Total gross merchandise volume (GMV) at the Top 100 marketplaces across the globe grew 2.9% in 2022 to $3.2 trillion, according to research by Digital Commerce 360. And while that rate of growth is a major decline from the 17.7% growth seen in 2021, it’s still growth.

By contrast, the U.S.-based marketplaces in the Top 100 saw GMV decline 0.05% in 2022 to $869.16 billion.

These are just some of the findings in the newly released 2023 Global Online Marketplaces Report from Digital Commerce 360.

The report is filled with details on what went right and wrong for the biggest digital marketplaces and the retailers who sell through them. More importantly, the report offers the insights everyone in the ecommerce industry needs to prosper in the newly reconfigured industry.

An unusual year in marketplaces

Online marketplaces are digital shopping malls where consumers can buy from a variety of merchants on one site. Some, like eBay Inc., are pure marketplaces that only sell merchandise from other retailers. Other major marketplaces are run by large retailers, like Amazon.com Inc. and Walmart Inc. These marketplaces, which we call hybrid marketplaces, sell merchandise they own alongside the products of third-party merchants.

they own alongside the products of third-party merchants.

By 2022, it became clear that the performance levels of pure and hybrid marketplaces were diverging and that the increase in total GMV among global marketplaces last year can be traced largely to an increase in first-party sales on hybrid marketplaces.

First-party sales are growing faster than third-party sales for the world’s top marketplaces. In 2018, third-party growth was about 90% as fast as first-party growth — 18.9% growth for marketplaces’ own goods compared to 17.4% for other goods sold through their platforms. But in 2022, first-party sales on marketplaces grew nearly 800% faster than third-party sales — first party growth of 9.% compared to 1.2% for third-party GMV.

Marketplace Facts:

- Over the past three years, the compound annual growth rate (CAGR) at the Top 100 global marketplaces is an impressive 16.2% for total GMV

- For US marketplaces, first-party GMV grew 1.6% in 2022

- Consumer brand manufacturers are the heaviest sellers on marketplaces

- 47.5% of digitally native brands – those born-on-the-web brands – sold on marketplaces over the last two years

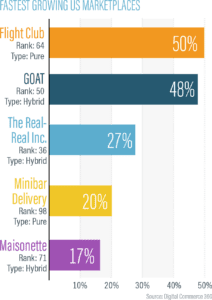

- Niche sites – like sneaker marketplaces GOAT and Flight Club – are some of the best overall performers among marketplaces in 2022

Included in the 2023 Online Marketplaces Report:

- A full ranking and analysis of the Top 100 online marketplaces including growth, total sales, which marketplaces Top 1000 retailers are selling on and more

- Exclusive consumer and retailer survey insights into marketplace buying and selling

- An overview of the ecommerce market in 2022

- Tips for sellers

- Breakout sections of niche and hybrid marketplaces

- View the table of contents

To purchase the 2023 Online Marketplaces Report for $499, you can click here. Digital Commerce 360 Gold and Platinum members receive this report for free.

ABOUT DIGITAL COMMERCE 360 RESEARCH

At Digital Commerce 360 Research our goal is to provide data and information about ecommerce that helps retail companies, investors and technology providers prosper. The team tracks hundreds of metrics on roughly 6,000 online retail companies around the world, including such sought-after data points as web sales and traffic, conversion rates, average order value and key technology partners used to power their ecommerce businesses. We sell this data in its raw format in our multiple online databases, and we dig deeply into these numbers in our custom research division, and to help inform our 30+ exclusive analysis reports we publish each year on key ecommerce topics, including online marketplaces, cross-border ecommerce and omnichannel retailing.