Luke Powers

The old rules of B2B customer engagement have changed. The world of ecommerce always seemed distant and “next year’s” initiative for equipment and parts manufacturing—until 2020 hit.

This year, we have seen fear grip the country and dramatic cuts to the economy, all while the share value of tech companies rocketed vertically. Of the tech companies that have benefitted, Amazon is one of the biggest winners with a $1.72 trillion market cap.

Why does that matter for the construction equipment industry?

Since Amazon has a multitude of business units, all offering the short-term ease of selling on the platform, it is easy to forget what some may describe as a predatory nature of their model. Amazon monitors all the seller and customer data across its channels, giving the company quite the advantage when deciding which products to offer themselves.

Basically, sellers give Amazon their customer data so Amazon can decide if they want to compete with them or not. We don’t need to guess if this is the case—just look at what happened in retail.

Today MRO Suppliers, Tomorrow Construction

Maintenance, repair, and operations (MRO) supplies are the first entry point of Amazon coming into the industrial markets. It is already going head-to-head with Grainger and other MRO distributors on its Amazon Business platform.

In the future, Amazon wants all procurement to be done on its platform regardless of the industry. Private-label brands in the construction equipment industry is the logical next step after adding MRO to their selection.

As Amazon founder Jeff Bezos once said, “Your margin is my opportunity.”

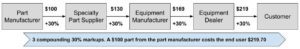

Equipment manufacturers, specialty part suppliers, aftermarket part suppliers, and equipment dealers are used to making healthy margins on parts sales, ranging from 10-50% or higher in many cases.

However, the parts procurement process is generally very difficult for customers. It’s fraught with many challenges including different sites to research, varying manufacturing lead times, unavailability, and trying to order it at the best value. The reasons for this pain are that many touchpoints exist in the parts distribution chain, each involving their own logistics, distribution, and markup.

Here is a typical parts distribution supply chain for an equipment manufacturer (OEM):

OEM and Aftermarket Supply Chains

Reading the OEM supply chain from left to right, you can see that it starts with a factory making a certain part for a “specialty” parts supplier. This specialty parts supplier sells to an equipment manufacturer to use it in their machine assembly line. The manufacturer has a distribution network of dealers.

These dealers have relationships with customers in their communities and act as their source of equipment rentals, equipment sales, service, and parts sales. Equipment rentals and sales are the primary business of most dealers or rental companies, with parts and service usually being the distant third priority.

Customers purchase from their local equipment dealers at a higher price, but are ensured it’s the OEM-branded part that comes in the same box. This is an easy option for customers, assuming the OEM has inventory on their shelves, but it is the most expensive one.

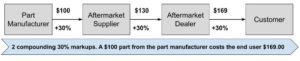

Alternatively, let’s consider the supply chain of a typical aftermarket parts supplier:

Aftermarket suppliers source parts from factories around the world. Part manufacturers are commissioned by suppliers to produce a replica of the OEM-branded part; these are referred to as “aftermarket” parts.

Sometimes aftermarket suppliers work directly with the same factory the OEM uses for the same parts; these are referred to as “genuine” parts.

Aftermarket parts typically have the same quality as the OEM part, cost less, and have the same or longer warranty. The only difference is that they do not come in an OEM-branded box. Most customers do not care about the OEM-branded box if they can get the same quality part at a reduced price.

However, the world of aftermarket parts is fraught with thousands of different suppliers, lead times, customer service levels, and warranty variables. All that friction leads them to stick with OEM parts many times.

What ‘Amazon Parts’ Will Look Like

Now let’s examine the supply chain assuming an “Amazon Parts” brand:

Amazon has the resources to source any given part, the most complex and vast worldwide distribution centers, and by far the most powerful ecommerce platform. For now, Amazon is gathering data on the construction equipment industry and evaluating how and when to promote their own private-label parts.

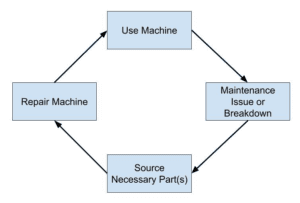

Now let’s consider the parts procurement process of the equipment end user (the customer). First and foremost, the customer is looking to repair their equipment as soon as possible. Down equipment is a huge cost. According to one Chicago contractor, it costs ~$1,000,000/hour to have a crane down on a job site.

The basic process of equipment repair lifecycle looks like this:

The faster they can get through the three-step process, the better it is for their business. A down piece of equipment represents lost revenue for equipment rental companies, as well as lost time and productivity for contractors.

Generally speaking, it is more important to equipment owners to be able to source their replacement parts quickly and reliably than it is to find the lowest price on all items.

Why Aftermarket Parts is an Easy Target for Amazon

Amazon has built its reputation around being fast and reliable for all things retail. They compete with traditional retail brands with their own 80+ private-label brands. Where Tide, Kleenex, Clorox, and Coca-Cola have some of the most famous brands in the world and come with a certain level of prestige, equipment replacement parts are first and foremost a utilitarian purchase.

In other words, it is far easier for Amazon to compete as an aftermarket parts brand than against the strong retail brands they usually do.

And as you can tell from the supply chain comparisons above, an Amazon Parts brand would likely also enjoy a pricing advantage against the incumbents in the industry.

So how can the industry stave off this seemingly predestined fate of Amazon’s takeover of replacement parts, tools, and equipment?

There is a way.

Come back for Part 2 in this article series.

Luke Powers is the co-founder and CEO of Gearflow.com, an online marketplace built for the construction equipment and parts industry. Connect with him at [email protected] and on LinkedIn. This article, the first of a 2-part series, was excerpted from a blog posted on Gearflow.com.

Favorite