Shani Rosenfelder, head of content & mobile insights, AppsFlyer

This year, as you prepare for the holiday rush, it’s imperative to have a mobile strategy in place.

Sixty percent of retail executives surveyed for recent eMarketer research had mobile websites in place, but 38 percent of those responders described their mobile sites as needing improvement. And only 53 percent of retail executives had mobile apps in place, with 39 percent describing their apps as needing improvement.

Retailers have work to do, and they would be wise to do it fast. In 2016, Cyber Monday became the biggest online shopping day in U.S. history, generating $3.45 billion in online sales—a 12 percent jump from 2015. Last year, mobile generated $23.43 billion in revenue, up 23 percent from 2015.

This year, retail m-commerce will account for about one-third of all e-commerce sales in the U.S., according to the same eMarketer report. By 2021, m-commerce’s share of e-commerce will surpass 50 percent.

Consumer behavior is rapidly shifting toward mobile, particularly apps. People spend more time in apps than they do watching television. If retailers can get consumers to download their apps, they can drive purchases, certainly, but they can also launch unique marketing campaigns, utilizing push notifications, retargeting ads and email to re-engage users and keep them coming back for more.

For those that have yet to develop a mobile app: it’s time! For those that do have one in place, let’s focus on earning the biggest possible slice of the mobile shopping pie. To help you do that, AppsFlyer pulled shopping app data benchmarks from the 2016 holiday season. Overall, we looked at 95 million installs of 130 leading shopping apps that measured 22 million in-app purchases generating $450 million in revenue.

Here is what you need to know:

- The holiday shopping season is longer than you think

Have you noticed that Starbucks has already switched to its holiday cups? Retailers aren’t waiting until Thanksgiving to kick off their holiday shopping season, and neither should you.

