Crocs Inc. announced its largest acquisition to date of privately-owned casual footwear brand Hey Dude Shoes. The deal, expected to close in Q1 2022, is valued at $2.5 billion.

The acquisition is the latest in Crocs’ efforts to increase its digital growth, as well as reach a $5 billion goal in sales by 2026. “This [goal] remains unchanged,” said CEO and director Andrew Rees during a Dec. 23 investor call.

“[Hey Dude Shoes’] scaled position in casual footwear more than quadruples the Crocs total addressable market to over $160 billion,” Rees said during the call, adding that Crocs expects the combined 2022 total revenue to be more than $3.4 billion on a pro forma basis. This would make Crocs, “the second-largest branded player in the casual footwear category globally,” Rees said. (Pro forma financials do not include one-time expenses as occurs during a merger or acquisition.)

According to Crocs, Hey Dude and Crocs will run commercial functions separately to maintain brand identity and clear consumer focus. The company declined to confirm whether Crocs and Hey Dude will continue to run separate websites after the acquisition is complete.

Crocs, No. 192 in Digital Commerce 360’s Top 1000, launched in 2002 as a boating/outdoor shoe brand. The footwear company started its ecommerce business in 2009. Web sales increased 58.2% year over year in 2020 compared with 2019, and reached nearly $360 million, according to Digital Commerce 360 research estimates.

Hey Dude Shoes is an Italian-based brand that sells online as well as in stores, such as Van Maur and Buckle, and other footwear retailers throughout the U.S., Europe and Asia.

Crocs’ expanding footwear options

The acquisition is a smart move to expand beyond Crocs’ single product of clogs/sandals and into the broader market of casual footwear, says Marie Driscoll, managing director, luxury and fashion at Coresight Research, an advisory research firm specializing in retail and technology.

Hey Dude can leverage Crocs’ global footprint to expand more into the U.S., says Driscoll.

Crocs’ ecommerce penetration is 37% and Hey Dude’s is 43% for a pro forma ecommerce penetration of 38%, says Driscoll, citing Coresight research.

“Digital is core to Crocs’ strategy with the intent to enhance Hey Dude’s digital capabilities and accelerate digital growth,” Driscoll says.

Crocs’ breakneck speed

Crocs’ goal of $5 billion in total sales in five years, however, could be a difficult feat, says Kristin Kohler Burrows, senior director of Alvarez and Marshal Consumer Retail Group.

“Although they have had rocket-ship growth in 2021 and expect to almost double revenues from 2020 to hit over $2 billion, they would have to continue at a pace of around a 20% CAGR to hit $5 billion in sales organically by 2026,” she says.

When just looking at web sales, that appears to be attainable, according to Digital Commerce 360 research estimates. From 2016 through 2020, Crocs’ 5-year CAGR web sales are 22.4%.

The acquisition of Hey Dude, which is also expected to nearly double total revenue in 2021 to about $700 million, “provides an additional level to achieve their $5 billion target by 2026,” Kohler Burrows says.

“However, the clog/sandal total addressable market is $38 billion,” Driscoll says. “Entering casual footwear with a youthful, trending sustainably positioned brand that resonates with a growing community of loyal customers is a wise move.”

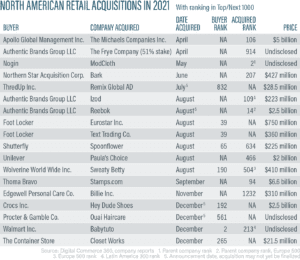

This acquisition is one of four North American retail acquisitions announced in December 2021.

Favorite

Favorite