The future for many sellers on Amazon.com Inc.’s Vendor Central platform is in limbo.

On March 4, a number of Amazon.com wholesale suppliers did not receive purchase orders they typically receive on Mondays. After days of uncertainty and a void in communication from Amazon, many of the suppliers, commonly called first-party or 1P sellers in Amazon lingo, did receive purchase orders over the weekend, while others still are waiting, merchants tell Internet Retailer. The exact number of suppliers affected is not known, but experts speculate it was in the thousands.

But the days of uncertainty with various automated responses from Amazon have given many first-party sellers a wake-up call that their future as vendors to Amazon may be at risk.

“We need to think about where we are committing our resources and what we should readjust or reallocate,” says Jay O’Neall, vice president of wholesaler Nostalgic Warehouse. “This is certainly a wake-up call, and we are not alone.”

Amazon suppliers sell their product to Amazon on wholesale terms, and Amazon then sells the product on Amazon.com and also warehouses and ships the products. First-party sellers work in Amazon’s Vendor Central platform, and Amazon does the work of creating and managing the product listing. This is separate from marketplaces sellers, known as third-party sellers or 3P sellers, which work in the Seller Central platform. These merchants pay Amazon.com a commission on each sale (which varies by category but on average is 15%) and have to maintain their own product listings. Sellers on Amazon’s marketplace accounted for 52% of units sold globally during the fourth quarter, Amazon reported. Merchants can sell on both platforms.

Amazon merchants that did not receive their normal wholesale purchase orders

Consultancy Marketplace Strategy works with about 65-70 merchants that sell as a first-party seller to Amazon.com, says CEO Drew Kraemer. About 20% of Marketplace Strategy’s clients did not receive their typical purchase order last week, Kraemer says.

He says vendors having purchase order issues share some commonalities. They are vendors with less than $10 million in sales annually to Amazon, or that supply potentially low-profit products. A lower profit item might be a heavy product that costs a lot to ship, thus affecting Amazon’s ability to make a profit on its sale.

Red Rocks E-commerce Consulting, a consulting firm that manages 25 brands to help them sell on or to Amazon, said about 10% of its Amazon first-party clients didn’t receive their normal purchase order, partner Irina Balyurko says. Those clients have less than $2 million in annual sales on Amazon, although Balyurko also speculates that Amazon factored in profitability into this decision, she says.

If 1P sellers sent Amazon a message about not receiving their normal purchase orders, Amazon’s response was one of three flavors:

- It was a technical issues and a purchase order would come soon.

- A purchase order was not issued for that vendor and Amazon is unsure if one would be issued soon.

- It is not issuing a purchase order and sellers should move from Vendor Central to Seller Central.

Some sellers received a message later that a purchase order “would be coming.” Some did receive one and some did not.

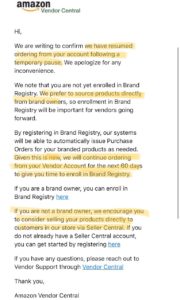

Amazon’s message to first-party sellers provided to Internet Retailer by Hub Dub Ltd. Highlighted for impact.

At Hub Dub Ltd.—which is a first-party seller to Amazon and sells multiple brands under its name—about 15 of its 55 brands did not receive a purchase order as it normally would, says CEO Eddie Levine, who also operates a consultancy for Amazon sellers called Wholesale Breakthrough. Unlike Kraemer and Balyurko, he did not notice a pattern among brands that did and did not receive purchase orders, as some small brands with less than $1 million in sales did receive a purchase order, and some with a few million did not, he says.

All of the 15 brands that did not receive their normal purchase order did receive them by the weekend, along with a message encouraging them to apply to the Brand Registry program. Brand Registry is Amazon’s program whereby brand owners with registered trademark can get access to tools to beef up their presence on Amazon, such as creating a brand storefront and videos.

O’Neall, at Nostalgic Warehouse, which is a first-party seller that manufactures and distributes door hardware, was among the sellers that did not receive a purchase order as expected on March 4 but did by the weekend. The merchant was encouraged to sign up for Brand Registry, and seeing no downside, did so.

The phrasing of Amazon’s automatic message to first-party sellers is notable, Levine says. First, Amazon puts in writing that it prefers to source products directly from brand owners, which he says is something it has not done before.

