Katerina Mikheeva, head of business development (EU), Yandex.Money

Russia is often seen as a non-priority and third-tier market for global and Western companies. Many in the West view Russia as struggling under economic sanctions, nontransparent legislation, a high rate of poor consumers and an undeveloped business culture. These are stereotypes I hear every day during negotiations with EU and U.S. businesses that view Russia as full of threats—even as they push into more difficult markets.

For those convinced that Russian ecommerce has little future, I remind them that Russia boasts the largest online audience in Europe (the sixth in the world after China, India, U.S., Brazil and Japan), that Russian consumers have a deep interest in foreign goods and that online shopping is increasing even in the furthest corners of this vast country.

A glance at the current state of affairs in Russian fintech and ecommerce shows why Western retailers shouldn’t accept the myopic view on foreign business development in Russia. Let’s have a look.

Rise of ecommerce market in Russia: true or false?

The Russian e-commerce market is constantly growing. A 2018 Morgan Stanley study predicted its nearly threefold growth over the next five years. According to the analysts, the electronic market for physical goods will grow to $31 billion by 2020 and probably reach $52 billion by 2023. Meanwhile the total ecommerce and services market reached $30 billion (2 trillion rubles) in 2018. The cross-border trade segment of the Russian ecommerce is increasing as well.

Source: RAEK 2018. As of April 3, 2 trillion rubles $30.6 billion, 1,8 trillion rubles $27.6 billion, 75 trillion rubles $1150 billion

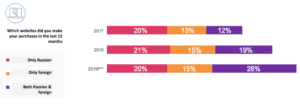

Russia is the top market for China’s AliExpress, just one of several Asian retailers that have recognized Russian customers’ demand for foreign goods. Just a few years ago Russians were afraid to order at foreign websites, but thanks to the rise of financial literacy trust in online purchases is increasing. According to Mediascope, 95.8% of Internet users in Russia shop online, and the percentage of those who buy on foreign websites is growing. Asian companies are firmly established on the Russian soil, and now Western retail giants are arriving, having recognized that there is a solvent audience eager to buy a diverse range of quality goods online.

Source: DataInsight and PayPal 2018

Fast facts on Russia’s fintech

There is little coverage of Russian financial technology in Western media. And many Westerners believe cash payments dominate the Russian economy. Let’s compare a number of cases in Europe and in Russia to determine how far local fintech moved.

1. A variety of payment options for online purchases

In Russia there is a wide number of online payment options, whereas PayPal is still is frequently the only choice for customers on European websites, apart from credit and debit cards. A decade or so ago, foreign companies entering the Russian market only offered PayPal, which was a weird and unknown option for the local audience, though the priority payment method for European customers.

Over the past decade, a wide array of payment methods has been introduced to Russian and CIS customers by payment services providers and banks. Among them there are bank cards with a contactless option, online banking, e-wallets, carrier billing, and many others.

Bank cards are widely accepted in major and middle cities, equipped with generally proper NFC-enabled POS infrastructure. According to Yandex.Checkout data, the top payment methods among Russians are bank cards, mobile banking (mostly Sberbank Online) and e-wallets (Yandex.Money, WebMoney, QIWI).

Source: Mediascope 2018

2. Banking services are strong in Russia, and there is a huge competition on this market

It was no coincidence Russia was chosen as one of the first markets for Apple Pay and Google Pay. The Russian banking industry is more innovative and flexible than many of those in Europe. Most bank cards are chip & PIN and NFC-enabled, personal banking is convenient and quite cheap for clients if not free, and most ecommerce and digital services support online acquiring. Banks have developed mobile banking apps and support digital banking scenarios for daily use, ahead of many EU banks.

3. Fintech as a driver of innovations to day-to-day life

While in many European countries people are just now starting to enjoy free online banking, convenient free of charge peer-to-peer transfers and expecting an updated version of 3D-secure that will stop ruining the payment experience, Russian users are literally spoiled with banking services. Fighting for every single client, banks and fintechs develop with enormous speed and offer new cutting-edge services virtually every month (or even week).

