Sponsor content is created on behalf of and in collaboration with Credit Key by DigitalCommerce360. Our editorial staff is not involved in the creation of the sponsored content.

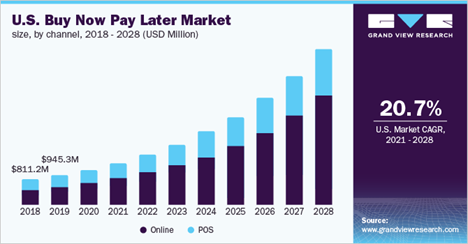

Over the last few years, BNPL (Buy Now Pay Later) has become the fastest-growing payments solution in the B2C market. Consumer-focused companies like Affirm, Klarna, Zip, and AfterPay have become household names that have integrated into large retailers like Amazon and Walmart.

What’s the common thread between all of these companies? An instant, streamlined consumer credit approval (typically integrated into checkout) paves the way to break down purchases into multiple installments.

BNPL payment options are attractive to consumers because it’s common for desired purchases to fit outside of their monthly cash flow. For instance, a brand new exercise bike might be outside of a consumer’s monthly budget, but when it’s broken down into installments, it becomes easier to afford and puts less strain on a household’s budget.

Merchants that offer these payment options experience increased growth from Average Order Sizes, higher conversion rates (especially with higher-priced items) – and increased loyalty. Simply put, BNPL significantly increases revenue.

With such a high adoption rate in consumer markets, it’s no surprise that the BNPL language has started to spill over in the B2B world as an easy way for old school payment providers and antiquated lenders to explain what they do. Unfortunately, existing solutions are nowhere near what customers expect from BNPL and become quite confusing to distinguish B2B payment options, with many companies falsely classifying themselves as a BNPL offering.

Let’s dive into some of the most commonly asked questions about B2B BNPL payment options.

Is it an instant approval?

Not minutes, not hours, and definitely not days; one of the top reasons consumers love BNPL offerings is that purchase approvals come instantly. These days, consumers expect fast service, which also applies to their payment options. To be considered a BNPL offering, instant approval is not a nice to have, but rather table stakes.

Very few vendors in the B2B market meet this requirement, and most have approval times that range from 24-48 hours. While this can be faster than most in-house credit programs, it’s a far cry from the instant approval that best-in-class BNPL vendors offer.

How fast is the application?

In addition to the approval speed, the amount of time needed to get through an application is a critical factor. A B2C BNPL offering asks minimal questions to quickly help consumers get through the process and decrease cart abandonment. The same goes for B2B; if an application takes a long time to complete, there’s a good chance that the buyer will leave. In fact, “80% of customers say that the experience a company provides is as important as the product and services they provide.”

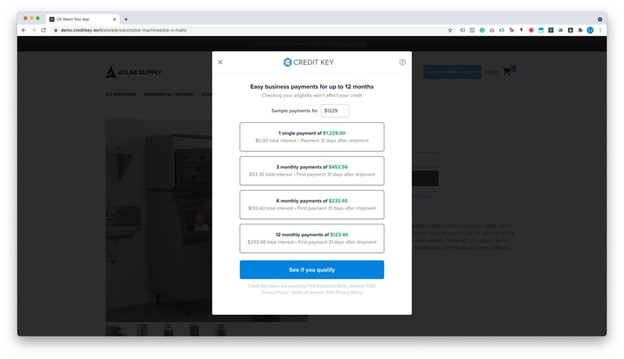

Are there easy to understand payment options?

Any BNLP payment option needs to break down purchases into simple payments. For B2C, this is commonly executed with a ‘4 interest-free payments’ product payment plan oroffering monthly installments of up to 12 months.

In the B2B world, the payment plans are far less common to see. Typically, a net terms program charges the full invoice amount, and payment is due within a specific amount of time (typically 30 or 60 days). While longer payment terms are more common in equipment leasing and financing contracts, these terms are typically, ranging from 12-60 months.

Is this available anywhere a customer shops?

In e-commerce, high conversion rates are crucial to success. This means turning website visitors into customers and avoiding opportunities for visitors to abandon a site in the middle of checkout. Companies like Affirm and Klarna understand that it’s vital to integrate payment options seamlessly into the checkout to ensure that customers stay on the site for instant approval and finish their checkout process.

For retail salespeople, the same rules apply. If they’re on the phone with a customer or in a store, they can’t afford to wait hours or days to see if a customer gets approved. They need simple, elegant solutions that seamlessly integrate into how they sell and how customers buy – regardless of channel.

In B2B, the same strategy needs to apply. It’s even more critical as most B2B sales today are offline through the phone or in the field. Even less time is available to fill out a traditional application, let alone “wait” 48 hours for a decision – B2B customers need the product for the job now!

Typical companies spend 10-40% on their sales and marketing costs. The last thing anyone wants is to have that money wasted by having a prospect or a customer leave because they couldn’t complete the transaction.

So what can BNPL do for B2B companies?

As mentioned earlier, BNPL solutions offer companies increased growth in average order values (AOV), conversion rates, and customer loyalty. In B2C, this growth is commonly calculated by comparing average rates of B2C order size placed via BNPL vs. credit cards.

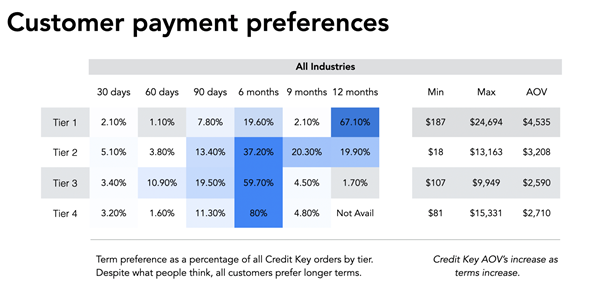

A standard net terms program has seen to increase AOV by up to 30% in comparison to a cash on delivery or credit card transaction. While this is a great increase, BNPL services offer a far larger jump in order size. Credit Key has reported some clients even reach 10x in average order size compared to a Credit Card or Cash on Delivery payment method.

When you look closely beyond the marketing fluff, very few B2B payment options meet multiple core requirements needed to be considered a true BNPL payment option. They are either not instant, have long applications, don’t offer installments, or do not drastically increase AOV.

While many vendors offer delayed payment of 30, 60, or 90 days, that is not enough flexibility to meet the needs of today’s business customers. Credit Key’s data shows that many business customers prefer terms of six months or longer.

Credit Key is a B2B BNPL pioneer with instant credit approvals anywhere purchases are made for up to $50K. Integrating seamlessly to e-commerce checkouts and over the phone and in-store, Credit Key offers a superior customer experience that can significantly increase AOV, conversion rates, and order frequency.