Today’s young parents are the generation that grew up with the Internet and they are contributing to making baby products the packaged-goods product category with the largest e-commerce penetration. E-commerce accounts for 20% of all sales in the $30 billion baby products market, far outstripping the 2% penetration for all consumer packaged goods, reports a new study from consumer research firm TABS Analytics.

The baby products market is thus one in which retailers may have a particularly strong opportunity to reach consumers and grow their online business, the report’s author says. “Online sales of baby products are out-competing all other segments of consumer packaged goods that we have surveyed over the last three years,” says TABS Analytics CEO Kurt Jetta. “Brick-and-mortar retailers with e-commerce aspirations should treat baby product sales as the frontline of their battle for online success.”

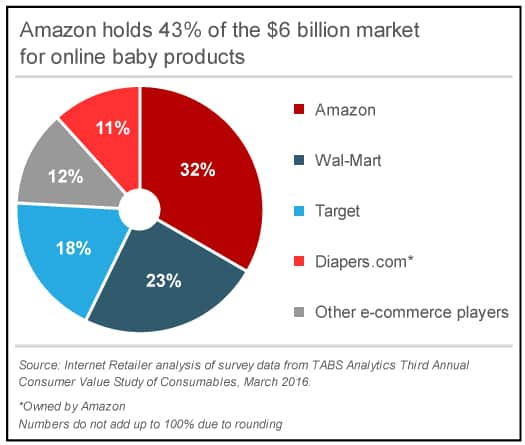

Roughly 75% of the $6 billion in baby products that are purchased online occur on e-commerce sites run by Amazon.com Inc., No. 1 in the Internet Retailer 2016 Top 500 Guide, Wal-Mart Stores Inc. (No. 4) and Target Corp. (No. 22).

When taking into account the $30 billion in online and offline purchases of baby products in the U.S.—including baby seats and safety products, feeding items, diapers, formula and baby bath products—the bulk of the sales, 54%-63%, go to mass merchandisers like Wal-Mart (which gets 17%-18%) and Target (12.4%-14%).

Online, however, Amazon along with its subsidiary Diapers.com is by far the market leader, comprising 7.3%-10.6% of all baby products purchases in the U.S. Walmart.com accounts for 3.7%-5.8% of purchases, Target.com, 3.3%-4.3%, and other e-commerce outlets, 2.2%-2.8%.

The study suggests that 18%-24% of baby products purchases occur online, and that would mean Amazon/Diapers.com represents roughly 43% of the baby products market online. That’s compared with Wal-Mart’s 23% and Target’s 18%. Other e-commerce players comprise roughly 12% of the market.

However, data from Top500Guide.com suggests that even though the bulk of online baby purchases occur on these three sites, there is plenty of room for small and midsized players to grow. The three merchants ranked in the just-released Internet Retailer 2016 Top 500 Guide and Second 500 Guide (which arrives in early May) that primarily sell baby products collectively grew online sales 66.4% in 2015.

The Honest Company Inc. (No. 132), grew 75.0% to an estimated $261.1 million last year. BabyHaven.com (No. 374), grew 65.0% to an estimated $53.1 million. Albee Baby (No. 556 in the 2015 Second 500 Guide), grew 5.0% to $21.3 million.

The TABS study, performed with survey company Toluna, surveyed 2,000 consumers between the ages of 18 and 75. Here are some additional findings:

- Households with children up to 5 years old are the heaviest buyers, accounting for 60%-70% of all purchases online and offline.

- Households with young children purchase 8.5 baby product types per year, compared to 1.6 for all other buyers.

- Roughly 40% of baby products are purchased by consumers who don’t have any young children in their households, which represents 71% of all households. The bulk of these purchases likely come from relatives or friends giving gifts, TABS Analytics says.