Two key trends will shape the future business environment, according to Deloitte’s 2024 U.S. retail industry outlook. Those trends are tighter labor markets and higher long-term interest rates, Deloitte said in the report, which focuses on how retailers can rekindle “profitable loyalty through experiences, personalization, and trust.”

“First, slow labor force growth and continued high demand require companies to offer higher wages to lower-skilled workers and to be more imaginative about hiring,” Deloitte economists Danny Bachman and Akrur Barua said. “Second, long-term interest rates are unlikely to return to the lows of the late 2010s.”

Interest rates and inflation overall had a noticeable impact on consumer spending at a critical time, according to the report.

“The pandemic-induced ecommerce surge and supply chain disruption caused a loyalty calamity,” the Deloitte report’s authors wrote. “Three in four consumers tested new brands and stores as they faced empty shelves. When life began normalizing, retailers focused on enticing customers back to their stores and keeping them in the so-called family. Then inflation hit.”

Deloitte weighs loyalty vs. better pricing

Half of the retail executives Deloitte surveyed expect consumers to prioritize price over loyalty this year. The fact that the online marketplace Temu’s app was the most downloaded on Apple’s store in the U.S. last year suggests that expectation makes sense, Deloitte said.

Just over two-thirds (64%) of retail executives Deloitte surveyed expect inflation-weary consumers to purchase fewer goods — something that also concerns consumer packaged goods (CPG) companies as they pivot to profitable volume.

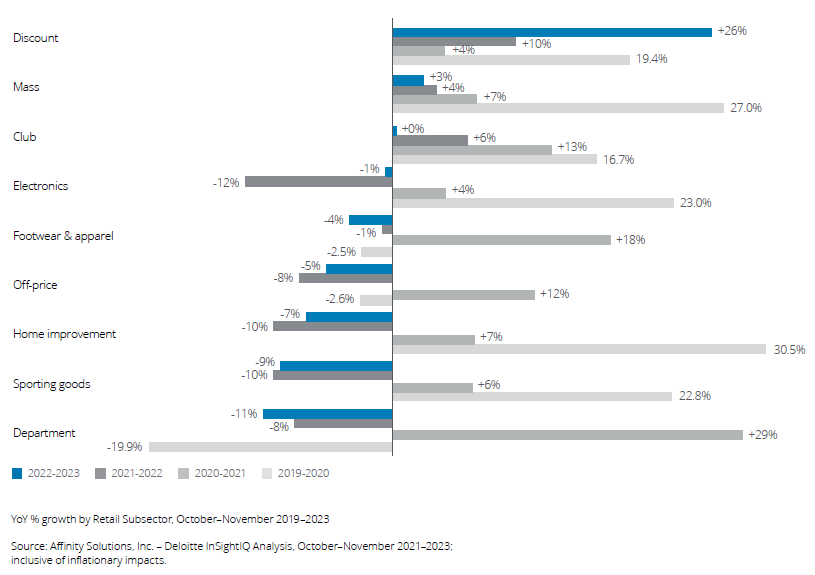

Consumer spending at discount retailers increased significantly year over year

Deloitte lists in the report three key tips for retailers to gain — or regain — consumers’ loyalty in 2024.

1. Lean into loyalty programs

Even among loyalty program members, not all customers spend the same way. By creating tiers within loyalty programs, retailers can give extra perks to the biggest spenders in a more financially viable way, according to Deloitte.

“While tiering programs are not new, we see more investments occurring behind the scenes that take a more scientific approach to segmenting,” the report’s authors wrote. “This includes providing different offers, benefits, and communication to higher tiers and working toward migrating people up.”

Loyalty programs can also be cobranded, as is the case with Target and Ulta, Kohl’s and Sephora, and other cases. Target also offers its members free trials on Apple services. This reduces the retailer’s responsibility to provide all the benefits, Deloitte said. For example, consumers can earn rewards toward their Target and Ulta rewards programs when they buy Ulta products from Target. The same applies for Kohl’s shoppers buying Sephora products in Kohl’s stores and on its website. Retailers should also consider joint promotions with travel programs that involve airlines, hotels and restaurants, Deloitte said.

