Yasen Dimitrov , co-founder and chief analytics officer, Intelligence Node

While most grocery shopping occurs in brick-and-mortar stores today, global experts agree that this pattern will change soon, as grocery e-commerce grows in popularity.

A recent analysis of three leading UK grocery chains—Tesco, ASDA and Sainsbury’s—provides insights into emerging trends in online grocery, according to data collected between November 2016 and February 2017.

Grocery retailers stores around the world can learn from the mature UK grocery e-commerce market. The following insights can help retailers improve the customer experience by delivering the quality, variety and prices online shoppers seek.

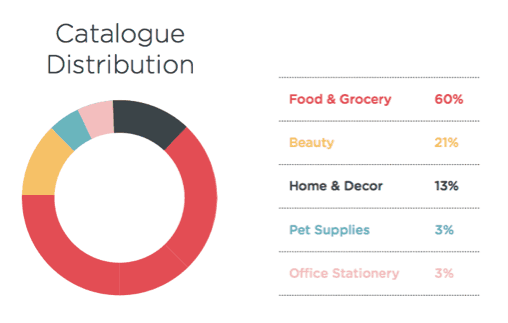

- Food before beauty:

Food and beverage products accounted for more than half of the retailers’ online assortments and beauty products accounted for one-fifth. These findings suggest that while shoppers shop online primarily for grocers’ food, retailers also upsell beauty and personal care items to make their sites a convenience single source for customers.

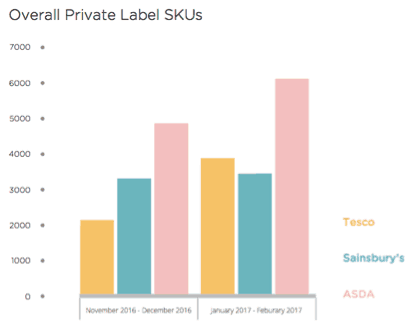

- Private-label growth:

The retailers promoted more private-label products online in the first two months of 2017 than in the final two months of 2016. This finding suggests the retailers prioritized national brand products on their websites, perhaps because shoppers expect and demand brands during the busy holiday season. Conversely, in the new year, retailers promoted more private-label products to entice shoppers to try new, innovative or unique private-label products.In the new year, retailers promoted more private-label products to entice shoppers to try new, innovative or unique products. - Private-label wins in milk

In the fresh milk category, private-label brands account for 62% of total stock. This category demands less innovation, as there is little product differentiation. There is also less brand loyalty, as consumers tend to be price conscious, so retailers carry more private label inventory. - National brands win in beauty

Product launches in the beauty category require substantial investment in product differentiation and brand management, so retailers find it more difficult for their private-label products to compete. As a result, private-label brands account for only 5% of beauty product launches. - Top trending categories:

During this period, the most popular categories among online grocery shoppers were:

- Frozen foods: Sainsbury’s had the lowest prices for frozen foods in December

- Bakery: In January and February, private-label bakery products were more expensive than the overall market average, possibly to lure customers with premium, gourmet and artisan items

- Fresh food: Prices increased for fresh food products from November 2016 to February 2017, likely due to price discounts during the competitive holiday season.

Sainsbury’s private-label brands’ average prices were lower than other brands in their catalogue, acting as a value option.

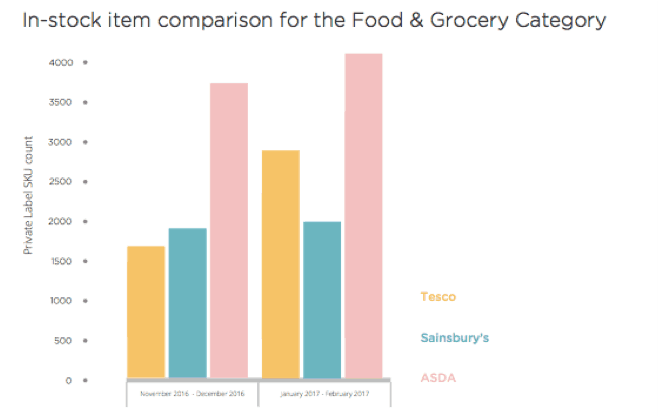

Superior availability in the new year

Superior availability in the new year

In the first two months of 2017, all three retailers had more products available in stock compared to last November and December. The busy holiday season tends to create out-of-stock issues, particularly among best-selling products. Retailers need to understand their sales trend and e-commerce data to accurately forecast their inventory and prevent out-of-stocks.

Intelligence Node is a retail analytics company that aims to help companies optimize their pricing.

Favorite