Amazon Pay may become a payment option at a lot more ecommerce sites.

Payment acquirer Worldpay Inc. recently announced that it is now offering Amazon.com Inc.’s quick payment button Amazon Pay as an option to its online retail clients. Worldpay, which acts as the go-between between banks and credit card companies, processes more than 40 billion transactions annually and supports more than 300 payment types.

The new integration allows online retailers to offer Amazon Pay as a payment button to shoppers. Prior to this, for an online retailer to offer Amazon Pay, it had to work directly with Amazon.

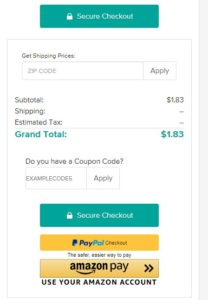

Amazon Pay on a checkout page

“[This] introduced another partner in which merchants have to contract, integrate and manage outside of their payments providers,” says John O’Brien, vice president of strategic solutions, global enterprise ecommerce, at Worldpay. “Now, as the single provider for merchants, Worldpay clients get greater consistency in payment settlement, data reporting and reconciliation—without needing to manage a number of vendor relationships.”

If an online retailer is a Worldpay client and already offers Amazon Pay, those merchants will be able to enable Worldpay as the acquirer and gateway for Amazon Pay transactions, so all of the checkout options can flow through Worldpay as opposed to many, O’Brien says.

For a shopper, if a retailer has an Amazon Pay button on its checkout page, she can click on it and pay for the purchase using her saved payment credentials in her Amazon account.

In 2018, 12.8% of online retailers in Internet Retailer’s forthcoming 2019 Top 1000 offered Amazon Pay as a payment option to shoppers, up from 4.5% of merchants in Internet Retailer’s 2018 Top 1000. PayPal is the most commonly offered quick payment button: 72.2% of merchants used it in 2018, up from 46.9% in 2017. However, more Top 1000 merchants offer Amazon Pay than Apple Pay, which 11.8% of ranked merchants offered in 2018, while 6.5% offered Affirm and 1.3% offered Venmo.

Many online retailers offer quick payment buttons because they can make checkout faster and can increase the likelihood a shopper will complete the purchase. Elena Castañeda, founder and CEO of BlingJewelry.com, offers Amazon Pay and PayPal as payment options. She says the cart abandonment rate for consumers shopping on their smartphones decreased 10% after implementing the payment options.

“Every keystroke you have to put in is a keystroke away from the cart,” Castañeda says.

These payment buttons can be used across devices, however, they are especially valuable on mobile devices, where tapping in payment data is more cumbersome than on a keyboard. Among consumers who have used a mobile payment button, most shoppers, 79%, said they use a quick payment button on a smartphone because it’s faster, 67% said because it’s easier, 40% said because they receive loyalty points or some reward if they do and 36% said because it’s more secure, according to an Internet Retailer survey of 500 shoppers conducted by Toluna in 2018. Shoppers could pick more than one response.

Earlier this month, Fidelity National Information Services Inc. announced it would acquire Worldpay in a $35.5 billion deal. The Amazon Pay news is unrelated to the acquisition, O’Brien says.