Ebrun

Tmall also stationed offline facial recognition booths in Beijing, Hangzhou, Shanghai, and Guangzhou, inviting passing pedestrians to try out the game. This campaign reflects the growing gamification of e-commerce in China—as the market becomes more competitive, brands are investing in creative ways to keep customers’ attention.

Content marketing is another method brands are using to vie for customers’ attention. Content-driven social commerce platform Little Red Book partnered with leading overseas brands to launch limited edition product lines ahead of the holiday season. For example, both SK-II and Jo Malone sold limited-edition Christmas products on Little Red Book this year.

SK-II’s and Jo Malone’s holiday-edition products were particularly popular this year.

Los Angeles-based cosmetics brand ColourPop also launched its “This Is Not A Dream” holiday-edition line of color cosmetics on the platform. Little Red Book and ColourPop have an exclusive partnership in the China market, demonstrating just how crucial social content is to building brand awareness in the cosmetics industry.

Key Takeaways

- This year’s Black Friday results reflected consumption upgrade trends in China amid growing demand for cross-border e-commerce products. Health and food-related products were popular on JD Worldwide this year, and dental-related search keywords saw an uptick in growth on Tmall Global. Azoya’s retail network saw strong performance in cosmetics.

- The top e-commerce platforms are investing in more overseas procurement centers and warehouses, setting up more direct partnerships with brands. Tmall Global opened its overseas warehouse in the US for the first time, enabling customers to purchase newer niche brands such as Hatley, Glamcor, and Evereden. JD Worldwide set up warehouses in Japan and South Korea this year, while Little Red Book has warehouses in 29 countries worldwide.

- Gamification and content marketing are helping e-commerce players enhance the shopping experience for their customers as cross-border e-commerce becomes more competitive. Tmall Global introduced a facial recognition game to award coupons to customers, while social commerce platform Little Red Book partnered with brands such as SK-II and Jo Malone to launch their holiday-edition product lines in the weeks leading up to Singles Day and Black Friday.

Azoya assists retailers and brands as they expand into China via e-commerce.