Theodora Richards, data quality analyst, 1010data

In light of macro trends such as personal health and environmental sustainability, the growing acceptance of plant-based meats should come as no surprise. A plethora of books from 2004’s The China Study to last year’s The Greenprint have made convincing scientific arguments that many, if not the majority, of modern health problems can be ameliorated by eating less meat and more plant-based foods.

As readers of this publication are well aware, this thought trend has translated into a wave of new products that are plant-based, yet emulate the taste and texture of meats. With improved flavor, packaging and availability, health-conscious meat lovers have more options to consider than ever before, and they are voicing their opinion with their wallets, and largely online.

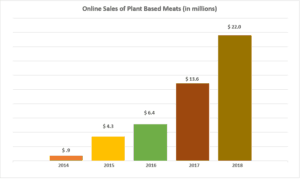

Starting in 2014 with a mere $900,000, online sales of plant-based meat have risen in steady leaps, to $4.3 million in 2015, $6.4 million in 2016, and $13.6 million in 2017. In 2018, online sales of plant-based meats rose another 40 percent to nearly $22 million, as online grocers scrambled to adapt their offerings to these shifting consumer preferences.

Source: 1010data

While veggie burgers have been in the marketplace since 1982, at least according to the Smithsonian, they’ve come a long way from the oat patties originally sold in a London hippie restaurant. Now, with food science pioneering and so much more known about consumer preferences, there are meatless burgers that taste like meat, have the texture of meat, and even cook like meat. Indeed, the newest wave of meat substitutes actually targets meat eaters rather than vegetarians and vegans—and judging from their growth, may finally succeed in tempting leery consumers to give them a try.

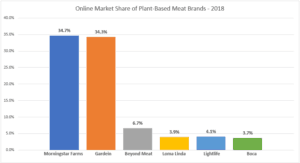

Longtime leaders in the veggie burger industry such as Kellogg’s Morningstar Farms and ConAgra’s Gardein have generated the majority of overall sales, and also account for a combined 69 percent share of online sales. However, new entrants are emerging, grabbing headlines and nibbling away at market share.

Brands such as Beyond Meat and Impossible Foods have produced patties that promise the same texture, smell, and appearance as a real burger and even “bleed” when cooked. Online sales of Beyond Meat’s “Beyond Burger” doubled in both 2017 and 2018, making it the third most popular meat substitute brand, after Morningstar Farms and Gardein, with a 6.7 percent market share among plant-based meat brands.

Source: 1010data

We look especially to online sales in this trend, as it appears that online retailers have become a refuge for people shopping for meat alternatives. With limited shelf space in physical stores, the selection of specialty products available to consumers is severely limited. Instacart in particular has succeeded in capitalizing on this weakness, commanding 38 percent of online alternative meat sales, followed by Walmart.com at 20 percent, Amazon at 12 percent, and Peapod at 8 percent.

Can alternative meats keep up the momentum, or are they just another passing fad? The new alternative meat burgers are on average a dollar more expensive than regular veggie burgers—which already have a higher price tag than regular beef patties. Alternative meat producers need to find ways to keep their prices competitive and offer a wider variety of products, all while expanding their online brand presence to stay relevant across multiple consumer groups.

Despite the obstacles inherent in an industry rapidly growing and changing, it looks like veggie burgers and other meat alternatives are here to stay. The data shows that, especially online, the consumer is ready today for the food of tomorrow.

1010data provides consumer transaction data and analytical intelligence to hedge funds and other asset managers.

Favorite