Abhijeet Sathe, principal analyst, Boomerang Commerce

There is no denying that Amazon and online shopping as a whole have changed the face of the retail industry. One way this can be beneficial to consumers is competitive pricing, in which various outlets match the lowest price available in an effort to attract or retain shoppers.

Many retailers have moved to automated pricing systems that attempt to undercut competitors and attract more business. In theory, this makes the market more efficient, but in practice this ends up driving profit margins down.

So, how did we get here, and what can brands and retailers do to avoid prices that bottom out and force a negative impact on profits? First, it’s important to understand what’s behind these new retail price wars.

Why you should care about Price Wars

A retail price war is essentially a race to the bottom thanks to retailers following each other’s online pricing—often driven by software automation. Many outlets have contributed to this phenomenon, but perhaps none more than Amazon. The company’sflywheel philosophyhas been well documented and includes “lower-cost structure” and “lower prices” as elements that help drive continual growth.

Of course, that’s much easier for a retailer like Amazon to take on. It has endless aisles of products, often at the best available price and delivered in a convenient and timely manner.

New technology has changed the way consumers shop and influenced these retail price wars as well. The rise of smartphones drove consumer price transparency and normalized “showrooming,” allowing shoppers to easily compare product prices instantly online, even while standing in a physical retail location.

The price wars phenomenon first hit mature product categories—such as electronics, toys and sporting goods—that were already prone to price comparisons. Even before showrooming became a common shopping tactic, it was normal for consumers to compare prices of TVs or computers across retailers with hopes of snagging the best price.

However, now a number of categories once thought to be immune to Amazon and online customer buying behavior are joining the price wars as well. This includes the auto parts market and even consumer packaged goods, a category that could be affected even more following Amazon’s acquisition of Whole Foods last year.

This ultra-competitive climate now drives price compression, and in turn, profit margin compressions across the retail industry. This intensifies during heavy promotional periods, such as the holidays for gifts or the Super Bowl for TVs.

Furthermore, due to the ongoing price wars, the largest retailers like Amazon, Walmart and Costco use their retail distribution power to squeeze brand manufacturers for cost savings, often asking these brands to reduce their wholesale prices significantly—else risk being de-listed or not carried in stores anymore. This phenomenon further perpetuates and escalates the price wars across retailers.

Good for consumers, potentially bad for business

Lower prices will always be a good thing for consumers, so why is this a bad thing for business? Doesn’t this mean retailers and brands eventually converge to the market price of a given product?

The answer to that question is “maybe.” What is certain is that retailers and brands can’t take margins for granted and will need to be ready to serve customers profitability at a low gross margin while focusing more and more on contribution profits.

In addition, “market price” doesn’t need to simply be the cost of a product plus a small or incremental change.

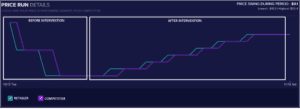

When these situations are identified early enough, an intervention is possible. If no action is taken, a product’s price could bottom out or flatten at an unprofitable price. On average, this leads to a 3.9 percent loss in revenue on products where a price war has started. However, if an intervention takes place in time, retailers can avoid those losses.

How pointless price wars can be prevented

Technology now plays a key role in almost every industry, and retail is no different. One way for retailers to avoid unnecessary price wars is to employ intelligent automated pricing. All it takes is some knowledge of the market

For example, retailers can raise the market on specific products by identifying instances of price leadership and acting accordingly. Technology allows you to track pricing changes and determine which sellers are price setters and which are price followers.

Imagine if Dick’s Sporting Goods lowered its price on a specific product, and then Amazon followed with the same move. This could lead to a price war and generate an index or probability score that identifies the likelihood of a competitor tracking a retailer’s pricing and following those changes indiscriminately. A higher price war index means a higher likelihood of being followed by competitors.

In this particular example, if Dick’s Sporting Goods discovers Amazon is following its pricing patterns blindly through basic tracking and automation, it becomes the price leader for this particular product and allows Dick’s Sporting Goods to move the market price back up.

Put another way, the price war index can be used to avoid driving down the market and minimizing profits.

The implications for retailers

For retailers, the new price wars have led to a “grow fast or die slow” state based on today’s consumer buying behavior. Consumers now have complete price transparency and quickly form impressions of which retailers offer best pricing based on their price perception. Furthermore, the rise of online retailers and smartphone penetration has intensified the situation because the expense of changing prices is very low. For brick-and-mortar retailers, changing prices involves an investment in time and resources because of the need to physically change price tags, in-store signage, and so on.

Amazon is clearly on the “grow fast” end of the proposition, as illustrated by its flywheel philosophy. Other retailers such as RadioShack or Toys R Us weren’t so lucky and got caught on the “die slow” side. Somewhere in the middle there are a number of businesses closing physical locations, and many will need to make key decisions before they disappear completely

The bottom line is, if retailers can’t be competitive online—the center of where the consumer journey begins—they likely won’t be relevant in a few years’ time. They won’t be able to compete using old-school “brick & mortar” methods that only involve people, legacy pricing models and Excel spreadsheets.

Here are three things retailers can focus on to improve their prospects in the retail price wars environment:

1. Technology: Retailers need technology to remain viable and scale at the pace of how consumers buy. This is not just technology for technology’s sake, but technology to support actual business goals and what that business stands for. This doesn’t mean retailers need to sell online exclusively, however.

