Matt Pace, senior director of client insights, 1010data

According to 1010data, online grocery sales in the U.S. soared 50% to $12.5 billion last year, as consumers, finally relenting, shifted much of their everyday food shopping to ecommerce. However, there’s still plenty of room for growth—in a recent Gallup survey, 81 percent of consumers reported that they never buy groceries online.

One of the primary drivers of online grocery’s growth has been Instacart and its army of do-it-for-you shoppers that have made online grocery shopping accessible to almost everyone, by way of partnerships with hundreds of supermarkets across the country. Remarkably, Instacart has been successful despite being surprisingly low-tech. The company acts as an intermediary between grocery stores and shoppers, managing orders and fulfillment by way of an Uber-like network of human hands navigating store aisles, filling shopping carts and delivering groceries to homes.

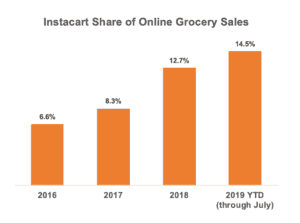

It’s clear the service is resonating with consumers as its availability grows across the country. Over the past three years, Instacart’s share of online grocery sales has jumped from 6.6% in 2016 to 14.5% in 2019, ranking it behind only Walmart and Amazon in the category.

Much of Instacart’s growth was previously fueled by its partnership with Whole Foods Market—in 2016, Partnering with a Whole Foods allowed Instacart to appeal to an affluent, vocal and time-strapped consumer base to disrupt the generations old way consumers shop for groceries. For Whole Foods, which lacked both a web presence and a home delivery infrastructure, Instacart’s arrival was a godsend.

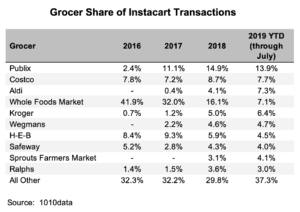

As a rival to Amazon’s own grocery ambitions, Instacart was squarely in Amazon’s sights when the ecommerce giant acquired Whole Foods for $13 billion in 2017. After the merger, Whole Foods’ Instacart partnership was destined to end, and accordingly, it has been winding down. While Whole Foods remained Instacart’s top grocery partner last year, accounting for 16% of orders, its share dropped to just 7.1% this year before orders ceased over the summer.

Despite losing its biggest grocery partner, Instacart has not only survived but also flourished. Over the past three years, sales through Instacart grew an average of 108% per year (double that of both Amazon and online grocery in general) as the service expanded and consumers shifted more of their grocery spending to digital.

Instacart has sustained its sales momentum, in part, by successfully diversifying its merchant mix beyond Whole Foods by way of new partnerships and expansion of existing ones. Year to date, Instacart’s top seven merchants account for half of its orders, compared to just two merchants contributing an equal share in 2016.

Our data on Instacart’s transactions (see Figure 2) reveals Publix is now Instacart’s top merchant partner, and comprises 13.9% of Instacart’s orders year-to-date. Kroger, the nation’s largest supermarket chain, accounts for 6.4% of Instacart orders as it separately seeks to build greater consumer adoption of its drive-up, click and collect services. Sprouts and Aldi, despite being relative newcomers to Instacart, together now generate over 10% of Instacart’s orders. And Costco has seen its own ecommerce fortunes rise alongside Instacart’s, as its order share has remained relatively consistent throughout these years of expansion.

Beyond organic expansion, Instacart has also succeeded in getting consumers to expand the number of items they purchase and the frequency with which they place orders. According to 1010data, this year, 44% of Instacart orders have included more than 15 items, compared to just 38% in 2016. Purchase frequency rose 22% over the past year and Instacart shoppers now place an average of 4.3 orders per quarter, or about one every three weeks.

While Instacart may not appeal to everyone who’s thinking about ordering groceries online, it’s clear that the service resonates among a growing number of consumers eager to save time as well as purchase their groceries from a local grocer they know and trust. Rather than wilt under increased competition from Walmart and Amazon and the loss of Whole Foods, Instacart has aggressively expanded and appears well positioned to maintain its leadership as consumers embrace online grocery shopping in ever-increasing numbers.

1010data provides data analytics and business intelligence technology.