Alternative payments are booming, as new entrants crowd the checkout process with ways to pay. But Michael Hershfield, founder and CEO of Accrue Savings, thinks he’s found a way to rise above the fray by offering shoppers a new way to save for a purchase, well before they reach checkout.

“We all know the last 30 years have been filled with credit innovation,” Hershfield says. “But in savings, there has been almost no innovation. Why shouldn’t a retailer provide a diversity of payment options where someone can work their way up to save up for the things they care about, rather than trying to saddle them with debt, whether it’s BNPL (buy now, pay later) or using credit cards?”

Hershfield may be onto something. Accrue Savings launched Nov. 3 with an impressive list of retailers as customers, including Casper Sleep Inc., ranked No. 167 on the Digital Commerce 360 Top 1000; Camp; and Candid Care Co.

Accrue Savings debuts as the alternative payments industry grows in size and generates new controversy. The House Financial Services Committee’s Task Force on Financial Technology heard testimony Nov. 3 alleging that buy now, pay later systems saddle consumers with debt. BNPL often leads consumers to “take on debts they cannot afford to repay,” Lauren Saunders, associate director at the National Consumer Law Center, told the committee, and “managing frequent irregular BNPL payments can be challenging.”

Save now, buy later

Accrue Savings is a fintech startup with $4.7 million from a seed funding round backed by investors such as Twelve Below, Box Group, Ground Up Ventures and others. Accrue calls itself “a merchant-embedded shopping experience that rewards customers who save for their favorite products and services.” Its pitch to retailers is that it can help attract new customers while putting cash into shoppers’ “pockets without debt, credit or fees.”

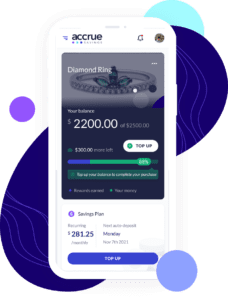

An Accrue Savings account lets a shopper save for a specific purchase without debt, interest or late fees. A shopper can schedule payments, request contributions and track progress on a mobile app.

The mechanics of the system are simple. A shopper finds an item he wishes to buy in the future on a retailer’s website or on Accrue Savings site. The retailer redirects the shopper to its product page on Accrue’s website. By opening an Accrue Savings account (FDIC-insured through Blue Ridge Bank N.A) a shopper can save for the purchase by making deposits, requesting donations from friends and family, or collecting rewards from the merchant. The savings are tied to the specific purchase the shopper wishes. When there’s enough money in the account, the shopper completes the transaction. If for any reason the shopper changes his mind, he can withdraw the funds, but not any cash reward deposits made by the retailer.

Accrue says the difference between it and other alternative payment options is that it “rewards customers for saving for the things they want, love and dream to have without taking out short-term loans.”

The fintech says its research shows 60% of Americans are currently saving for a big discretionary purchase—things like cars, electronics, travel, jewelry, fitness equipment, gifts and furniture.

Saving for diamonds

Slightly more than 27% of the Top 1000 online merchants offer a pay-in-installments option upon checkout, according to Digital Commerce 360. The single biggest category for such offerings is jewelry, where more than half of the top sellers let shoppers buy over time.

David Sweet is in the diamond business. He sees potential in Accrue Savings’ save now, buy later idea. His employer, Eterneva, is one of Accrue’s first customers.

“We have a price point that can be a reach for certain customers. And so we’re always trying to find ways to make that more appealing and approachable,” says Sweet, vice president of marketing and product for the Austin-based Eterneva. “What’s really interesting about Accrue is it can put the savings in the hands of the customers and make something that may or may not have been attainable for them attainable.”

Eterneva’s product is unusual. The retailer turns cremated human (or pet) remains into diamonds. Customers are sent a “welcome kit” that includes a container for a half-cup of cremated ash. Eterneva separates the carbon in the ash and then places the carbon under extreme levels of pressure in a crucible for months and months. The longer the process, the larger the diamond grows. Eterneva can introduce gases into the product to create a colored diamond. And Eterneva has a diamond cutter who finishes the stone, which can be set in jewelry.

“We say that we’re creating a category around something that people don’t like talking about often, right? I mean, death is not often a common and uplifting story,” Sweet says. “You’re trusting us with the most remarkable thing that’s left of your most remarkable loved one. And so we take a great amount of pride in that.”

With a product as new Accrue Savings, it’s too early to know if Eterneva’s customer base will respond to a save now, buy later option. And Eterneva already offers a BNPL option through Affirm, which recently signed a deal with Amazon. But Sweet is confident Accrue’s debt-free alternative will be popular with shoppers who can’t afford to pay upfront.

An Eterneva diamond can cost up to $3599. By using Accrue Savings, a shopper can earn as much as $1505 in rewards.

“We can actually reward the customer for saving up along the way,” Sweet says. “They can actually fund their diamond by making regular contributions. And when they hit certain milestones, we will give extra cash rewards toward their diamond. So, it helps us contribute and incentivize as well.”

Considered purchase and Accrue Savings

Sweet says deciding to memorialize someone by turning their remains into a diamond isn’t the sort of spur-of-the-moment decision that lends itself to a rapid, seamless checkout. An Eterneva diamond, which requires more than a year to “grow” from a cup of cremated ashes, may be the perfect example of a “considered purchase.”

Thus, Eterneva requires customers to talk with it about the process of making, and paying for, a diamond. “And every conversation is tailored to the customer and their unique circumstances,” Sweet says. “When we hear that price is a barrier, this is absolutely the perfect opportunity for us to say, ‘hey, we hear you,’ and there are a variety of opportunities for us to meet you at a point that’s convenient for you. [With Accrue], there is a way now to say if this is something that you know you want to do, but you want to take a little bit more time to do it on your terms, we’ve got a way that you can do that.”

Hershfield is quick to point out that the nature of a considered purchase varies greatly among socioeconomic groups. So, Accrue Savings aims to work with merchants who sell goods and services at multiple price points, including “$100 shoes and $10,000 pieces of jewelry.”

“Brands are using us for lots of different reasons because their demographics have different definitions of ‘considered,’” Hershfield says. “You know, thankfully, you and I might not need to save for a $100 toaster, but someone does.”

Hershfield says he doesn’t want to punish people because they can’t afford to buy something today. Instead, Accrue aims to reward responsible debt-free spending. Shoppers are not charged fees or interest to use Accrue Savings, which makes money through fees paid by retailers. Hershfield declined to disclose an amount or range of how much retailers will pay in fees for the service.

Favorite