Vera Sivakova, head of business development, Yandex.Checkout

Being metrics-driven is the new black in today’s business world.

Merchants, seeking to maximize profits, tend to concentrate on outperforming vital ecommerce KPIs. High-level KPIs focus on global performance, while low-level ones keep an eye on the performance of processes or individuals.

For those entering the Russian & CIS (and not only) ecommerce markets, I have a real million-dollar insight: Every merchant already has one indicator that is a hidden gold mine, the payment success rate. [CIS stands for Commonwealth of Independent States, a federation of post-Soviet republics in Eurasia.]

E-merchants can get a lot more benefits from the same traffic just by analyzing a transaction acceptance rate. Its consistent optimization will surely give a significant boost to the sales and a substantial increase in the revenue.

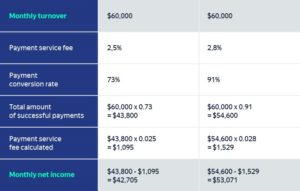

Let me guide you through a very illustrative example: Compare two hypothetical e-merchants with equal turnover figures and other indicators differing.

The difference between the first and the second example is evident. Increasing the turnover data, we can see a more dramatic situation: profit losses are growing as well.

These examples reflect arbitrary figures of the payment success rate, turnover, and acquiring fees, but they clearly demonstrate that even 1% increase in transaction acceptance rate can equate to a potential revenue increase of thousands and even millions of dollars, depending on the size of the business. So let’s have a closer look at what actions can be undertaken to grow your business’ profits.

Having analyzed Yandex.Checkout processing data, we can determine the following top 5 reasons why a bank card payment might be declined:

- Insufficient funds

- 3DS authorization is not completed

- Suspicion of fraud

- Invalid CVV

- Expired card

At first glance, it may seem that none of these issues can be resolved by a merchant. However, the modern payment industry can offer a number of solutions to minimize these loses, and it’s absolutely up to merchant to utilize these in their business.

1. Insufficient funds

The most common card transaction decline reason is “Insufficient funds.” Up to 15% of orders can be lost due to this issue. Actually, no rational explanation for such attempts does exist except that people are hoping for a miracle to happen so that they can complete the payment for free.

As ecommerce continues to evolve, there is a stronger emphasis on a seamless and frictionless user experience during the online shopping (as well as checkout) process. The number of e-merchants that offer online loans and installments are growing, and reasons for this are pretty obvious. There are great advantages both for sellers and buyers.

2. 3DS authorization is not completed

2. 3DS authorization is not completed

Every country has its own experience of 3D Secure as an additional security layer for authenticating cardholders online. A correctly entered verification code proves out that it is definitely you who are in the hustle of online shopping. 3DS is widespread in Russia to the point where customers expect it during the payment process, and the absence of such type of authentication can be considered very suspicious and insecure.

For a business, the benefits of 3D Secure are obvious: it reduces fraud risks and ensures there will be no confusion with an erroneous transaction when the actual cardholder comes with a reasonable question, “What was that? I want a refund.”

But 3D Secure has its downsides that should be mentioned: It does add an extra step to the checkout process, thereby creating additional discomfort, potentially leading to lost sales.

Enabling or disabling 3D Secure is always a trade-off between fraud and revenue. Finding the right balance between optimized acceptance and security can be a smart solution.

A set of rules determined by a merchant and a payment service provider can help find this balance. For example,

- if the customer has already made a payment in the store and confirmed it via 3DS,

- as long as the parameters on all devices remain the same, it is very likely that the further payments from this particular customer can be conducted without 3DS.

The graph shows that the longer an adaptive 3DS is utilized, the more data will be accumulated, and, as a result, more and more payments can be carried out safely and without 3DS authorization.

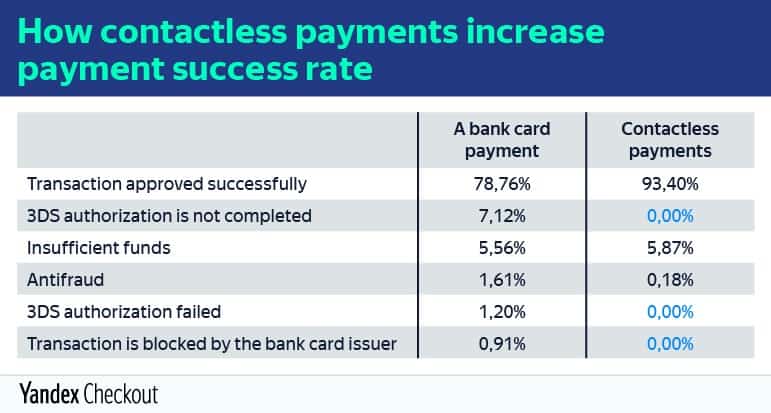

It would be a very good point to mention that Apple Pay, Google Pay, and Samsung Pay are becoming increasingly popular, and in terms of seeking a solution for the second most common online transaction decline reason they are a real remedy.

3. Suspicion of fraud

3. Suspicion of fraud

Antifraud is a complex system that tracks suspicious behavior and anomalies and actually saves business owners’ nerves and money. Antifraud advanced AI engines use a wealth of technology to detect and prevent fraudulent transactions in real time.

Each model of ML can be customized to have its own threshold. It is important to select thresholds reasonably and moderately in order not to block most normal payments—that is, a deviation from the usual that is considered significant enough to take action. A transaction can be declined by a bank issuer, bank acquirer, or by a processor. Let’s view a quick example.

Although Elon Musk’s tunnels are real, we can agree it does look suspicious if a person who has just had a taxi ride in Moscow is now trying to make a purchase in New York within just 5 minutes. In such cases, the bank issuer can even block the card to protect the cardholder from unauthorized payments and prevent the merchant from a chargeback later on.

4. Invalid CVV

CVV is a security code that provides additional security for online purchases. If a company is a type of merchant that has returning customers, or it provides a subscription model with recurring payments, one-click payments are a must. The need to specify card details every time can be frustrating for a customer.

By offering a one-click payment solution, merchants can easily enhance customer retention. Once payment details are securely stored, consumers can focus on the purchase process and complete the transaction in a single click without re-entering their payment details.

5. Expired card

Cards routinely expire, and they can be lost or stolen. For subscription-based merchants, this might result in lost sales, service cancellation, and general customer dissatisfaction if the client hasn’t updated the card details in advance.

Recently, MasterCard and Visa have presented a real game-changing solution that provides a seamless account-update process, eliminating the need for direct action on the part of the cardholder. The MasterCard Automatic Billing Updater (ABU) and Visa Account Updater (VAU) solutions make it all happen and increase authorization approvals.

So fighting for the success of every single transaction definitely makes sense. And these means of increasing payment acceptance rate work well, both for global ecommerce and the evolving Russian & CIS market that reflects the current trends of the industry vividly.

Small and midsized businesses and large corporations can win big from analyzing and considering the above-mentioned 5 key factors that affect revenue grow and help to decrease profit losses.

Yandex.Checkout is an online payment service provided by Yandex.Money, a Russian payments-processing firm.

Favorite