Jill Regular, senior vice president of ad operations & platform, YellowHammer Media Group

I’m not surprised when a new direct-to-consumer (D2C) brand is hesitant to work with Amazon. As a huge, generic retailer of everything, Amazon is quite different than the bespoke, personalized brand experience most of these startups deliver. What’s more, many D2C startups are concerned about Amazon competing with them directly.

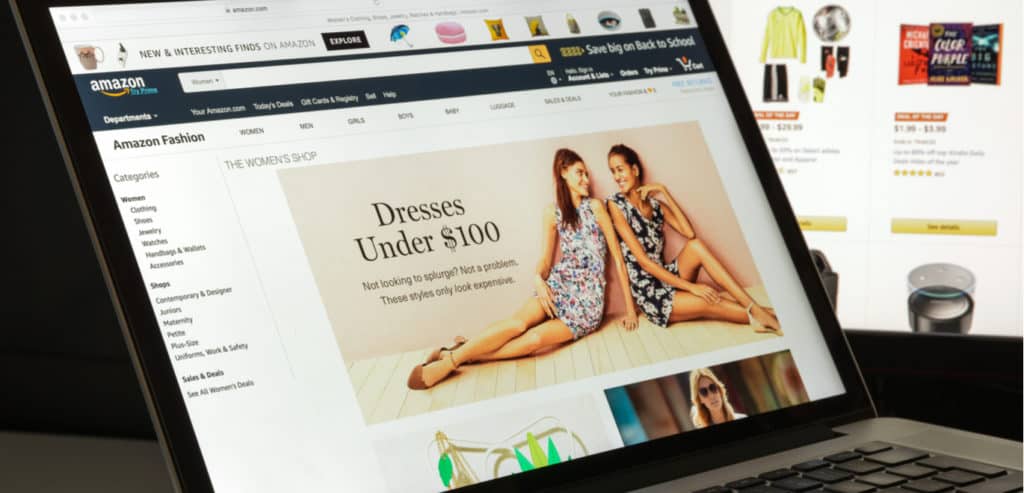

In fact, Amazon has emerged as a platform with unique opportunities, so much so that companies are shifting away from Google to take advantage of it. Yet, D2C brands are missing out. The platform now delivers so much more than cheap retail experiences, and their advertising offering is new enough that savvy media buyers can still achieve great performance.

Amazon (Probably) Won’t Steal Your Idea

Many retail startups are concerned about competition, but need to change their perspective about Amazon. They sell millions of products, while they have private-labeled 76 brands to sell their own products. Amazon is going to compete where they see an opportunity for revenue based on broad market dynamics, so brands are best off making revenue from the platform regardless of the company’s retail decisions.

A quick keyword search for a D2C brand and you’ll find plenty of other retailers taking advantage of the pent-up demand for a brand that isn’t available on Amazon. Search for “Warby Parker” and you can get everything from $10 knock-offs to designs from direct competitors.

Ignoring Amazon is to ignore a significant portion of retail and advertising opportunity. Goldman Sachs reported that Amazon is the top destination for online shoppers, especially millennial men, who rank the site as their “favorite place to shop” in nearly every category. In fact, 94 percent of online shoppers shop at Amazon, which accounts for 49 percent of all online sales. People prefer speed and convenience, and if D2C brands want to reach those customers, they have to come to where the customers are.

Brands Can Still Control Experience (A Little)

A brand that considers the customer experience would cringe at the banged-up boxes that show up from Amazon. It’s also true that the stripped-down design of Amazon’s site, and generic ad formats such as “Sponsored Ad” and “Display Product Ad” units leave little opportunity for brand expression and control.

While not as good as your own branded app, many brands are taking advantage of upgrades like the Amazon “storefront”, which allows a retailer some design freedom. Amazon is touting storefront as a key part of their campaign to improve brand design and control on the website. Samsung is a nice example, with a home page, and different sections for different categories of products. While not every brand has embraced it, the feature does show that Amazon is listening to brands looking for more control.

Smart Brands Can Benefit From Amazon Advertising

As an advertising platform for retailers, Amazon has millions of engaged consumers available and tons of inventory to bid on, but without a big, experienced service layer, many retailers are essentially on their own to figure out how to advertise on the platform. Amazon just announced an overhaul of their different offerings to try to streamline things and eliminate confusion, but they still aren’t delivering best practices, or staffing up with enough service reps to really level the playing field. This is a huge opportunity for savvy brands.

One sure sign that there’s money to be made? New agencies specializing in Amazon founded by former employees like Flywheel are popping up right and left. These shops are similar to the early search agencies with expertise in Google search and adwords, which is now a booming industry.

Amazon offers a huge programmatic opportunity to brands willing to learn the platform better than their competitors. D2C brands are no exception, especially when they offer a unique product that already has pent up demand being unmet on Amazon.

When It’s Time to Scale, Amazon is There

Direct-to-consumer brands like Caspar and Harry’s are shaking up retail. With lots of venture funding, expensive design and a focus on the consumer, they’re miles ahead of many older brands that haven’t mastered the art of looking good and targeting messages at the same time.

But being on high ground can be dangerous. I’ve worked with many D2C brands that have had the luxury of being very picky and very precious about their advertising and retail strategies in their early stages, only to hit a wall when they realize they can’t scale without breaking out of their comfort zone.

Selling and advertising on Amazon can be tough on the ego—it’s one of those things that makes a hot new startup feel like a sell-out. But Amazon, is growing and changing as the company takes on the Google and Facebook duopoly. In this phase of growth, brands will find unique opportunities to be early adopters of promising features and to shape what Amazon offers in the future. Like Facebook and Google, Amazon delivers consumers by the millions, and ignoring the company now simply opens the door for competitors willing to try it out.

YellowHammer Media Group is an independent digital marketing agency.

Favorite