Amazon has become the “go-to” online retailer for many consumers, with some shoppers bypassing traditional search engines altogether when seeking out a specific product. But how does Amazon stack up against Google for product searches?

Amazon vs. Google Exclusive Searches

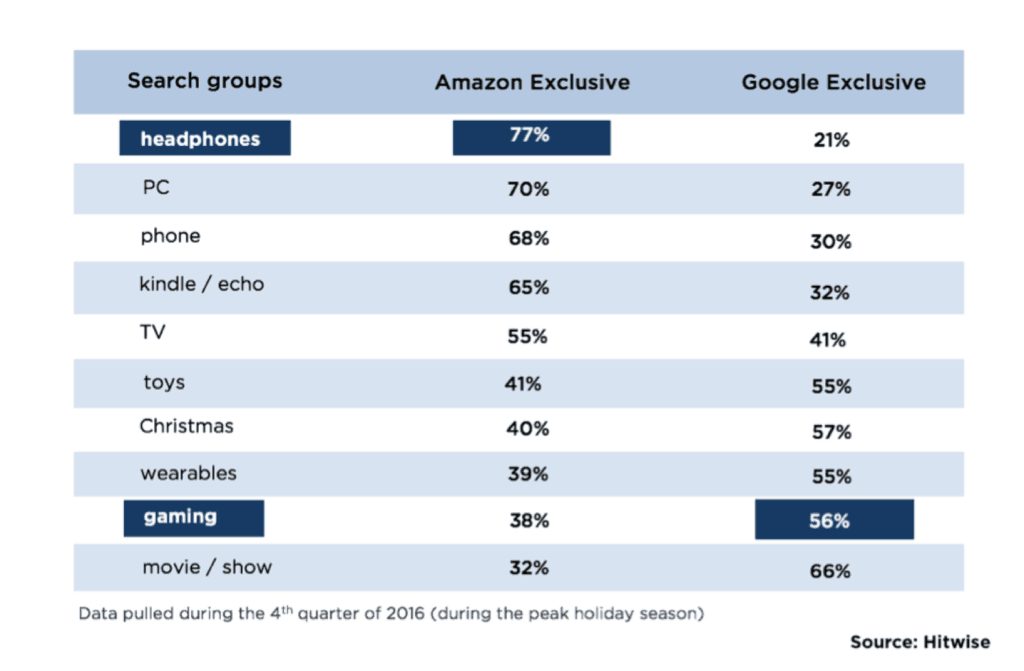

The table below reveals the share of consumers conducting several of the top product searches* exclusively on Amazon, versus the same searches conducted exclusively on Google over the last quarter of 2016:

Note: similar search terms grouped i.e. headphones, earbuds, wireless headphones, etc.

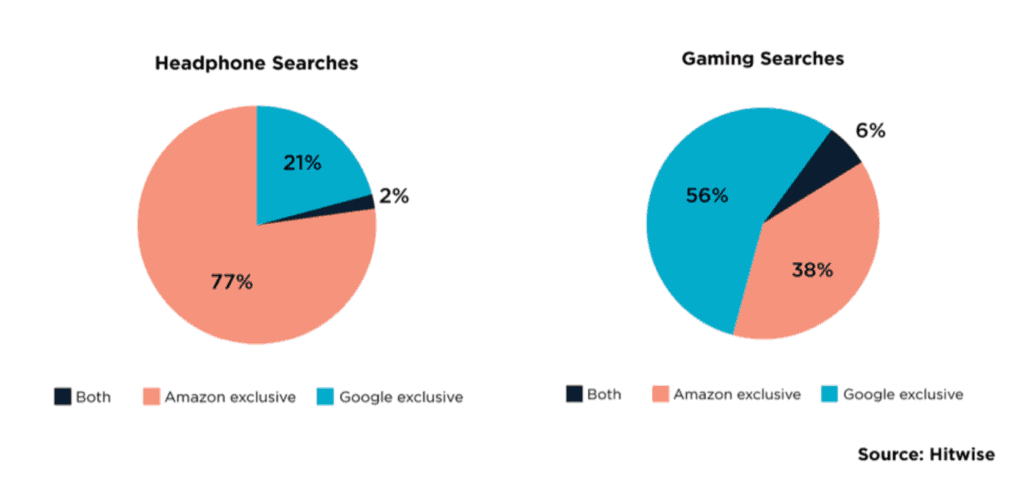

Breaking down searches for headphones and games reveals how differently consumers search by product category.

Over three quarters of people conducting headphone searches did so exclusively on Amazon, suggesting that headphone sellers should invest more in Amazon product listings and store optimization. Meanwhile, a video game company might want to dedicate a higher percentage of its budget to Google PLAs and SEO-optimized content:

Singular vs. Plural Searches

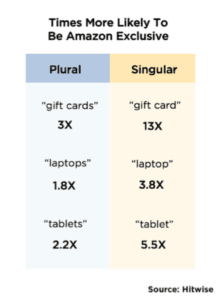

A pattern also emerges between singular and plural search variations. While many product searches skew more heavily to Amazon*, singular variations are a lot more likely to be Amazon-only.

