Buy now, pay later service Affirm said a “technical issue” caused some consumers to be charged multiple times on Jan. 12 and Jan. 13, resulting in pending duplicate charges associated with their Affirm Holdings Inc. loans.

“We worked quickly to resolve the technical issue, which has since been fixed,” an Affirm Holdings Inc. spokesperson said Jan. 16. The BNPL service did not confirm when on Jan. 12 it fixed the problem. The BNPL service provider said “this was not an outage but rather a brief technical issue,” according to the company. Affirm did not share the percentage of affected customers.

Affirm said customers will not be responsible for duplicate charges. The authorized payments are pending and will not be settled, according to the company.

14.4% of retailers in the 2022 Digital Commerce 360 Top 1000 database offer Affirm at checkout, including Amazon Inc., Walmart Inc., Target Corp., Wayfair Inc., Williams-Sonoma Inc. and others. The Top 1000 ranks North American web merchants by web sales.

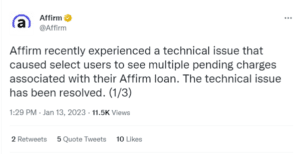

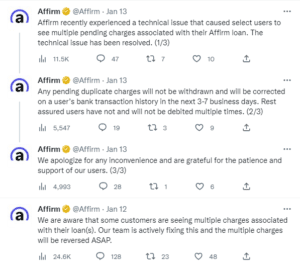

The payment service provider also shared updates on Twitter.

Affirm took to Twitter on Jan. 12 to explain the technical issue that resulted in multiple pending charges.

Affirm duplicate charges frustrate consumers

That hasn’t stopped shoppers from voicing their frustration online. One Twitter user said she had been auto-drafted more than her loan amount. Instead of the $12, the Twitter user said Affirm charged them $73 five separate times.

Another Twitter user said the charges affected her mother’s Affirm loan.

“She used Affirm because she’s retired and on a fairly fixed income,” she told Digital Commerce 360. “The hold put her in danger of having her car note and other commitments not clearing the bank. It’s a three-day weekend, so the holds still haven’t dropped [as of Jan. 17].”

Affirm told Digital Commerce 360 that it is not able to reverse the duplicate pending charges. The consumer’s financial institution must remove the pending charges. Then, it will no longer appear in their transaction history. Affirm consumers can expect to see the pending charges automatically removed from their transaction history in three to seven days.

“Consumers who received an overdraft fee from their financial institution as a result of this issue can contact Affirm, and we will reimburse them,” an Affirm spokesperson said.

“We understand the impact issues like these can have on people, and we sincerely apologize for any confusion or inconvenience this may have caused,” a spokesperson said.

Sign up

Stay on top of the latest developments in the ecommerce industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News.

Follow us on LinkedIn, Twitter and Facebook. Be the first to know when Digital Commerce 360 publishes news content.

Favorite