Tom Byrnes, chief marketing officer, Vesta Corp.

According to The Nilsen Report, an industry publication that covers card and mobile industries, direct fraud losses incurred by retailers on all credit, debit and prepaid payment cards totaled $16.3 billion globally last year, or nearly 5.7 cents for every $100 in transaction volume. Total fraud volume for the year was up a stunning 19 percent from 2015, outpacing even the 15 percent increase in payment volume.

Hard Costs

Hard costs to merchants associated with fraudulent card charges can include not only the cost of goods sold but also shipping costs, where applicable, as well as the administrative costs associated with processing chargebacks. In addition, some retailers can incur penalties from card associations such as Visa and MasterCard when their chargebacks exceed a predetermined threshold. They also may owe processing fees to the banks that issue cards.

If the damage done by fraudulent card payments was limited to these direct costs, it would still be a massive problem. Unfortunately, costs associated with rising levels of fraud include the money a merchant spends to maintain a well-oiled fraud-fighting machine.

A majority of the survey respondents say their organizations maintain multiple departments or functions with at least some responsibility for detecting and assessing fraud, including 66% who have dedicated fraud operations, 66% with order review programs, 64% with a payment processing function, and 60% with a regulatory compliance function that helps ensure compliance with Payment Card Industry Data Security Standards. In addition, 47% of survey respondents say their organizations maintain a chargeback management function, and 46% have risk analytics operations.

For companies that derive more than 90% of their revenue from e-commerce, these percentages average 10 points higher across all functions.

In addition to the hard costs enumerated above, fraud also can impact revenue, reputation, customer loyalty, and strategic business planning.

Opportunity Costs: Lost Revenue

Merchants take a hit to revenue and inventory when a sale turns out to have been paid for by fraudulent means. But retailers also lose when legitimate transactions are declined due to suspected fraud that proves unwarranted. Javelin Strategy and Research estimates that these false positives account for three out of every ten declined transactions, and they can directly harm merchants by robbing them of revenue they otherwise might have booked.

Reputation and Customer Loyalty

Customers who see fraudulent charges on their monthly statements may blame the merchant, becoming frustrated by the need to dispute the charges and wary of doing additional business with the merchants that processed them. Merchants who generate false positives at the point of sale also run the risk of souring their reputation and relationship with customers, who may be offended by having their card rejected and inconvenienced by having to go elsewhere for the goods or services they need. For those enterprises most affected by fraud, these negatives can impact their approach to creating new products and services—and even lead to a rethinking of their business models—as they look for ways to mitigate the damage fraud imposes on them.

Quantifying the Strategic Risks

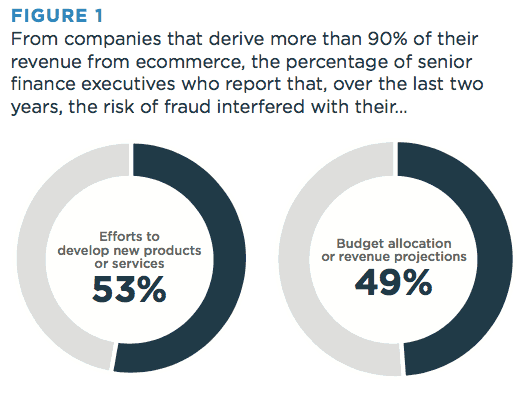

In a recent survey of 155 finance executives by CFO Research, in collaboration with Vesta, more than four in ten respondents—43%—say the risk of fraud has interfered with their organizations’ efforts to develop new products or services, or caused them to make changes to their business models. That number swells to 53% for companies that derive more than 90% of their revenue from e-commerce, and 55% for those that use only internal resources to detect and assess fraud rather than enlisting the aid of a third-party fraud-prevention specialist.

The risks associated with fraud can have a surprisingly long tail, in part because companies that can’t count on the integrity of sales charged to payment cards can’t accurately forecast their financials, either. Four in ten survey respondents say the risk of fraud has interfered with their budget allocations or revenue projections. For companies that derive more than 90% of their revenue from e-commerce, that figure jumps to 49%, and for those that use only internal resources to detect and assess fraud, the percentage climbs to 52%. In addition, within finance the ability to accurately forecast the costs of building and maintaining fraud-related functions is equally uncertain.

The risks associated with fraud can have a surprisingly long tail, in part because companies that can’t count on the integrity of sales charged to payment cards can’t accurately forecast their financials, either. Four in ten survey respondents say the risk of fraud has interfered with their budget allocations or revenue projections. For companies that derive more than 90% of their revenue from e-commerce, that figure jumps to 49%, and for those that use only internal resources to detect and assess fraud, the percentage climbs to 52%. In addition, within finance the ability to accurately forecast the costs of building and maintaining fraud-related functions is equally uncertain.

EMV Cards and Fraud Risk

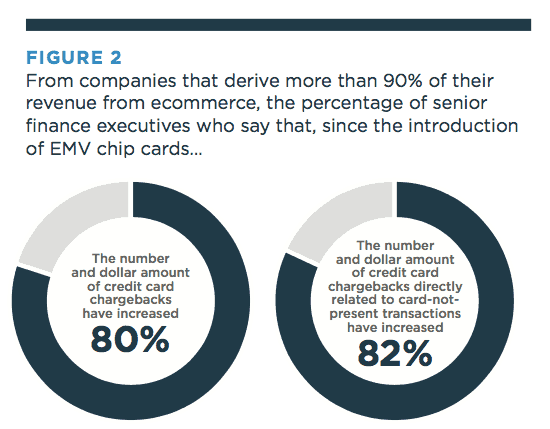

The rate at which online fraud is growing rivals the rate at which e-commerce is increasing, which isn’t particularly surprising. What may be surprising to some is that the debut of EMV chip cards, marketed as a fraud-fighting tool, appears to be exacerbating the incidence of online payment fraud. While 71% of survey respondents say payment fraud generally has decreased substantially since the introduction of chip cards in the U.S. in 2015, six in ten (62%) say both the number and dollar amount of credit card chargebacks has increased. One possible explanation is that chip cards, which generate unique transaction codes for every purchase, may have pushed fraudsters to focus less on card-present transactions at brick-and-mortar stores and concentrate more on online purchases. Countries that adopted chip cards in advance of the U.S. rollout saw a similar shift in fraudster strategy.

Indeed, nearly two-thirds of survey respondents say the number and dollar amount of credit card chargebacks directly related to card-not-present transactions has increased since chip cards made their debut. Among companies that derive more than 90% of their revenue from e-commerce, 80% say the number and dollar amount of credit card chargebacks have increased since the introduction of chip cards.

Payment-card fraud is an old problem that continues to present new challenges—and to impose substantial costs on banks and merchants. The impact extends beyond hard costs, robbing companies of potential revenue, testing customer loyalty and corporate reputations, and even reshaping efforts to develop new products, services, and business models.

Payment-card fraud is an old problem that continues to present new challenges—and to impose substantial costs on banks and merchants. The impact extends beyond hard costs, robbing companies of potential revenue, testing customer loyalty and corporate reputations, and even reshaping efforts to develop new products, services, and business models.

Vesta Corp. provides payment and fraud-prevention services.

Favorite