Swanson Health Products needed a more hands-off repricing tool, says Patrick Yatskis, the nutrition supplements retailer’s senior digital marketing manager.

Swanson Health sells around 20,000 SKUs on its ecommerce site, SwansonVitamins.com, as well as on Amazon and other online marketplaces. Only about 20% of the items Swanson sells are private label products, which means that it is often competing with other retailers that sell the same items. To ensure it doesn’t miss out on prospective sales, it needs to be vigilant about price, particularly on online marketplaces, which account for about 10% of its online sales, he says.

Why competitive pricing on marketplaces matters

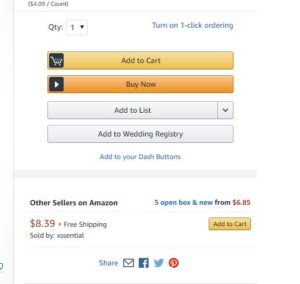

Price is important for the competitive landscape and for winning the “buy box” on Amazon, Yatskis says. The “buy box” refers to the product that is linked to the Add to Cart button on the product detail page. If a consumer clicks “Add to Cart” the product that is added to her cart is the one that “won” the buy box. If another seller sells the exact same product, and it is not the product that is not linked to the Add to a Cart button, that seller did not win the buy box. Instead, below the Add to Cart button, Amazon lists other sellers that sell the same product that the shopper can navigate to.

Price is important for the competitive landscape and for winning the “buy box” on Amazon, Yatskis says. The “buy box” refers to the product that is linked to the Add to Cart button on the product detail page. If a consumer clicks “Add to Cart” the product that is added to her cart is the one that “won” the buy box. If another seller sells the exact same product, and it is not the product that is not linked to the Add to a Cart button, that seller did not win the buy box. Instead, below the Add to Cart button, Amazon lists other sellers that sell the same product that the shopper can navigate to.

While Amazon’s buy box algorithm is a black box, it is known to incorporate a product’s price and reviews. Ecommerce platform provider BigCommerce estimates that 82% of shoppers’ purchases on Amazon are from merchants featured in the buy box.

“If you are not winning the buy box, it literally shuts down what you are trying to grow at the product level,” Yatskis says. For example, if Swanson Health is not in the buy box for that product, it not only is losing revenue for the product, but the problem becomes cyclical as it then can’t advertise for that product with sponsored product ads. And if its ads aren’t showing, then it’s not generating traffic and sales for it, he says.

Swanson Health wants to focus its business on growing its private-label supplement brand and to do that, it needed to devote less time to price monitoring its national brands on marketplaces.

For about a year, Swanson Health used a rules-based repricing system from an undisclosed pricing vendor, Yatskis says. With a rules-based system, it had to determine thresholds for each of its products, such as how low it would price each product, and factor in multiple variables, such as how much lower it would price its product if it was competing against a seller who used Amazon’s Fulfillment By Amazon (FBA) services.

“It was really hard to manage across 20,000 SKUs, all of these pricing decisions,” Yatskis says. “It was much more of a race to a bottom, so we saw a lot of shrinking margins in the pricing.”

At least once a week, Swanson Health would update pricing in the tool and would only be focusing on its highest-selling products. The retailer was on the lookout for a more hands-off tool that didn’t cut into its profit margin so much.

Swanson Health selects Feedvisor

Swanson Health selected pricing vendor Feedvisor in March for its patented artificial intelligence-optimized pricing tool for a pilot program. The retailer funneled 50% of its national brand product catalog that it sold on Amazon through Feedvisor in March and pitted it against its analyst team, who would continue to manage the rules-based software.

From March 15-23, the results were substantial: products managed through Feedvisor had 18% higher sales compared with the ones Swanson Health was managing. Plus, it wasn’t just because Feedvisor lowered the price, he says.

“We ended up with more profit dollars in our pocket every day,” Yatskis says. “It wasn’t just a price war, we aren’t going to sit at the lowest price. The proof was in the pudding. It was a smarter pricing decision that was now possible for us.”

Plus, Swanson Health’s buy box rate went up with the new repricing tool. Its buy box percentage for all of its products on Amazon.com increased to 91%, up from 84%, he says.

After the pilot, Swanson Health selected Feedvisor for managing marketplace repricing. Besides the sales and profit increases, Yatskis doesn’t have to devote so much time to managing the tool.

“All of the time devoted into repricing, now we’ve been able to invest into the core elements of business that are helping drive growth,” Yatskis says, such as developing and marketing its Swanson-branded products. Although not directly related to the tool, Swanson Health’s ecommerce revenue is up 60% year over year and total sales via Amazon are up 35% year over year, he says.

How Feedvisor’s pricing tool works

Feedvisor’s tool works to find the “sweet spot” between demand and price using its artificial intelligence algorithm, says Gil Mizrahi, vice president of product and business development at Feedvisor. Plus, it takes into account other factors, such as if competing products are exact matches or just similar, as well as marketing expenses.

For example, if a seller has 100 sandals he wants to liquidate before the winter, Feedvisor determines if it’s more profitable to reduce the price dramatically or spend money on marketing and selling the sandals for full price, and all of the combinations in-between.

“It’s like a dance,” Mizrahi says.

Unlike other pricing vendors that may automatically adjust prices down to outbid competitors a penny at time until the price floor is reached, Feedvisor experiments with raising the prices and monitors how the market—both shoppers and other sellers—adjust.

“Sometimes you will be the only seller with the higher price because of your profit margin, and maybe sell less units, but you will sell them with a higher profit margin, so now its balanced,” Mizrahi says.

Feedvisor’s pricing and reporting tools are more intuitive to use than the ones Amazon provides, Yatskis says, citing this as a benefit to using its product.

Swanson Health is No. 603 and Amazon is No. 1 in the Internet Retailer 2019 Top 1000.

Favorite