A pattern also emerges between singular and plural search variations. While many product searches skew more heavily to Amazon*, singular variations are a lot more likely to be Amazon-only.

This suggests that consumers are more likely to use Google (or both Google and Amazon) to cast a wider net and compare multiple products. Meanwhile, they are more likely to conduct singular product searches on Amazon to see the specific models and prices Amazon has available, rather than to seek out broader information.

Income Audience Differences

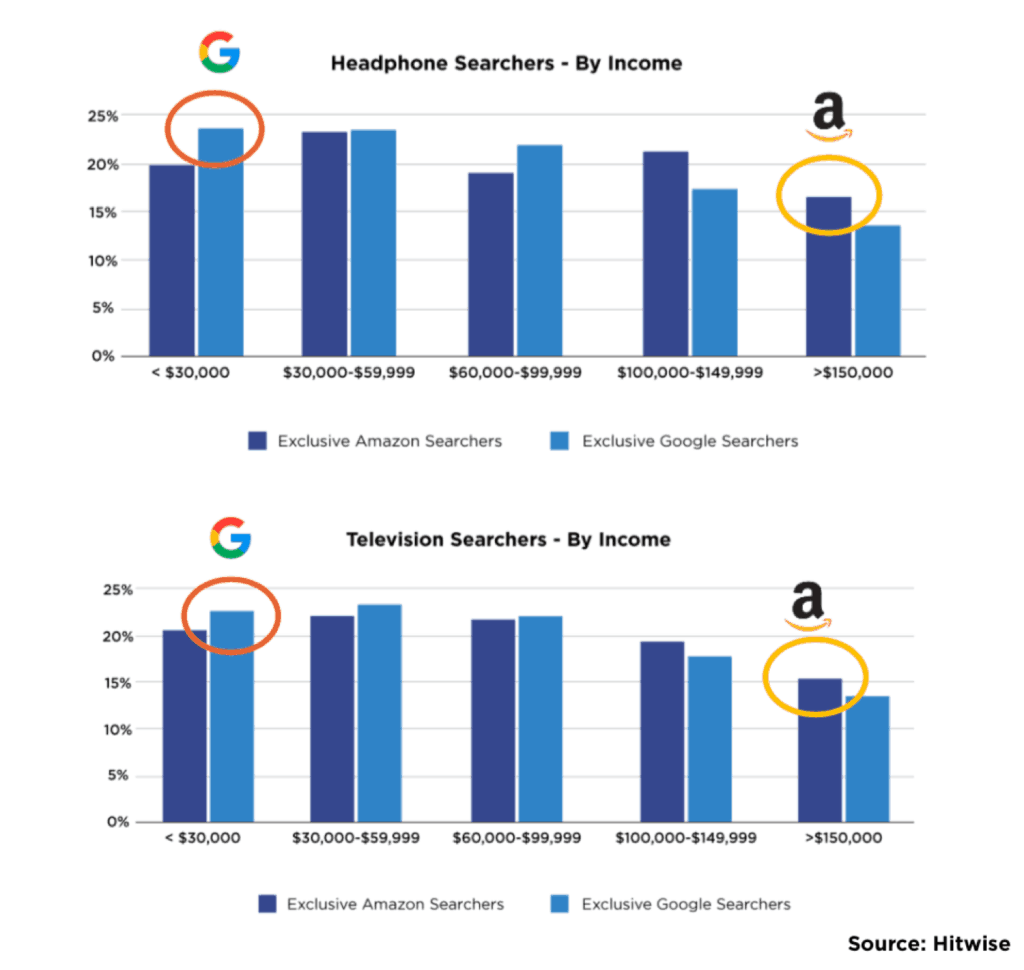

As seen below with headphone and television searchers, high-income households are more likely to be Amazon-exclusive searchers, while lower-income households skew toward being Google-exclusive.

This pattern could be influenced by an increased likelihood of higher-income households to be Amazon Prime members, and therefore conduct more of their product searches exclusively on Amazon.

Understanding these granular differences is crucial for retail and e-commerce companies, many of which spend huge percentages of their budget promoting products on Google and Amazon. When marketers adapt their promotion strategies to support where and how consumers actually search, these small tweaks can lead to major wins.

To learn more about where this data came from, and how to perform a custom analysis like this for your company, click here.

* About this study: This is based on Hitwise study available here based on the top 100 product searches on Amazon internal site search, compared to the same searches on Google during Q4 2016. Results may skew slightly toward Amazon because top 100 product searches were pulled from Amazon queries first, then compared to the same searches on Google.

Favorite