Meanwhile in the Netherlands, if you want to purchase something online from a desktop, you need to have a physical token-generator provided by your bank about you at all times or to check out from a mobile app. In Germany, you can’t pay offline with familiar Visa or Mastercard unless you go to a touristy area; and online purchases are much easier to make with PayPal than with a bank card.

Nonetheless, the fintech community is determined to make financial services great all over the world, which is discussed at every conference. We see it all gradually evolving, and innovative banks, like N26, are leading change in the conservative payment landscape. [N26 is a German bank focused on offering banking services to consumers through mobile devices.]

New opportunities for foreign companies to sell online in Russia

Does Russia still look like an unpromising market to enter? When carrying out a SWOT [Strengths/Weaknesses/Opportunities/Threats] analysis before going to Russia, a foreign business should consider the following:

1. Study the most-demanded industries and target audience

There are a number of retail product categories where Russian demand is strong and Russian consumers prefer foreign products to domestic ones. In fact, sometimes it feels like we are still recovering from the Iron Curtain. Goods for kids are often imported from EU and U.S., as Russians consider their quality better. Wellness products are very trendy here, which is why Russians were attracted to iHerb, a U.S. online retailer that localized its website for Russian-speaking countries and has been a success.

There have been some surprises: for example, a significant percentage of Russians (like their Chinese counterparts) are in love with luxury retail. They got very excited when Farfetch launched a Russian version of its website. Many Russians prefer foreign apparel and footwear to local brands, and online department stores like the UK’s ASOS make it super easy to shop online.

And physical goods are not the only opportunity in Russia. Digital goods are just as popular. Some major gaming and entertainment brands have localized their products for Russian market and not been disappointed by the results.

2. Become familiar with Russian legislation

Many foreign companies that sense the potential of the Russian market believe that dealing with Russian legislation would be so overwhelming and oppressive that most of them have dropped their plans before even starting their research.

Many mistakenly believe that it is mandatory to establish a Russian legal entity. However, cross-border operations are no stranger to the Russian market, and in most cases, you can get going online in no time at all. It is highly recommended, however, that foreign companies hire a legal counsel to check what is required in rtheir particular case, or find a local partner that has experience in cross-border ecommerce. That brings us to our next point.

3. Establish local partnerships

When entering new markets, it is a good idea to take a close look at the most representative and successful partnerships with local payment service providers. It is often better to establish a relationship with a local Russian PSP rather than using a one-stop solution from a global provider. With such a distinct market like Russian you often need local guidance to navigate the payment landscape effectively, and if you try to use the same strategies that you employ in other European markets you may fail without even realizing why.

4. Localization is the key to success

A number of Western companies have analyzed the traffic from Russia, realized the potential and decided to localize a Russian ecommerce site. That includes building a website in Russian, organizing fast delivery and integrating payment options that are popular in this particular market.

As for payments, it is advised to add as many options as possible (for example, via a payment integrator) and to avoid cash on delivery.

Cash on delivery will result in more expenses than benefits, and most of the local Russian businesses are trying to get away from it. It is more expensive than the simple delivery of prepaid online orders. Moreover, cash collection and audit takes money (and the time of accounting departments.) Online payments increase conversion of sales, as once the order in paid online there is no opportunity for a customer to refuse the delivery.

As mentioned earlier, Russians are spoiled with banking and fintech services, and when they see a payment form that looks like it’s from the early 2000’s they immediately assume that the website is not trustworthy.

Nowadays users expect a convenient, seamless and visually pleasing payment experience. And that is valuable not only for purchasers, but for merchants as well. The Russian market abounds in fintech development and is marked by enormous online shopping demand. As a result, a Western company has every chance of identifying a niche and expanding its business in Russia painlessly and profitably.

Yandex.Money is a Russian firm that provides online payment services for retailers and consumers.

Favorite