“By co-branding the benefits, retailers can get greater exposure and plug into a broader set of consumers while providing exciting benefits with shared costs, potentially improving the program’s profitability,” Deloitte’s researchers said in the report.

With all this first-person purchasing data, loyalty programs give retailers the opportunity to personalize suggestions to consumers, giving room for additional revenue, Deloitte said. This can be valuable to retailers that have extensive data from digital and in-store shopper visits.

Nearly two-thirds of retailers share or plan to share loyalty data with retail media network advertisers, Deloitte said, citing data from a Deloitte Digital report. Deloitte Digital released the report, called “Harness the power of Retail Media Networks to elevate the brand to consumer connection,” in December 2023.

2. Enhance omni-experience through in-store investments

Omnichannel inconsistencies and poor execution can be detrimental to loyalty, Deloitte said.

It cited its December 2023 omnichannel holiday analysis report, which reviewed 145 companies’ omnichannel capabilities from Nov. 21 to 23, 2023. It found that buy online, pick up in store (BOPIS) and buy online, return in store (BORIS) “were widely available,” but only one in 10 retailers offered alternative delivery pickup.

Meanwhile, “a third failed to indicate how long it would take to receive a refund. Shipping was also a sore spot; by December 5, only a third listed shipping cutoff times for Christmas arrival. And when we tested the claims of 17 companies offering on-time delivery of holiday gifts purchased on Dec. 19, nearly one-quarter of the holiday delivery orders arrived after Dec. 24.”

Whereas the pandemic’s digital acceleration benefited omnichannel shopping, Deloitte said, retailers need to maintain “a cohesive, consistent omni-experience.” It said the experience “is often lacking, potentially eroding trust” despite pandemic-induced tech upgrades and new last-mile and return options.

According to Deloitte data, the top four growth opportunities that retail executives anticipate in 2024 are:

- Strengthening loyalty programs (54% of executives selected this)

- Strengthening ecommerce offerings (44%)

- Enhancing in-store customer experience (36%)

- Enhancing omnichannel experience (32%)

3. Drive individual engagement at scale with trustworthy AI

Building on first-party data that retailers acquire through loyalty programs and visits to their ecommerce sites and physical stores, retailers have an opportunity to further personalize product recommendations and tailored interactions, Deloitte said.

Half of retail executives are prioritizing AI-driven personalized product recommendations in 2024, Deloitte said. However, only five in 10 retail executives are confident in their company’s ability to use AI effectively across their businesses, it added.

Meanwhile, eight in 10 consumers from Deloitte’s holiday study said they had little to no trust in retailers’ ability to use artificial intelligence responsibly.

“Retailers also see this as a challenge, as more than three-quarters said using next-generation AI technologies in the next five years will strain consumer trust and heighten their concerns around privacy violations, surveillance, lack of transparency/accountability, and job displacement,” Deloitte said.

Trust in a brand drops 144% for customers who know a brand is using AI, Deloitte data found. To build trust, Deloitte said, brands should focus on four factors:

- Humanity: Retailers should focus on building human interactions, Deloitte said. “AI should be trained with an expansive set of rules to be responsive to the context of the customer.” That can include training AI to give condolences if a consumer mentions a death in the family, Deloitte said as an example.

- Transparency: Retailers should explain how and why chatbots are being used, providing specific details about their purpose and function, Deloitte said.

- Capability: Retailers should give employees the chance to use AI tools in a zero-risk environment. From there, retailers should highlight the tools’ benefits “while underscoring that the tools do not undermine their work and value.”

- Reliability: Retailers should make clear what consumers can expect from AI tools so as to “drive perceptions of reliability.”

Do you rank in our database?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite