U.S. online grocery sales tied for their third-highest total in July, according to data from Brick Meets Click and Mercatus.

Online grocery sales in July once again reached the $10 billion mark, growing 26% year over year, according to the companies. They attributed the growth to “record-high household penetration, strong order activity, and solid gains in spending rates.” As a result, online sales accounted for more than 17% of total grocery spending in July, according to Brick Meets Click.

Brick Meets Click and Mercatus categorize online grocery sales based on three receiving methods:

- Delivery: Includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

- Pickup: Includes orders received by customers either inside or outside a store or at a designated location/locker.

- Ship-to-home: Includes orders that consumers receive via common or contract carriers like FedEx, UPS, USPS, etc.

“The elimination of explicit fees, like the standard delivery cost, via a membership or subscription program, removes a top barrier to increased usage and customers are taking advantage of it,” said David Bishop, partner at Brick Meets Click, in a statement. “This tactic is unlocking latent demand for Delivery which is typically viewed as the more convenient but also the more expensive option when compared to Pickup.”

Online grocery sales in July

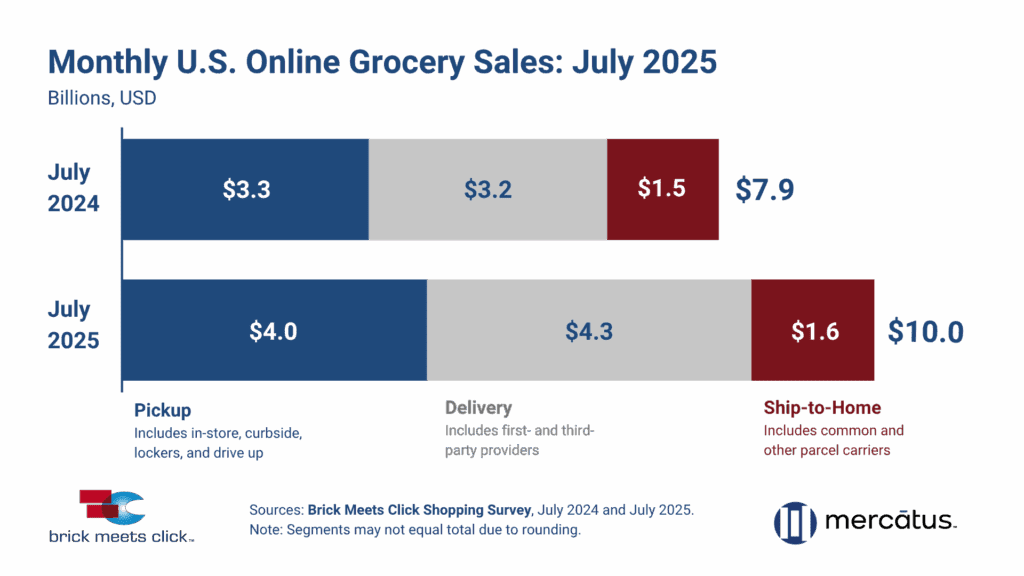

In July, online grocery sales totaled $10.0 billion, according to Brick Meets Click data. That’s $2.1 billion more than in July 2024.

To date, the only other months to reach that milestone were October 2024, January 2025 and February 2025. October 2024 holds the record for the most U.S. online grocery sales in one month at $10.5 billion.

Each segment Brick Meets Click tracks grew sales year over year in July, with Delivery driving more than half of online grocery growth in the month. Delivery sales grew 36% year over year in July to reach $4.3 billion. That made it the largest of the three segments in July by both year-over-year growth and total sales.

Pickup grew 24% year over year to reach $4.0 billion in monthly sales. Meanwhile, Ship-to-Home sales increased 10%, reaching $1.6 billion.

Brick Meets Click also noted that July set a record for online grocery penetration among U.S. households, at 81 million. That represents about 61% of households that bought groceries online during the month, regardless of segment, according to Brick Meets Click.

The number of monthly average users (MAUs) increased 11%. Brick Meets Click attributed that mostly to infrequent users reengaging with online grocery shopping. Additionally, the average number of orders those MAUs completed increased 6.5% year over year.

Each of the receiving methods increased its respective average order values (AOVs), according to Brick Meets Click. However, Delivery drove the bulk of the 7% year-over-year growth in overall July online grocery AOV.

By segment, Delivery’s AOV increased 8% year over year. Pickup’s AOV grew less than 5, while Ship-to-Home’s AOV grew by less than 2%.

Piyush Patel, chief ecosystem officer at software provider Algolia, said in a statement that Fourth of July festivities and other at-home summer cookouts likely drove part of the lift in online grocery sales. He referred to that as “a welcome sign for grocers who’ve dealt with hesitant, budget-conscious consumers all year.”

He also cited Algolia consumer survey data indicating 73% of respondents are stressed about their grocery bills this year. 30% said it has led them to search for more deals and 28% are cutting back to only the necessities as a result.

How Mass Merchants factor into online grocery sales

Mass Merchants benefited from increased order frequency among its MAUs in July, according to Brick Meets Click data. That group’s order frequency grew “in the mid-single digits,” Brick Meets Click said. Meanwhile, supermarkets’ order rate “declined slightly” compared to July 2024, which the company attributed to growth in supermarkets’ MAU base.

On Aug. 13, Amazon announced it is now offering same-day delivery of perishable grocery items in over 1,000 cities and towns. It also plans to expand that reach to more than 2,300 cities and towns by the end of 2025, it said. Same-day delivery is free for orders over $25 for Prime members, according to Amazon. It’s also available to customers without a Prime membership for a fee.

Amazon framed this as “undergoing one of its most significant grocery expansions” in an Aug. 13 statement.

“In an era where ‘free’ delivery is setting new customer expectations and Walmart’s retail media revenue fuels its competitive edge, regional grocers face mounting pressure to profitably serve shoppers online,” said Mark Fairhurst, chief growth marketing officer at Mercatus, in a statement prior to Amazon’s announcement. “Grocery retailers that own and activate their customer data to target and personalize offers — especially for infrequent or lapsed shoppers — can turn renewed engagement into lasting loyalty, defending both sales and margins.”

Click here to read last month’s update on online grocery sales.

Do you rank in our databases?

Submit your data and we’ll see where you fit in our next ranking update.

Sign up

Stay on top of the latest developments in the online retail industry. Sign up for a complimentary subscription to Digital Commerce 360 Retail News. Follow us on LinkedIn, X (formerly Twitter), Facebook and YouTube. Be the first to know when Digital Commerce 360 publishes news content.

Favorite