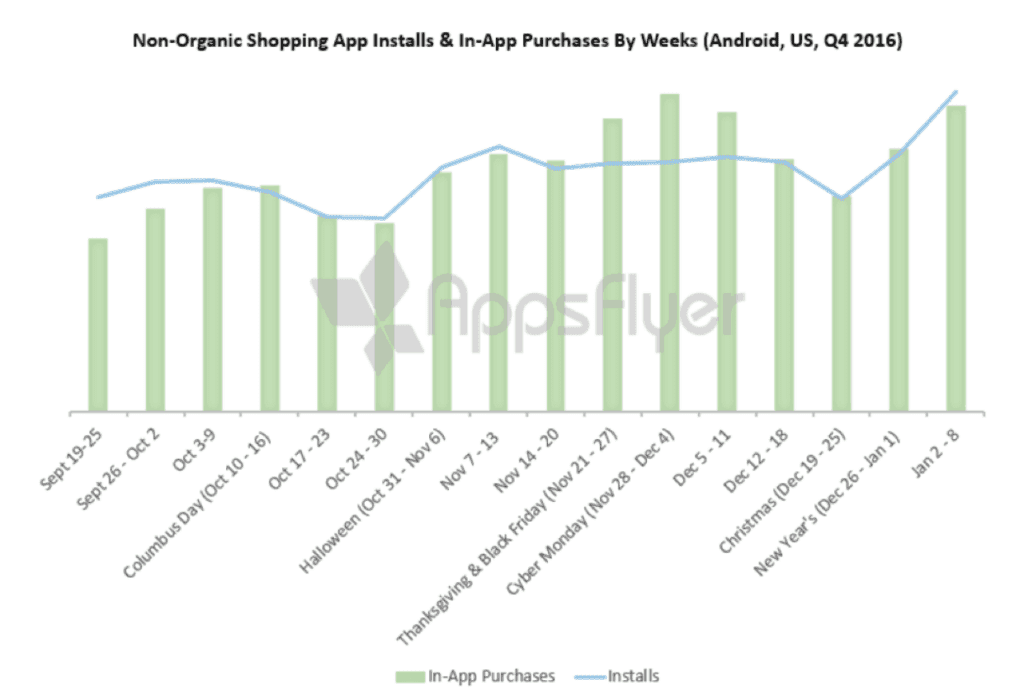

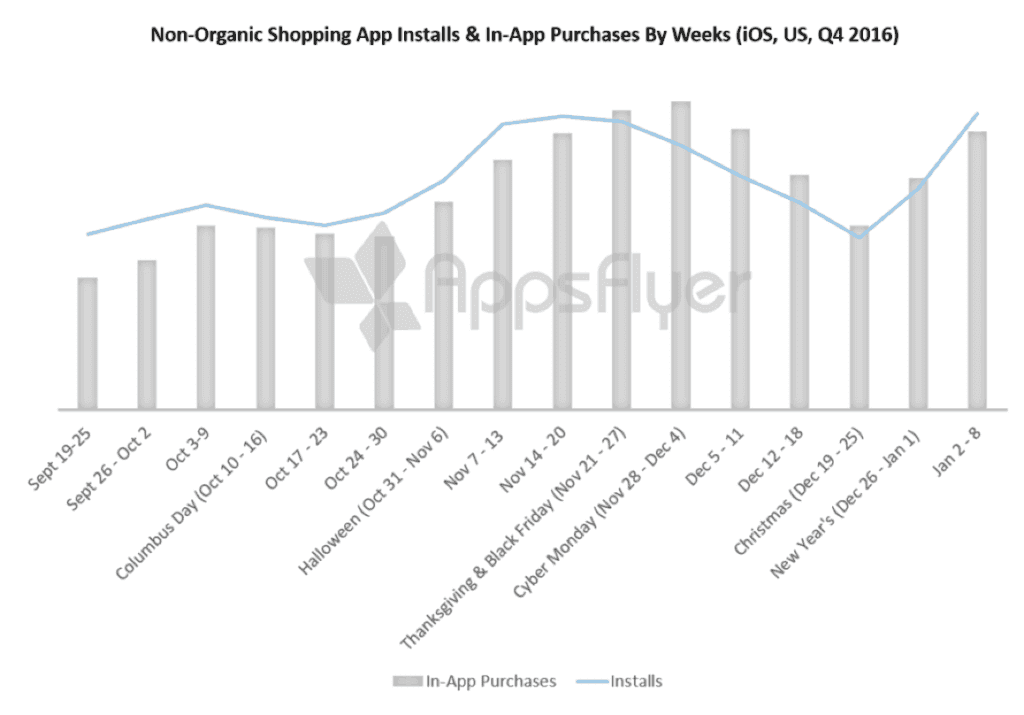

Check out app installs and in-app purchases for Android and iOS users in the graphs below; these start to climb after Halloween. Many marketers started to scale their campaigns after Halloween as a lead-up to the peak period, and most kept up the heat until the week before Christmas.

That said, the shopping sweet spot is still right after Thanksgiving. Last year, during the weeks of Black Friday and Cyber Monday, we found a 46 percent higher rate of shopping activity than in October and a 19 percent higher rate than in December (based on a count of purchase events).

With this in mind, retailers should try to get users to download their apps before these peak shopping days. That way they can focus on driving revenue via their mobile marketing and promotional strategies during the biggest shopping days of the year. We also found that new users acquired earlier in November are more likely to make purchases than users obtained during the peak shopping days. To strike while the iron is hot, be sure to create high-quality, targeted promotions when you re-engage (or acquire) users. Almost seven in 10 m-commerce app users in the U.S. access apps because they want to receive deals and offers, according to a study by Clutch.

Not only does the shopping season start early, but the graphs above also reveal that the mobile app holiday shopping season extends beyond Christmas. There is a surge in app installs after the holidays, as people who received new phones as gifts download their must-have apps. In fact, the week after Christmas was a busier time for app downloads than even Black Friday or Cyber Monday last year.

People keep shopping, too, after a short break during Christmas. New Year’s and post-holiday clearance sales drive shopping activity in early January—to rates nearly as high as the week of Cyber Monday. For retailers, it makes sense to continue to push user acquisition and re-engagement strategies after the holidays, although it is worth noting that the average purchase value is much lower during this time period than it is at the end of November, according to last year’s data.