Take the department store Nordstrom as an example. Even before the e-commerce days, Nordstrom was known for its above-and-beyond customer service because it is a part of the retailer’s business strategy. It has now melded its online presence with its in-store customer service experience.

You may be in a Nordstrom location and bring to the counter a $300 pair of shoes you’ve had your eye on. You notice the shoes ring up at $250 as the clerk notifies you that the store honors its online pricing in its physical locations as well. You then leave the store smiling and feeling like the store is always looking out for you.

Lowe’s is another good example. The home improvement chain has said 60 percent of shoppers who buy items online pick those products up in the store. Of that group, 40 percent end up spending an average of $80 per shopper more while they’re in the store.

Technology comes into play because Lowe’s uses it to identify which products lend themselves to buying online and picking up in-store. Not only does it save the chain on shipping costs, but also it increases the chances of those customers buying even more when they’re in the store, where they are less focused on price and more focused on convenience and the great service of Lowe’s knowledgeable customer service employees.

2. COGS and shipping variable costs: When assessing their place in the current state of price wars, retailers need to consider more than just the price of their products. The climate has also placed increased importance on cost-of-good-sold (COGS) for retailers. Obviously, the better they can negotiate with various brands and labels, the less gross profit margins will be affected when prices are lowered.

When it comes to shipping, there is an opportunity for retailers to save money by encouraging shoppers to pick up items in the store to drive up contribution margins.

Walmart, for example, passes shipping savings to customers by offering lower prices to those who agree to pick up items in the store. This builds positive sentiment among consumers, and as the Lowe’s example showed, increases the chances of these consumers spending even more while they’re in the store

3. Private labels and exclusives: Retailers that sell products under their own private labels minimize the effect of price wars because they pay only a manufacturing fee for those products but not the typical wholesale fee.

Common private label brands include the likes of Archer Farms and Market Pantry at Target, Kirkland Signature at Costco, and Alfani, Epic Threads and American Rag at Macy’s.

Retailers can create a similar situation if they offer exclusive third-party brands in their stores. If customers know they can buy Behr paints only at Home Depot, they may be willing to pay slightly higher prices because they know it’s the only game in town for that particular brand and paint color.

The implications for brands

The retail price wars affect not only retailers, but brand manufacturers as well. Here are key things brands can do to minimize negative effects:

1. Hybrid selling strategy: For brands that sell products on retail sites such as Amazon, diversifying selling strategies is vital. When possible, brands should make products available for first-party purchases (to take advantage of Amazon Prime, which usually includes free two-day shipping), third-party (in which the brand ships the products from its own business) and direct-to-consumer (in which they sell from their own site and fulfill the orders, as well).

This hybrid strategy allows for more flexibility and keeps the retailers honest. For example, in third-party sales, the brand can set the price, and in a direct-to-consumer situation, they can offer exclusive deals that won’t be found anywhere else.

2. Partner with retailers on exclusives: We’ve already discussed how offering brand exclusives can benefit retailers, and those benefits carry over to the brands as well. Retailers can sell to consumers at higher prices because the products can’t be found anywhere else, which means brands can offer their exclusive products to the retailers at a healthy margin also.

3. Online-optimized packaging: Consumer-friendly packaging is a way for brands to boost sales online. If a granola bar brand offers 10-bar packs at the supermarket and jumbo 24- or 48-bar packs at price clubs such as Sam’s Club or Costco, they might consider drumming up online sales with smaller delivery-friendly 4-bar packs.

4. Surgical marketing:Instead of spending money on expensive above-the-line advertising (e.g., TV commercials) or traditional marketing programs, brands can be much more surgical and measured on investing marketing dollars to drive awareness and conversion for more profitable products through new digital advertising vehicles like Amazon Marketing Services.

5. Bundling:By understanding unit-level contribution profits and identifying product affinity relationships through real-time market insights, brands can quickly bundle the unprofitable products with their more profitable products.

6. MAP monitoring and enforcement actions:In addition to having a strong MAP policy and having it part of any retail-wholesale agreement, brands must also actively monitor and enforce policies when there are violations. While these discussions have to be navigated skillfully, brands that are armed with real-time monitoring and data will have a much better opportunity to negotiate with and change the behavior of violating retailers.

The implications for consumers

For consumers, the retail price wars come down to a strategy of “buyer beware.” Online pricing changes frequently, and across retailers, so they should always shop around to ensure they get the best product to meet their needs at the best price possible.

Showrooming plays a huge role here, of course. Almost all of us have found ourselves in a store considering a particular product we like, then whipping out our smartphones to compare prices before making that final in-store decision.

That’s not likely to change anytime soon. The takeaway here is the everyday shopper will continue to find ways to be savvy when it comes to getting the product they want at the lowest price possible. However, that doesn’t mean retailers need to feel pressured to constantly undercut their competition. Yes, in the short term that strategy may result in some sales. But in the long run it will mean dwindling profit margins, not only for that individual retailer and brand, but for the industry as a whole.

Just as consumers use technology to find low prices, retailers and brands can make use of technology to monitor trends, identify opportunities and take actions at every turn to put an end to price wars before they even begin.

Boomerang Commerce provides price-optimization technology and competitive intelligence for online retailers and brands.

Favorite