The move may have to do with Amazon cracking down on counterfeit goods, both Levine and Balyurko say. If Amazon buys only brand-registered products on a wholesale basis, it rids itself of the problem of selling unauthorized goods directly, he says. However, this may only push the problem onto Amazon third-party marketplace.

“Amazon is looking for ways to solve the counterfeit problem, and working directly with brand owners on a 1P model is one of the ways they are trying to solve it,” Balyurko says.

Amazon encourages Brand Registry and Seller Central and may get rid of Vendor Central

The note encouraging Brand Registry also is cryptic. Amazon does not explicitly say it will stop ordering from vendors that aren’t Brand Registered, but it does say to sign up within 60 days and states “enrollment in Brand Registry will be important for vendors going forward.”

Plus, the message funnels non-brand owners to Seller Central, to be a seller on its marketplace. Levine says this points to Amazon likely not cutting off all non-registered brand owners immediately, but it is likely phasing them over to Seller Central in waves.

Amazon has not provided much more information beyond this. “We regularly review our selling partner relationships and make changes when we see opportunity to provide customers with better selection, value and convenience,” says an Amazon spokesperson.

Kraemer also speculates Amazon is preparing to shift more Vendor Central merchants over to use the Seller Central platform. Merging Vendor and Seller Central makes sense for Amazon, as it can gain economies of scale, Kraemer says.

“They want to have scale in everything they sell and there is a cost burden for them,” he says.

“We’re seeing a lot of signs to potentially integrate both Seller Central and Vendor Central,” he adds. For example, Amazon provides a vendor manager for its Vendor Central clients. However, many of Marketplace Strategy’s first-party seller clients have noticed that their dedicated manager has been replaced with an automated system.

This happened to Nostalgic Warehouse’s O’Neall. He says that his account had a vendor manager though April 2018 who then disappeared for eight months until about two months ago. “Out of the blue we were contacted by a real person in Seattle who said she was our new vendor relationship manager,” he says. “We have tried to contact her about this situation and we’ve gotten crickets.”

After days of Nostalgic Warehouse not receiving its normal purchase order last week, Amazon sent the merchant 105 purchase orders for a previously agreed to and accepted bulk inventory order. The following day, Amazon canceled each order one by one, without any communication, O’Neall says. A few days later, again the 105 purchase orders came in, and again Amazon declined them one by one the next day.

“It makes you think if anybody is minding the store over there or what’s going on,” O’Neall says.

Just yesterday on March 12, O’Neall received a purchase order for about two-weeks worth of inventory, along with a bulk buy order.

“This is obviously very frustrating and difficult to manage,” O’Neall says. “Amazon is a large part of our business, and we have scaled our operation to manage their volume and need for expedited fulfillment.”

Nostalgic Warehouse’s annual sales to Amazon are less than $5 million, which is a sizable chunk of its annual business, O’Neall says. It also wholesales its products to merchants such as Build.com and Home Depot. It does not operate its own ecommerce site, and O’Neall does not want to be a third-party seller on Amazon, as it doesn’t want to be viewed as competition with its wholesale partners.

How first-party suppliers can move forward without Vendor Central

Marketplace Strategy is advising its clients that have not received a purchase order to assess their current state as a 1P seller on Amazon and consider the following:

- Has Amazon’s communication with the seller become more automated?

- What is the sell-through rate of their products and when will their products be out-of-stock?

- Does the seller have the resources to sell on Seller Central? For example, does the merchant have time to monitor pricing so it can “win the buy box,” switch advertising campaigns over to Seller Central and provide meaty content on their product listing pages?

Levine also says merchants that are being pushed to Seller Central should not be afraid to embrace it, as many merchants have lucrative businesses as third-party sellers on the marketplace.

Kraemer is emphasizing that Amazon as a selling platform is not going away, but its relationship with Amazon may change, and retailers should have a contingency plan.

“If they stop issuing purchase orders all together, we now have a Plan B in place and are ready to execute,” he says.

Balyurko echoes these comments, and says first-party merchants should have a backup plan in place.

“Adapting is key to thriving, and that applies to being successful on Amazon as well,” she says. “Amazon is still a powerful platform for a brand to grow on, it’s a matter of being ready to ‘business as usual’ being redefined, as these events show us.”

Amazon is No. 1 in the Internet Retailer 2018 Top 500.