- iOS and Android users have some fundamental differences in shopping behavior

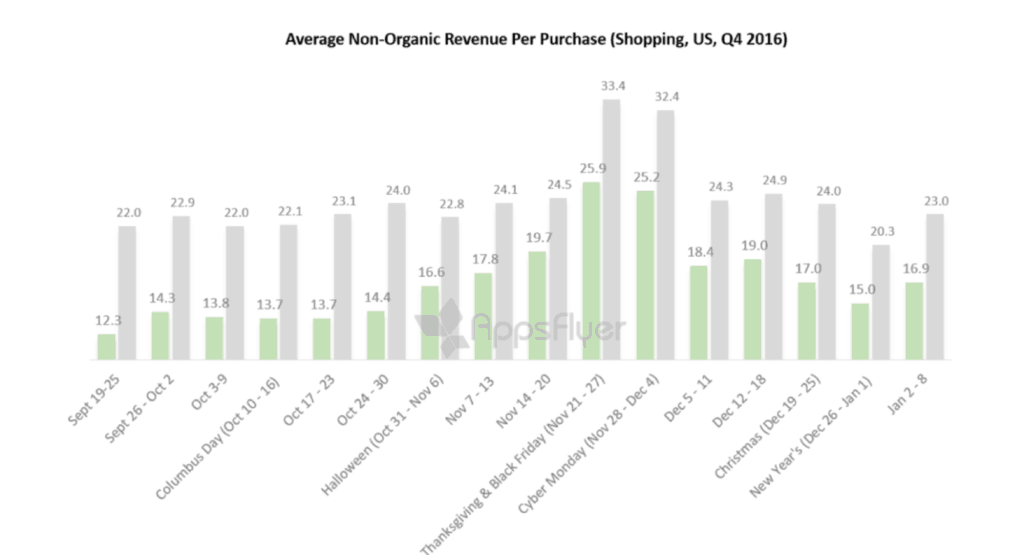

The cost of iPhones continues to rise. The iPhone X starts at $999. Androids, on average, are significantly cheaper. Thus, iOS users tend to be more affluent and have more spending power than other device users. In the graphs below, we compare the average revenue per purchase between iOS and Android users throughout the 2016 holiday season.

For iOS, the average purchase value was $24.3, which is 41 percent higher than Android’s $17.3. For some retailers, that might mean it makes sense to focus more on iOS than Android in user acquisition campaigns, but it is important that you know your audience. Brand loyalty is often stronger among iOS users, and they can be harder to influence than other demographics. They are also less likely to try an unknown product or brand or download an app they have never heard of—or at least it often costs more to get them to do so. Also, media costs more on iOS. Ultimately, you have to focus on ROI and consider how much you are spending to drive the results you set out to achieve

For both types of users, there is a clear November rush, not only in terms of volume of shopping activity, but also in the actual money being spent. During this period, iOS and Android users spent 58 percent and 66 percent more than other weeks in Q4, respectively.

- You have to be prepared, flexible and armed with data

As with any marketing tool, you will get more from your mobile app if you have a strategy for monitoring and refining your results. Media cost for both user acquisition and retargeting campaigns will likely be high during these peak holiday shopping weeks. If your efforts are generating results, that shouldn’t be a concern, but you do need to monitor key performance indicators (KPIs) to be sure.

Use multiple media sources so you are not tethered to one partner, and so you can optimize your campaigns more effectively based on data. Go into the season with alternative media sources lined up and multiple creative options ready to go. Then if something isn’t working, you can quickly try something else. (Time is of the essence here.) Monitor your results tirelessly, compare ROI across sources, and be willing to shift spending as needed so you can drive the highest possible return at the lowest possible cost.

As the eMarketer data shows, many retailers are lagging when it comes to using apps to drive e-commerce. But for those that have apps ready to go, data and measurement will make a big difference in how much revenue you can earn this holiday shopping season.

AppsFlyer provides a mobile app tracking and attribution platform designed to help app developers, brands and ad agencies track and optimize their user acquisition funnel.