Crawford Davidson, managing director, Go Inspire Group

With so many of our daily activities now occurring online and nine out of ten American adults using the internet, it may seem logical to assume that retail purchasing will also become a primarily digital activity. This is compounded by the tales of an ongoing retail apocalypse told by the media, with 12,000 store closures expected by the end of 2019.

However, US consumers are still making the majority of their transactions in-store, as online retail only had a 14.3% share of total retail sales in 2018. Similarly, in the UK, where some of the biggest brands are struggling to stay afloat and the British ‘high street’ has been plagued with countless store closures, just 18% of retail sales are online.

It is not unfair to say that US and UK marketers are facing similar strategic challenges when it comes to deciding the best balance between online and offline marketing efforts. It would be imprudent however, to make commercially important decisions on the general perception that the end of bricks-and-mortar retail is now near and that all our shopping will move online irrevocably in the coming years.. UK-based Go Inspire Group decided it was time to look deeper into this generalization and commissioned independent research assessing whether this drift to online purchasing is really as unstoppable as we think.

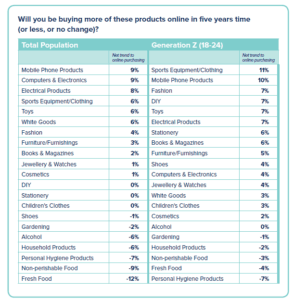

The study asked consumers whether they envisioned buying more or less online in five years from now across a wide variety of products. Go Inspire Group also wanted to understand the nuances in purchasing behavior between the wider population and our most digitally influenced Generation Z (18-24 years old).

The results of the study demonstrate that a surge in online shopping cannot be expected for every single product category: In five years from now, consumers will increasingly browse the internet for mobile phones, computers, electricals and sports equipment. yet they expect to return to the shops for food, household and gardening products, and also alcohol.

The results of the study demonstrate that a surge in online shopping cannot be expected for every single product category: In five years from now, consumers will increasingly browse the internet for mobile phones, computers, electricals and sports equipment. yet they expect to return to the shops for food, household and gardening products, and also alcohol.

Although Generation Z showed a higher tendency towards buying online, they too return to the high street for the same product categories as the wider consumer pool.

Stores still have a future

The bottom line is that taking assumptions on future consumer trends for granted is never commercially justifiable. The research clearly shows that some products will be attracting increased footfall in the next five years, including among younger consumers, so businesses selling these products must be prepared to accommodate these customers in-store and ensure they keep coming back.

A solid marketing strategy has to be underpinned by behavioral consumer data that reflects a holistic view of both digital and traditional shopping channels and includes various customer profiles and diverse product categories. The commercial magic happens when a marketer manages to balance efforts across both shopping channels, based on sound and accurate information about purchaser preferences.

Go Inspire is a marketing agency based in the United Kingdom.

Favorite