Digitally native vertical brands often tout the value they give to consumers by cutting out the middleman, instead designing, manufacturing and marketing products directly to customers all online with little physical footprint. But with no middleman, it can be harder to offer discounts on days when nearly every shopping site has markdowns. Or, at least, that’s what they’re telling customers.

Of the 65 DNVBs in the 2019 Digital Commerce 360 Top 1000, 30.8% were not displaying discounts on their homepages on Cyber Monday, compared with just 16.0% of the overall Top 50 retailers not displaying discounts. While some had holiday imagery on the site, others offered the same kind of homepage you’d expect any other day of the year.

“We don’t do Cyber Monday sales, or any sales for that matter,” a live-chat agent at suitcase manufacturer Away (No. 488) wrote Monday to a Digital Commerce 360 analyst. “That’s the upside of our direct-to-consumer model—since we make and sell everything ourselves, we can give you top quality products at a dramatically lower price every day of the year.”

Similarly, mattress maker Saatva’s (No. 164) homepage had only a small banner at the top of the screen with the text “Cyber Week prices year-round” that linked to the main product page for its mattress with no discounts. Otherwise, the homepage looked normal.

“The skeptic in me says that [DNVBs] do not promote, ever, because they already make no money or lose a lot of money and paying more, effectively, to acquire a new customer puts them deeper in the hole,” says Eric Roth, managing director at investment firm MidOcean Partners. “The optimist would say DNVBs have brands with awareness and loyalty and so people value their association with the product over a discount. I come down in between the two—some of each.”

That optimistic thinking may be the case for footwear brand Allbirds (No 438), which had a nutcracker standing between its shoe models with the text “Make your mistletoes merry” on its homepage, seen above. But it made no mention of holiday offers on its website or in its email marketing received by Digital Commerce 360 staff.

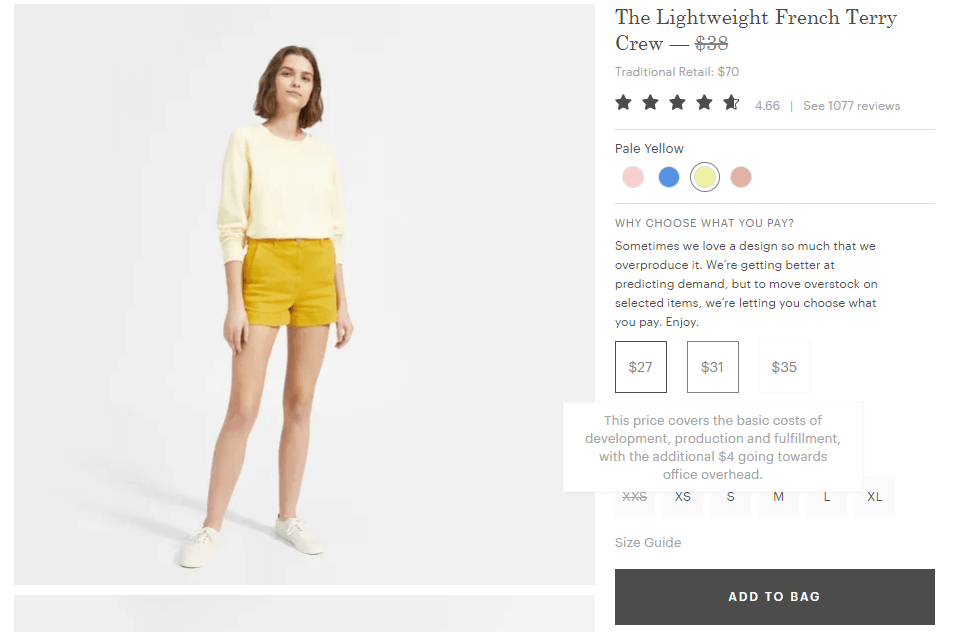

Everlane offered discounts and described what each discounted price covers. The $31 price of this sweater covers development, production, fulfillment and $4 of office overhead.

Apparel brand Everlane (No. 304) didn’t have any explicit Cyber Monday deals, but offered a “Choose what you pay” discount, showing consumers what the discount would cover, from just the materials used to make the product to the overhead needed to run the site. Everlane markets itself year-round as transparent about pricing, with a breakdown of where the consumer’s money goes on each product page, so this promotion builds on that ethos.

Meal kits had the least discounting, as none of the six meal-kit brands Digital Commerce 360 tracks offered a Cyber Monday deal. The meal kit category has had a tumultuous few years, with meal kit brands shuttering, getting acquired and facing competition from Amazon.com Inc. However, some categories discounted more than others. Saatva was the only DNVB mattress brand to not run a sale on Cyber Monday, while its competitors offered up to $500 off mattresses or deals on buying matching bases for the beds.

This comes down to the margins DNVBs make. Fresh food offers low margins, with the cost of goods and acquiring the customer nearly equal to what consumers are paying, according to Roth, while mattresses have high price points and gross profits, allowing them to absorb the costs of the discounts.

Favorite