Franklin Chu, managing director, Azoya International

As the world’s largest and fastest-growing e-commerce market, China has a population of nearly 1.4 billion consumers who are increasingly affluent, tech-savvy and likely to shop online for American products.

During today’s period of slower U.S. retail growth, more American retailers are looking toward China’s massive market for lucrative foreign expansion. We will explore how U.S. retailers can mitigate risks with proven e-commerce options to sell online in China.

Why China matters

In 2016, China’s cross-border e-commerce market reached $917 billion US, according to iiMedia, and Forrester says China is poised to be the first country to reach $1 trillion in retail sales by 2020. China has experienced explosive e-commerce growth, as 19% of all retail sales now take place online (vs. less than 10% in the U.S.); Forrester predicts China’s online sales rate will reach 24% by 2021. Cross-border consumer e-commerce in China reached $40 billion in 2015 with an annual growth rate of 50%, reports McKinsey & Company.

Significant room for digital growth exists. In 2016, the total U.S. offline population was 59 million, compared to 677 million in China, representing consumers who could eventually convert into online shoppers, states Tech in Asia.

In this era of retail reinvention, the U.S. and China face opposite consumption trends. American retail demand continues to decline, with store closures and bankruptcies. Meanwhile, China enjoys unprecedented demand for products “made in the USA,” particularly cosmetics and personal care, mom and baby, nutritional supplements, fashion and apparel and digital products, according to iResearch.

Retailers’ options

To attract and delight shoppers in China, U.S. retailers can make online shopping easy and convenient for consumers, while incurring less risk and investment in local distribution capabilities, with cross-border e-commerce.

Two ways U.S. retailers can enter China’s online retail market are:

- Online retail marketplaces: Chinese-language websites for business-to-consumer (B2C) online retail, including Tmall

- Independent e-commerce websites: U.S. retailers establish their own Chinese retail websites

While many U.S. and foreign retailers choose to enter the large, flourishing China market through online retail marketplaces, independent e-commerce websites are growing in demand to meet the needs of both retailers and consumers. For example, luxury fashion brand Coach closed its official Tmall store, replacing it with a standalone online store and WeChat shop for the Chinese market, as shown below.

A marketplace makes sense for short- to medium-term strategies. Tmall is such a well-established, top-of-mind marketplace brand that U.S. retailers can gain a speedy market entry and focus on selling.

A marketplace makes sense for short- to medium-term strategies. Tmall is such a well-established, top-of-mind marketplace brand that U.S. retailers can gain a speedy market entry and focus on selling.

Retailers with their own online shop tend to have longer time horizons. They focus on reaching Chinese shoppers through direct brand exposure, sales and brand building, while maintaining greater control over their online operations. Their e-shop provides a good starting point for a multichannel strategy and stationary expansion, and retailers can integrate their preferred online payment options into their website.

The bottom line

Overall, marketplaces tend to be more suitable for brands and manufacturers with high margins, and strong control over their supply chain and distribution channels. In general, independent e-commerce websites in China are more suitable for retailers, as Chinese customers prefer online stores with a wide range of SKUs and competitive prices.

For maximum online conversion rates, U.S. retailers must also localize their marketing to suit the unique needs of the Chinese market. For instance, Chinese consumers’ growing affluence has led to a consumption upgrade, Chinese millennials use several omnichannel sources of product information and they consciously seek to express their individuality.

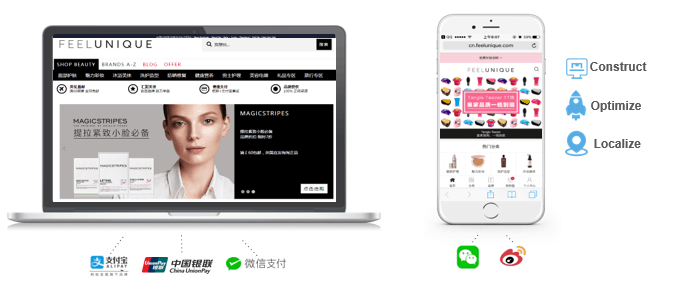

Chinese consumers’ shopping expectations include a user-friendly, mobile website with easy navigation, full language support, integrated payment and multilingual search, as shown by the Chinese website for online cosmetics company Feelunique, below.

Online success story

Online success story

To attract online shoppers in China, French fashion retailer La Redoute created a Chinese e-commerce website with seasonal campaigns for desktop and mobile. (See image below right.)

La Redoute’s China e-commerce strategy increased sales, with an average basket value of $79 US, a 7-10 day logistics turnaround time and an enhanced ability to avoid out-of-stocks for best-selling products. In addition, the retailer’s Black Friday sales were five times higher than its average daily sales. Below is an image of La Redoute’s Chinese mobile marketing for Black Friday.

La Redoute’s China e-commerce strategy increased sales, with an average basket value of $79 US, a 7-10 day logistics turnaround time and an enhanced ability to avoid out-of-stocks for best-selling products. In addition, the retailer’s Black Friday sales were five times higher than its average daily sales. Below is an image of La Redoute’s Chinese mobile marketing for Black Friday.

U.S. retailers can succeed in China’s online retail market by using two different methods. Well-known retailers with broad assortments may prosper on established online marketplaces. To avoid competing on crowded online marketplaces, retailers can also establish a distinctive online presence with their own Chinese e-commerce website. These options give U.S. retailers a chance to win in China, where “Made in the USA” is hot and profitable right now.

Azoya International provides services for overseas retailers seeking to sell online in China.

Favorite