Patrick McGovern

At Bowery Capital, we have spent years studying industry-focused B2B marketplaces and have been actively investing in these businesses for the last decade. Like all early-stage investors, we look towards public comparables to get a sense of how the companies we are evaluating will be valued at scale.

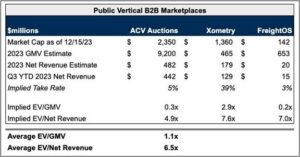

Reviewing public outcomes helps us to better underwrite which marketplaces we should back when evaluating seed-stage investment opportunities. Looking across the landscape of publicly traded marketplaces, there are three that tend to be viewed as comparables for today’s startup B2B marketplaces looking to raise venture dollars: ACV Auctions, Xometry, and Freightos.

- ACV Auctions is a marketplace for automotive transactions that matches wholesale buyers and sellers of used automobiles (think of them as a modern alternative to in-person auto auctions).

- Xometry is a marketplace for on-demand specialty manufacturing; they connect companies that need certain items manufactured on short notice — typically prototypes — with a vast network of SMB manufacturing shops with which Xometry has vetted and established relationships.

- Freightos is a marketplace for air cargo that matches shippers (typically freight forwarders) with airlines selling cargo capacity. These airlines are a mix of specialized cargo carriers and well-known passenger airlines with a side business focused on cargo.

Marketplaces are typically valued on a multiple of net revenue — this is because it is very difficult to value them on gross merchandise volume systematically, as take rates (the amount of money a marketplace makes for enabling online sales transactions) can vary wildly from marketplace to marketplace, which means the same GMV figure may result in wildly different net revenue outcomes.

PUBIC VERTICAL B2B MARKETPLACES

The current generation of vertical B2B marketplaces trade at an average EV/Net Revenue (enterprise value divided by net revenue) of ~6.5x. I would caution this multiple was closer to ~5.2x when I ran this same exercise a few weeks ago for internal purposes, so we may be taking a snapshot at a particularly generous point in time in terms of valuation.

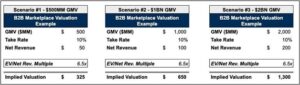

But assuming this 6.5x EV/Net Revenue multiple holds, what does this mean for founders who want to go the venture route to scale their B2B marketplace? My biggest takeaway is that if you want to raise VC dollars to supercharge growth, you need to go after a really, really big end-market to have a shot at a successful ‘venture scale’ exit — let’s call this something in the $500 million – $750 million EV range for argument’s sake.

As an investor, I have seen B2B marketplaces with take rates ranging from less than 1% to just south of 30%. These take rates tend to vary based on how managed a marketplace is and what that particular industry will tolerate giving up to a middleman. Most startups we see raising venture dollars claim that they will be able to command a take rate around the 8-12% range at a steady state. For simplicity, let’s just say 10%.

10% Take Rate B2B Marketplace Outcomes

Assuming a 10% take rate and today’s EV/Net Revenue multiple of 6.5x:

- At $500 million in GMV and $50 million in net revenue, your marketplace would be valued at $325 million EV.

- At $1 billion in GMV — no small feat — and $100 million in net revenue, your marketplace would be valued at $650 million. Given the amount of paid-in capital that is likely required to reach this $1 billion GMV mark, this valuation is on the low end for a venture-backed outcome.

- To achieve a $1 billion EV at exit, a B2B marketplace with a 10% take rate would need $1.5 billion in annualized GMV at today’s multiples.

However, let’s also note that 10% is a higher take rate than two of the three public marketplace comparables put forward in this piece. ACV and Freightos have an implied take rate of approximately 5% and 3%, respectively. Xometry’s implied take rate is much higher largely due to how much more managed it is than either ACV or Freightos.

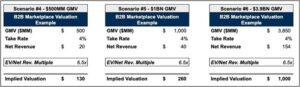

So, let’s re-run these same calculations, assuming a 4% take rate at scale.

4% Take Rate B2B Marketplace Outcomes

Assuming a 4% take rate and today’s EV/Net Revenue multiple of 6.5x:

- At $500 million in GMV and $20 million in net revenue, your marketplace would be valued at $130 million EV.

- At $1 billion in GMV and $40 million in net revenue, your marketplace would be valued at $260 million EV.

- And to reach a unicorn exit, your marketplace would need a whopping $3.85 billion in GMV.

These different scenarios illustrate the importance of commanding a healthy take rate; otherwise, the GMV required for a big outcome can be almost prohibitive in some sectors.

So what are some lessons for founders from this valuation exercise?

- Make sure the vertical you target is large enough to reach a few billion dollars in GMV. At Bowery, we have recently been gravitating towards marketplaces in large global markets, investing in a chemicals marketplace (SourceForce), a heavy equipment marketplace (Spectinga), and a steel marketplace (Reibus). There are many valid reasons B2B buyers/sellers will avoid a marketplace model, so you will never capture all of the transaction activity in a given segment. Given this reality, you need to build your marketplace in a large category where you can be doing billions of dollars in GMV even if you are not the primary way industry participants transact. If you are building a marketplace for a sector like chemicals or steel, this growth strategy is doable, but if you are too verticalized you will never get to the kind of GMV numbers required to reach a venture-scale outcome.

- B2B marketplaces that serve categories responsible for several percent of GDP are ideal for a venture-backed approach. This is why so many trucking marketplaces have been able to scale up; freight is a huge part of the U.S. economy, and you can get to a GMV figure north of $500 million while still being a relatively small player in the overall category. The most common reason we pass on marketplaces is the size of the sector they serve — many founders make the mistake of going after too narrow a vertical, where GMV will never be large enough to get to a >$100 million net revenue figure.

- You want to build in a category with average order values (AOVs) are on the high side. There is why we see so many B2B marketplaces in sectors like automotive and heavy equipment — it is much easier to reach $500 million or $1 billion in GMV selling $20,000 tractors or $30,000 cars than it is by cobbling together tens of thousands of $500 transactions.

About the author:

Patrick McGovern is a senior associate at Bowery Capital, a venture capital firm that specializes in business software. Prior to Bowery, McGovern worked as an independent consultant advising early-stage B2B SaaS and marketplace businesses. He can be reached at [email protected].

Sign up

Sign up for a complimentary subscription to Digital Commerce 360 B2B News, published 4x/week. It covers technology and business trends in the growing B2B ecommerce industry. Contact Mark Brohan, senior vice president of B2B and Market Research, at [email protected]. Follow him on Twitter @markbrohan. Follow us on LinkedIn and be the first to know when we publish Digital Commerce 360 B2B News content.